Impact of BTC Halving Cycle on Bullish Start?

Since its inception in 2009, Bitcoin, the largest cryptocurrency by market capitalization, has experienced numerous bull runs and bear markets, each marked by unprecedented growth and market-shaping events. Understanding these cycles provides valuable insights for investors waiting for the next potential rally. Let’s take a closer look at Bitcoin’s past bull runs and review the key factors that could shape future bull runs.

A Bitcoin bull run usually starts after halving cycles. In the first bull runs, such as in 2013, Bitcoin rose from around $145 in May to around $1,200 in December, a 730% gain driven by early adoption and infrastructure development. Then, the 2017 bull run saw it surge from around $1,000 in January to around $20,000 in December, compounded by increased media attention and retail interest due to the Initial Coin Offering (ICO) boom. This staggering 1900% increase was catalysed by institutional adoption and increased acceptance, and the 2020-2021 bull run, which took Bitcoin from around $8,000 in early 2020 to over $64,000 in April 2021, a 700% jump.

In order to know where the bull season is, we first need to know whether the bull has started or not. When we look at the previous statistics, it is seen that BTC has been on the rise after the halving and that other investors have entered the cryptocurrency sector after each halving. When we examine the chart below, the chart after the BTC halving is shown, except for the top 10 cryptocurrencies. Accordingly, after each halving, the bull market first jumped to BTC and then to high mcap coins such as ETH-SOL. After this cycle, the appetite of investors and traders increased, and they turned to riskier coins outside the TOP 10. When we analyze the chart, we see that we are on the verge of an altcoin bull. The altcoin market, which is about to approach ATH with approximately 432 billion mcap, may become more appetizing after ATH.

What is the Impact of Macroeconomic Data on BTC and the Altcoin Bull?

Although we distinguish BTC from other coins, generally all coins follow BTC. The 2024-25 bull run brought new dynamics with the approval of spot Bitcoin ETFs, giving institutional investors the opportunity to participate. Since their approval in January 2024, the ETFs have dominated the market capitalization by December 2024, totaling over $71 billion. This flow has propelled Bitcoin from around $40,000 at the start of 2024 to over $100,000 by December 2024, illustrating how these combined factors set the stage for each distinct bull run and reinforced Bitcoin’s growing appeal as a digital asset.

Bitcoin prices react strongly to monetary policy shocks. Trump, now President of the United States again, made statements during the election campaign about his embrace of digital assets, promising to make the US the “crypto capital of the planet” and to create a national Bitcoin reserve. This was the signal that started the bull. However, Bitcoin suffered a significant price slide in the few days following the FOMC meeting. The impact of the monetary policy shock on the Bitcoin price is very lasting. Monetary policy surprises have a bigger impact on Bitcoin prices in a bull market. A hypothetical unexpected monetary tightening of 1 basis point in the Treasury yield is associated with a 0.25% drop in the Bitcoin price on the day of the FOMC meeting. Following the FOMC meeting, there is a significant divergence in the cumulative price of Bitcoin. This divergence is more pronounced in altcoins. Our analysis shows that the impact of the FOMC decisions on the Bitcoin price is very persistent. In contrast, the effects on gold and stock prices disappear quite quickly. The impact on Bitcoin prices is more pronounced, suggesting that monetary policy surprises have a bigger impact on Bitcoin prices in a bull market. For the first time since March 2020 or since September 2024, the FED cut interest rates by 50 basis points. This increased interest in BTC and altcoins. If we anticipate that interest rate cuts have just started in the US and the current interest rate is as high as 4.75%, we can foresee that it will not put pressure on the blockchain from a macroeconomic perspective for now.

When can Taurus end?

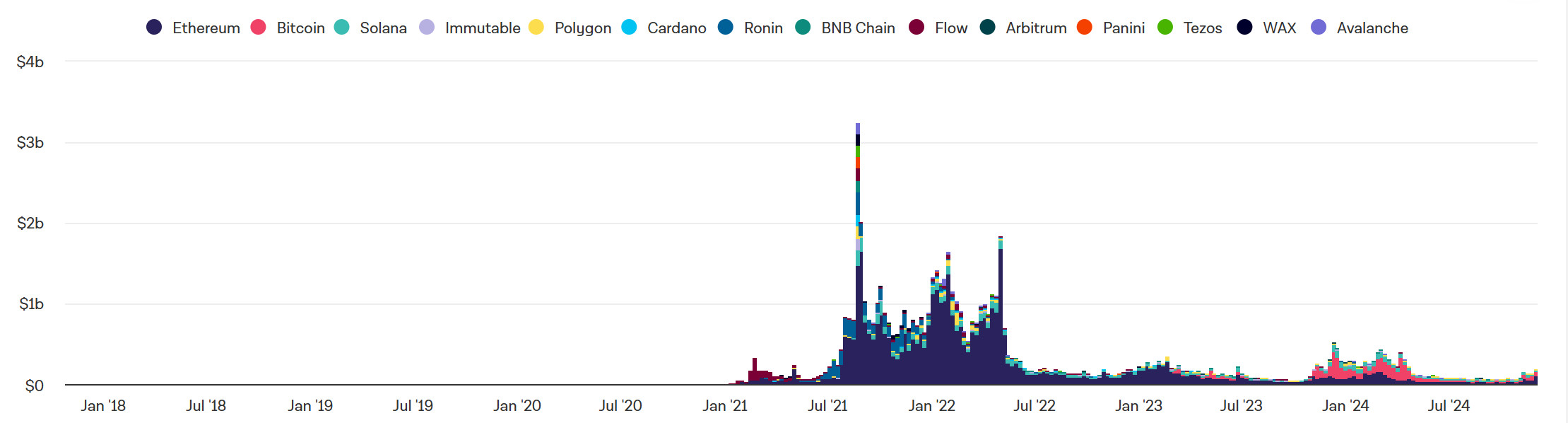

It is impossible to know when the bull will end or begin. But there are ways to predict it. The first one is the bear trap. This is one of the terms used in the stock market to describe market direction. This trap is when investors create the perception that prices will rise after important support points are broken in declining markets. It encourages people interested in the stock market to buy based on this perception. Another indicator that the bear market is about to begin for cryptocurrencies is the increase in NFT volumes. It should be noted that BTC rises first in the cycle. Then the altcoin bull begins with the rise of coins with high mcap. Finally, volume enters the NFT market and the cycle is completed. As we can see in the chart, the NFT volume increased to about $3 billion in August 2021, during the late stages of the bull. After this rise, the bear market dominated the blockchain. When we look at it now, it is seen that it has reached a volume of 190 million dollars.

The bottom line: When should investors start thinking about taking profits? Many digital assets have enjoyed significant price gains since the beginning of 2023. Those who have bought and held crypto over the last 2 years may be wondering whether they should start locking in profits, if they haven’t already. Of course, the answer ultimately depends on the individual’s goals and risk tolerance. Traders should remember that while the current bull market always seems to be the same, past performance is no guarantee of future results. It is always possible that this cycle will move differently and the bull market will end earlier than expected. However, using JPMorgan’s estimate that there is a 45% chance of a US recession in the second half of 2025 adds a layer of complexity to market expectations by suggesting that Bitcoin’s peak and economic downturn forecasts are likely to overlap. Investors may find this point important when considering portfolio strategies amid macroeconomic uncertainty.