The BITCOIN Act

The BITCOIN Act is a bill to recognize Bitcoin as a strategic reserve asset in the US. Its main purpose is to make Bitcoin part of the national reserves, just like gold, and to purchase a total of 1 million BTC over five years and store them in the state treasury. These assets cannot be sold, pledged or exchanged for at least 20 years. The draft law also calls for the establishment of a special structure within the Treasury called the “Strategic Bitcoin Reserve”, which will be kept in secure facilities and regularly disclosed to the public through transparency reports.

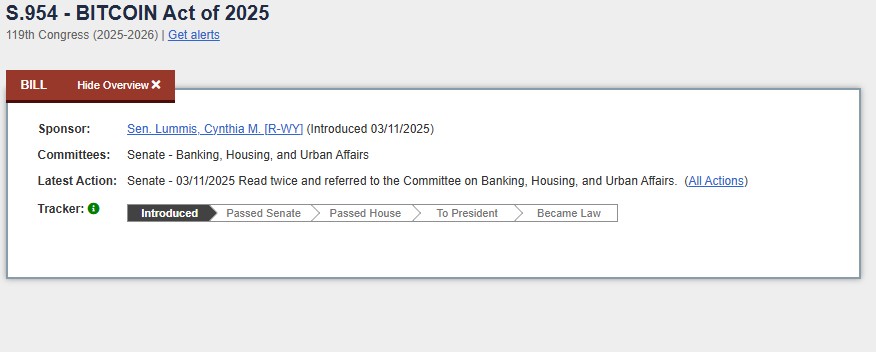

The bill was spearheaded by Republican Senator Cynthia Lummis. Lummis has long argued that crypto assets are of strategic importance for the US. In addition to her, some Republican senators from states such as Alabama, Tennessee, Kansas and West Virginia co-sponsored the bill. Leading companies in the cryptocurrency industry and blockchain advocates also welcome this step. Because large-scale Bitcoin purchases at the state level will both increase the legitimacy of Bitcoin and reassure the markets. The fact that similar laws have been passed in some states, such as Texas, shows that this approach has support not only at the federal but also at the state level.

However, there are serious obstacles to the draft law. The first is the legal framework. US Federal Reserve Chairman Powell has previously said that the Fed cannot hold Bitcoin and emphasized the need for legal changes. Second, financial risks. The 1 million BTC purchase plan could lead to large price fluctuations in the market, and the high volatility of Bitcoin could seriously jeopardize the value of the reserve. Third, there is the question of budget. A purchase of this magnitude would require huge resources, and the mechanisms to provide these resources are questionable. Proposals such as the revaluation of gold reserves or the use of Fed revenues are also open to criticism. Fourth, there is political resistance. Democrats are generally averse to such radical crypto initiatives and legislation cannot be passed without the approval of both houses of Congress.

As of today, the bill is pending in the Senate committee. It must first be debated and voted on in committee, then approved by the Senate and the House of Representatives and finally signed into law by the President. This process is unlikely to be completed in 2025; given the magnitude of the debate, it is more likely to be delayed until 2026. Therefore, although the “BITCOIN Act” has started an important debate on the US agenda for the time being, its finalization will be a long and difficult political process.

Who Supports It? Who are its political and technical supporters?

- The bill’s main sponsor: Senator Cynthia Lummis

- Other senators who testified on the bill were: Tuberville, Moreno, Marshall, Blackburn

- Crypto & blockchain advocates: Cryptocurrency companies, blockchain technology providers and “digital asset advocates” generally welcome such steps. This is because the government holding BTC reserves is seen as a signal to strengthen the legitimacy of crypto assets.

- Some state governments and similar initiatives at the state level: The state of Texas passed a similar law in 2025 called the “Texas Strategic Bitcoin Reserve”. This suggests that there is interest in this federal-scale approach on a state-by-state basis.

Obstacles and Criticisms Faced by the Bitcoin ACT

There are serious obstacles to the “BITCOIN Act” and these obstacles are manifested in legal, economic, political and technical dimensions. First of all, there are problems in the legal framework. US Federal Reserve Chairman Jerome Powell has made it clear that the Fed cannot hold Bitcoin under current law and that this would require a direct act of Congress. Therefore, it would only be possible for the Treasury or the Fed to create such a large Bitcoin reserve if new laws are passed. Moreover, given the powers of Congress over budget spending, borrowing and fiscal policy, the implementation of a massive operation such as the purchase of 1 million BTC requires a direct political decision, not just a technical one.

The biggest economic challenge is the market impact. Such a large purchase plan by the US could cause sharp fluctuations in the market. Buying 1 million BTC would send prices skyrocketing, so the cost could be much higher than expected. Conversely, if the reserve needs to be sold in the future, the market could experience sudden and sharp declines. In short, this step risks disrupting the natural functioning of the Bitcoin market.

Another economic risk is volatility. As Bitcoin is still a highly volatile asset, the value of the reserve can suffer significant losses in short periods of time. This has been heavily criticized by economists and taxpayers alike, as it amounts to tying public resources to a speculative asset.

The budget is also a moot point. To buy 1 million BTC would require hundreds of billions of dollars. The bill envisages that this funding would come from Fed revenues or the revaluation of gold certificates. However, these methods are highly controversial both in terms of the Fed’s independence and the current financial order. In particular, the idea of revaluing or selling gold reserves has been met with opposition in traditional economics circles.

Conclusion

In conclusion, although the “BITCOIN Act” carries a great vision, there are many legal, economic, political and technical obstacles to overcome. Therefore, its enactment and implementation in the short term is considered to be a very challenging process.

There are technical challenges in the implementation phase. There are many risks, such as the security of Bitcoin’s private keys, storage in cold wallets, protection against cyber-attacks and the security of physical facilities. In addition, verification systems called “Proof of Reserve” need to be established in order to publicize the reserve transparently. However, operating this system in a reliable, independent and regularly auditable manner is a serious challenge.