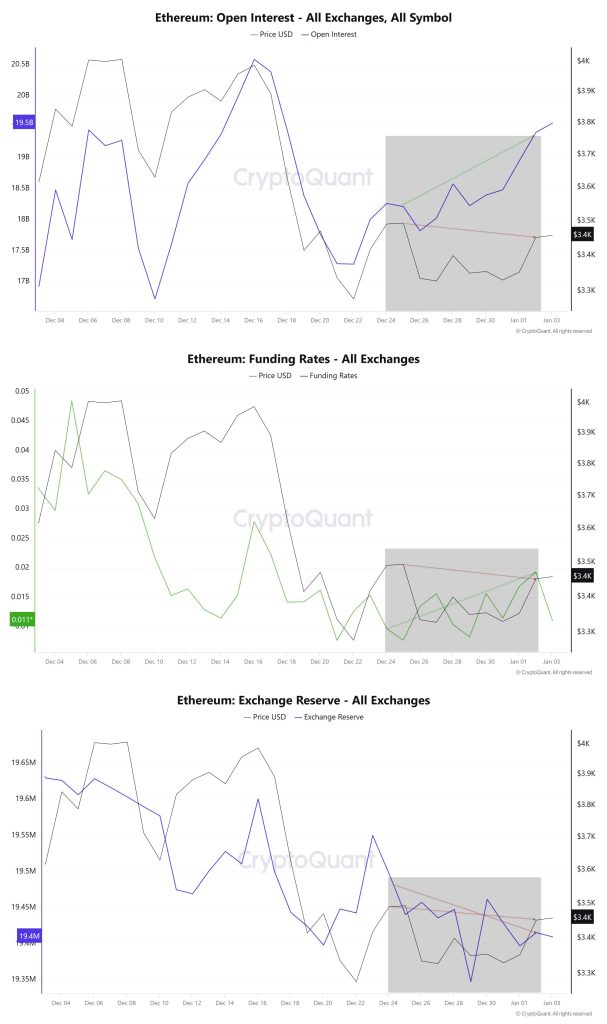

The dynamics in the Ethereum market are remarkable in terms of derivatives and spot market interactions. The doubling of the funding rate between December 24 and January 2, from 0.009% to 0.019%, indicates an increasing dominance of long positions. This implies that market participants have a strong expectation that the ETH price will rise. However, this bullish expectation may be unsustainable without adequate support from the spot market.

The nearly 6% increase in open interest suggests that more capital is flowing into the derivatives market and positions are increasing. While this points to a potential increase in volatility in the market, the fact that the price only changed by 0.3% is a notable inconsistency. This inconsistency may indicate that despite the increase in long positions, buying power in the spot market is not supportive enough. The derivatives market’s effort to push the price up seems to be weakened by the low demand in the spot market.

ETH reserves on exchanges decreased by about 81,928 ETH from December 24 to January 2. This decline suggests that investors are withdrawing their assets from exchanges and may be in a long-term accumulation trend. However, this reserve decline is not on a scale to provide meaningful support to price action. On the contrary, with the accumulation of positions in derivatives markets, this decline implies that the market has a fragile structure.

If the price does not rise to support long positions in derivatives markets, this could create the risk of a potential long squeeze. In the event of a long squeeze, the forced closure of positions could increase selling pressure and lead to a sharp drop in ETH price. On the other hand, strengthening demand in the spot market and increased stablecoin inflows could provide upside support. However, the current reserve depletion and limited price movements suggest that this scenario has yet to materialize.

As a result, the Ethereum market is currently in search of a balance. The increase in long positions in the derivatives market and the inability of the spot market to meet this demand is putting pressure on the price. This increases the risk of a correction in the ETH price, while a sustainable rise in the spot market is difficult without liquidity and demand growth. This fragile structure may increase volatility in the coming days and cause unexpected shifts in price movements.

Disclaimer

This content is for informational purposes only and does not constitute investment advice. All investment decisions are your responsibility.