BÚSSOLA DO MERCADO

Like traditional markets, digital assets are set to end another challenging week. Cryptocurrencies have given back most of the gains made in the bullish run-up to Trump’s election as President of the United States with declines this week as a result of investors’ risk-averse behavior. Even a painful couple of days brought on by the hacking of a cryptocurrency exchange did not create the pressure of political and economic developments. However, Donald Trump’s unpredictable administration and his “tariffs” that could damage global trade continue to worry markets, and digital assets are feeling the effects of this situation. Of course, at this point, the fact that investors are now waiting to see concrete steps on the President’s promises regarding the crypto world and the gap created by the need for a new catalyst has caused the sales to be felt more deeply. Within this ecosystem, the results have been an appreciation of the dollar and bonds, a fall in bond yields and a sell-off of risky assets.

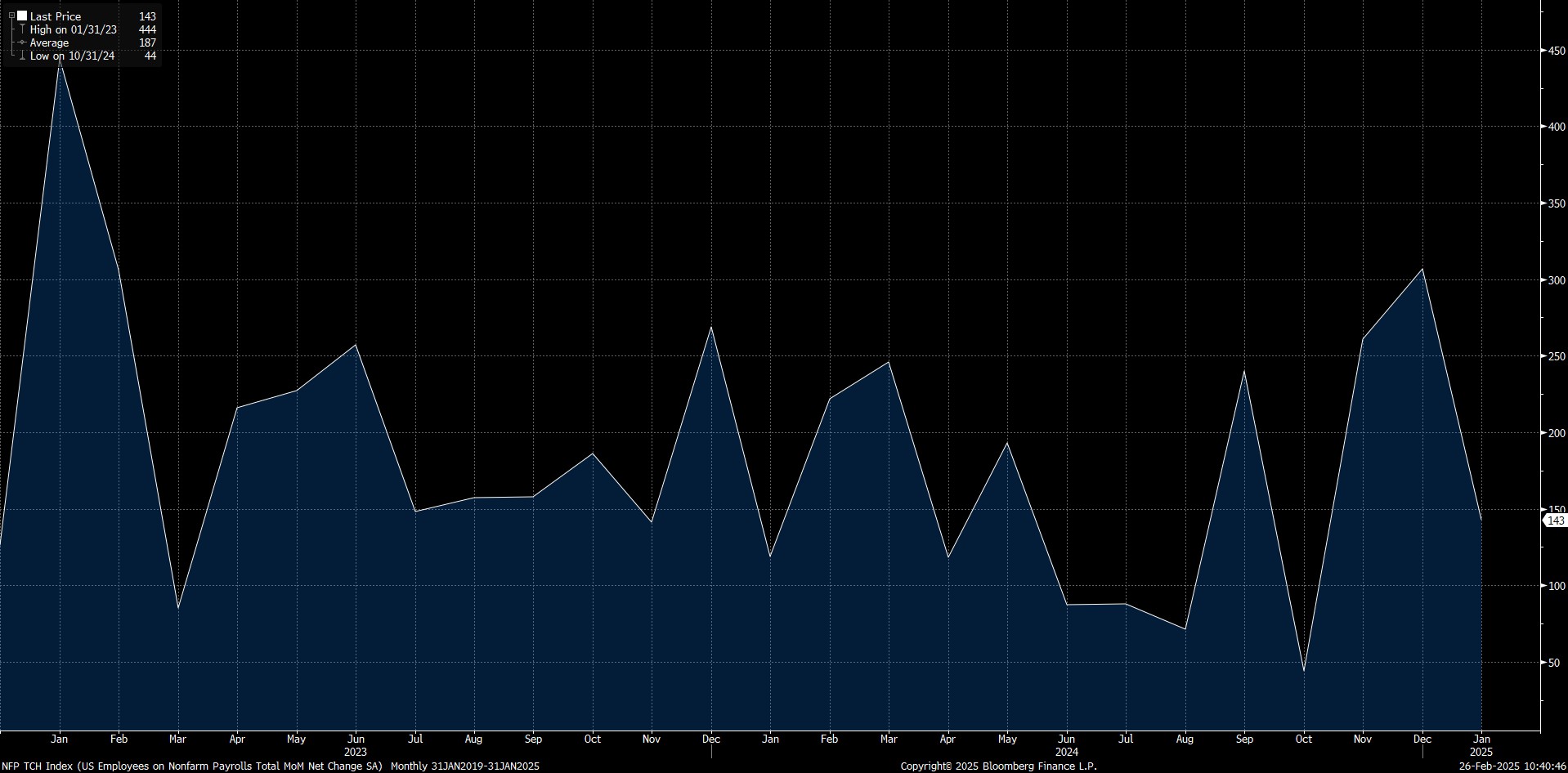

We can say that the main variable that has been driving prices in recent weeks has been the risks awaiting global trade. In addition, it would not be wrong to say that macro dynamics, which have been in the background in the past period, may come to the fore a little more next week. In particular, the US labor statistics and non-farm payrolls change data, which will be released on Sexta-feira, will be critical in predicting the US Federal Reserve’s (FED) next policy change move. In fact, ahead of this data, we will be watching US macro indicators during the week, which may also change pricing behavior. The European Central Bank’s (ECB) monetary policy statement will also be noteworthy. For now, however, we will give a separate parenthesis to the employment data, which will provide information about the health of the world’s largest economy.

Non-Farm Payrolls Change in the Shadow of the “Tariff” Agenda

For the markets, the first critical macro data for Março comes on Março 7. Non-Farm Payrolls (NFP), which will provide clues about the US Federal Reserve’s interest rate cut path and the tightness of the financial ecosystem in the coming period, will be the priority. In addition, Fevereiro figures such as average hourly earnings and the unemployment rate will be followed.

The NFP for the first month of the year was announced as 143 thousand, which was below the general expectation of around 170 thousand. However, when the details of the employment report and other data are analyzed, we believe that this set of statistics does not point to a bad labor market. But to open a separate parenthesis, it is important to note that while the tendency of Americans to stay in their current jobs has increased, their willingness to demand higher wages has decreased. We may see the effects of this negatively in the long run.

Fonte: Bloomberg

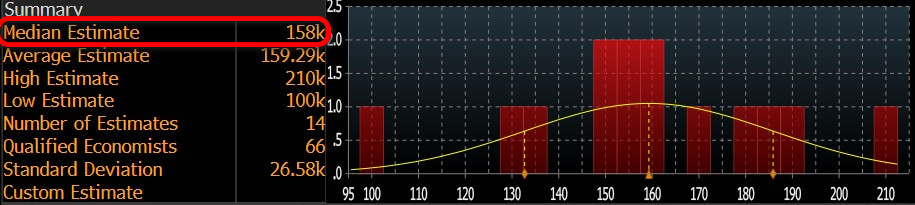

Coming back to the Non-Farm Payroll Change data, which is highly sensitive to the market, our forecast is that the US economy added approximately 150K new jobs in the non-farm sectors in Fevereiro. At the time of writing, although the number of forecasts entered is small, we see that the consensus on the Bloomberg terminal is around this level, slightly above (around 158K in the last update).

Fonte: Bloomberg

We believe that if the Fevereiro NFP data, which will be published in the shadow of the deterioration that Trump’s tariff-centered foreign policy may create domestically, is slightly below expectations, this will be priced as a metric that may create an expectation that the FED may act more boldly to lower the interest rate, thus increasing the risk appetite and having a positive impact on financial instruments, including digital assets. We think that a slightly higher-than-expected data may have a similar but opposite effect. However, a much lower than expected NFP data may trigger recession concerns with a commentary on the health of the US economy, which may put selling pressure on assets considered to be risky. It should be noted here that we expect that a much better than expected data could also have a positive impact. It is worth noting that we anticipate these effects by taking into account the current market sentiment.

ESTUDOS ATUAIS DO DEPARTAMENTO DE PESQUISA DA DARKEX

Relatório mensal de estratégia da Darkex - março

Análise semanal do BTC Onchain

Análise semanal de ETH Onchain

The Combination of Ethereum Staking and ETFs: A New Era for Investors?

Impact of Tether’s Possible Bitcoin Sale on Crypto Markets Under the US Stable and Genius Acts

Why Tether Chose the Arbitrum Infrastructure Network for Stablecoin USDT0?

High Correlation Between Bitcoin and the Russell 2000 Index: Causes and Consequences

The Digital Asset Fund Revolution: Altcoin ETF Process

Clique aqui para ver todos os nossos outros relatórios do Market Pulse.

DADOS IMPORTANTES DO CALENDÁRIO ECONÔMICO

Clique aqui para ver o calendário semanal de criptografia e economia da Darkex.

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

A Darkex não pode ser responsabilizada por possíveis mudanças decorrentes de situações semelhantes. Também é possível verificar a página do Calendário Darkex ou a seção do calendário econômico nos relatórios diários para possíveis alterações no conteúdo e no momento da divulgação dos dados.

AVISO LEGAL

As informações, comentários e recomendações sobre investimentos contidos neste documento não constituem serviços de consultoria de investimentos. Os serviços de consultoria de investimento são prestados por instituições autorizadas em caráter pessoal, levando em conta as preferências de risco e retorno dos indivíduos. Os comentários e recomendações contidos neste documento são de caráter geral. Essas recomendações podem não ser adequadas à sua situação financeira e às suas preferências de risco e retorno. Portanto, tomar uma decisão de investimento com base apenas nas informações contidas neste documento pode não resultar em resultados que estejam de acordo com suas expectativas.