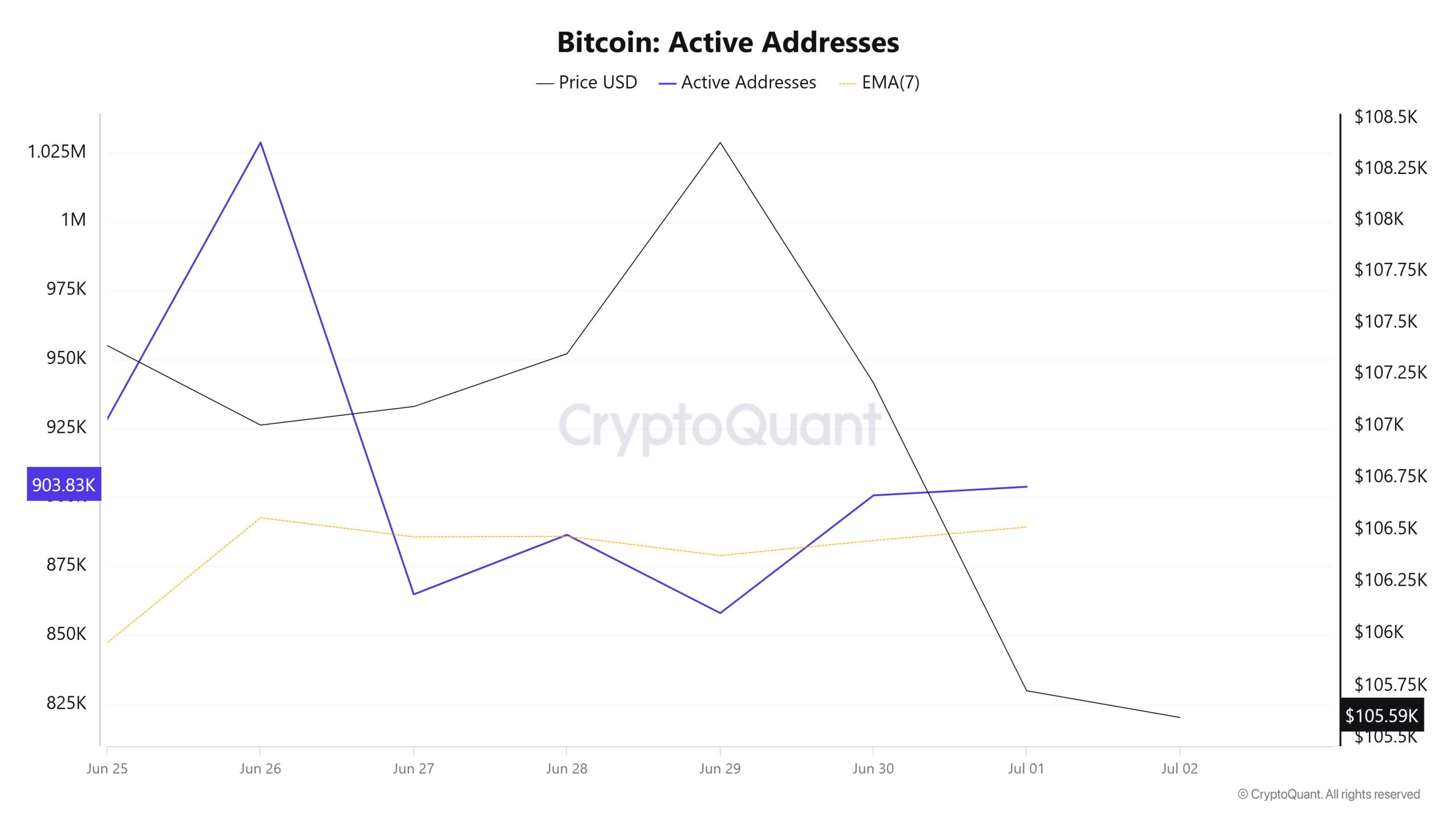

Endereços ativos

Between Junho 25 and Julho 2, 1,028,725 active addresses were added to the Bitcoin network. During this time, the Bitcoin price rose as high as $108,000. On Junho 29, there was a drop in the number of active addresses, while Bitcoin saw an increase of $108,000. When the 7-day simple moving average (SMA) is analyzed, it is observed that the price follows a downward trend on the dates when this average crosses the price. This indicates that buying pressure is weakening.

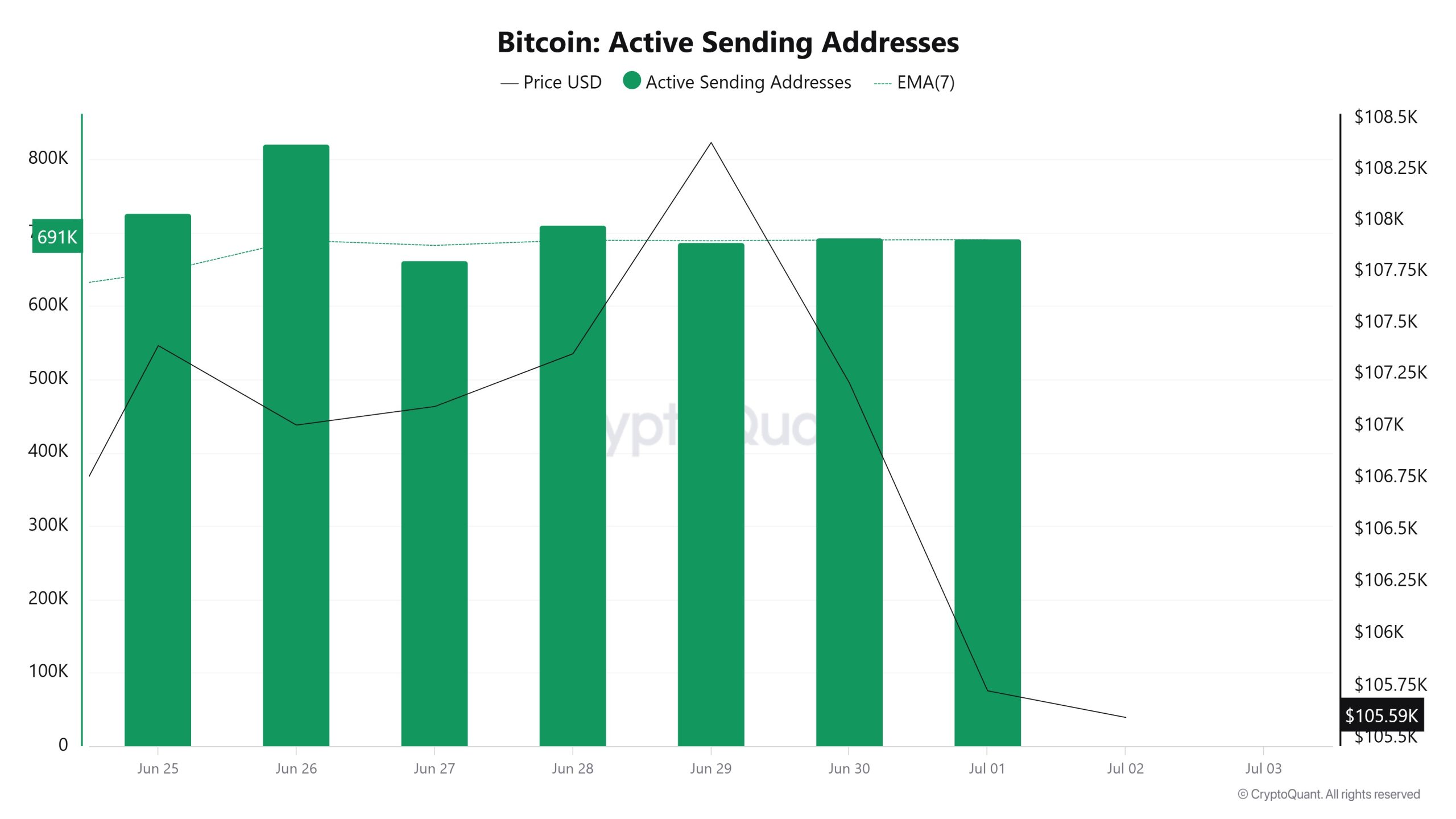

Endereços de envio ativos

Between Junho 25 and Julho 2, there was a sideways movement in active shipping addresses. On the day of the price high, active sending addresses rose as high as 686,698, indicating that Bitcoin active address inflows were considering the $108,000 level. As a result, the ‘Active Sending Addresses’ metric was generally flat

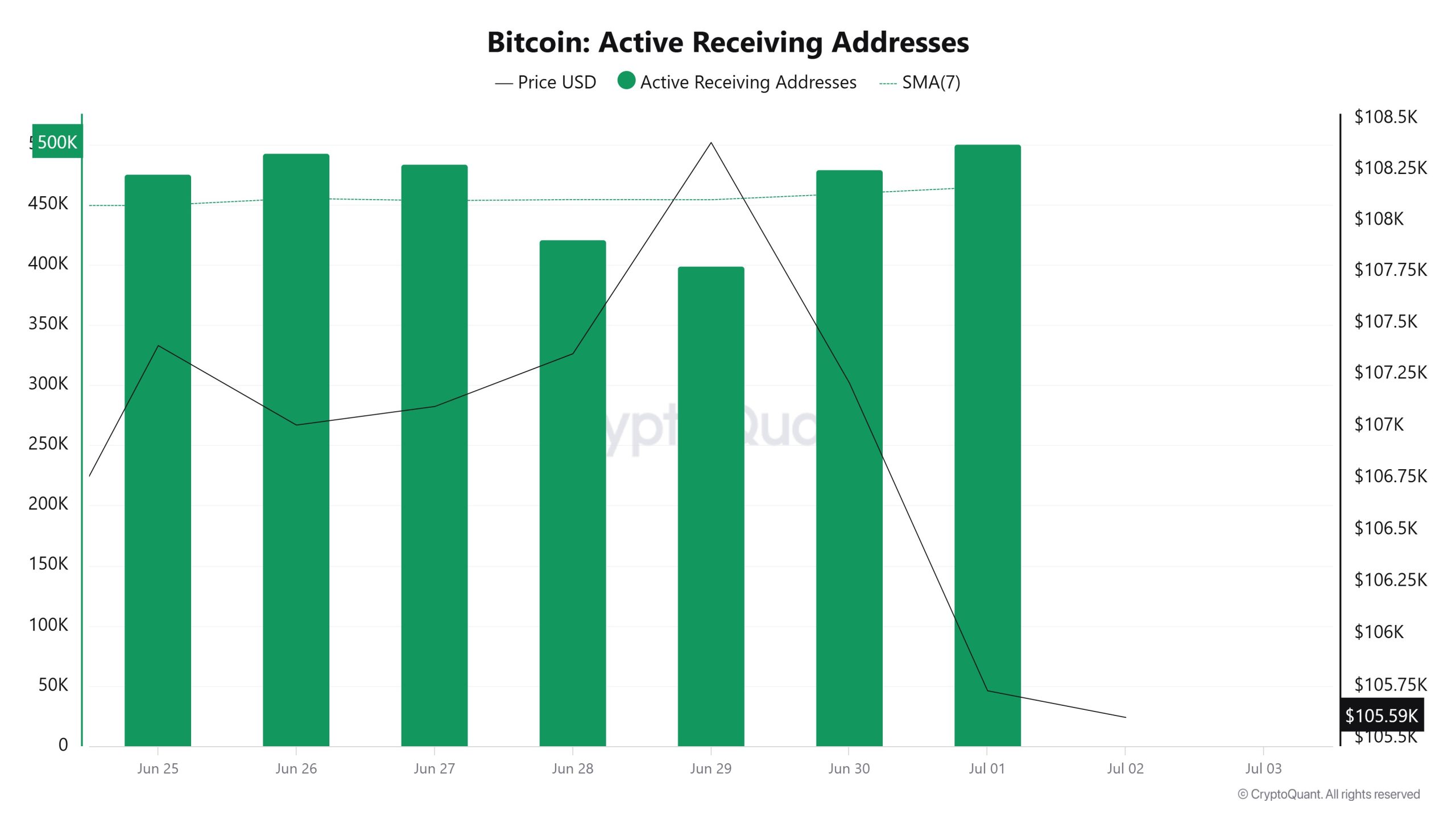

Endereços de recebimento ativos

Between Junho 25th and Julho 2nd, there was a regular rise in active buying addresses with the Black Line (price line). On the day when the price reached a high level, active receiving addresses rose to 461,021 levels; It shows that buyers bought Bitcoin at $108,000 levels.

Desmembramentos

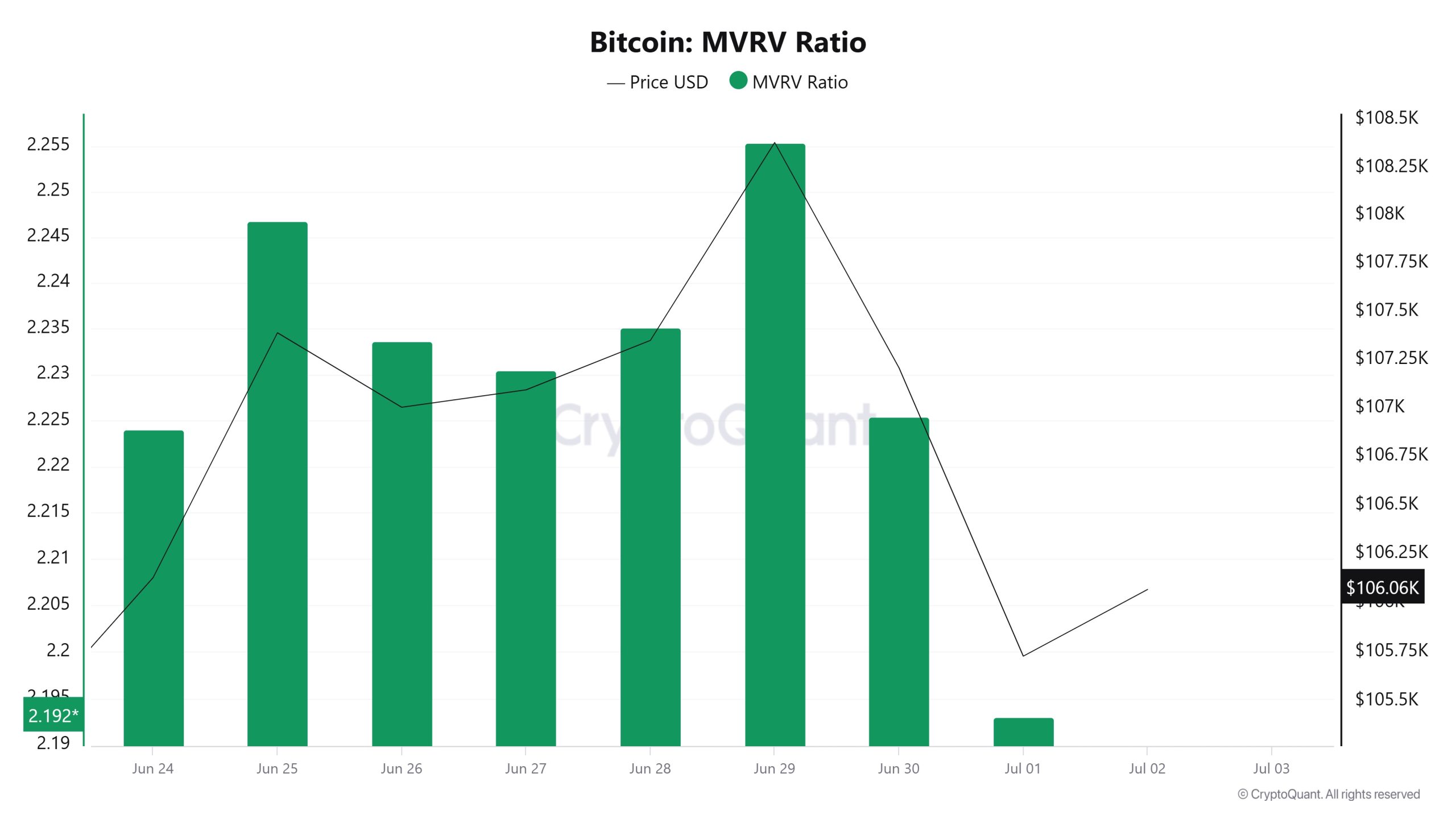

MRVR

On Junho 25th, the Bitcoin price was 107,390 while the MVRV Ratio was 2.246. As of Julho 1, the Bitcoin price fell 1.55% to 105,727, while the MVRV Ratio fell 2.40% to 2,192.

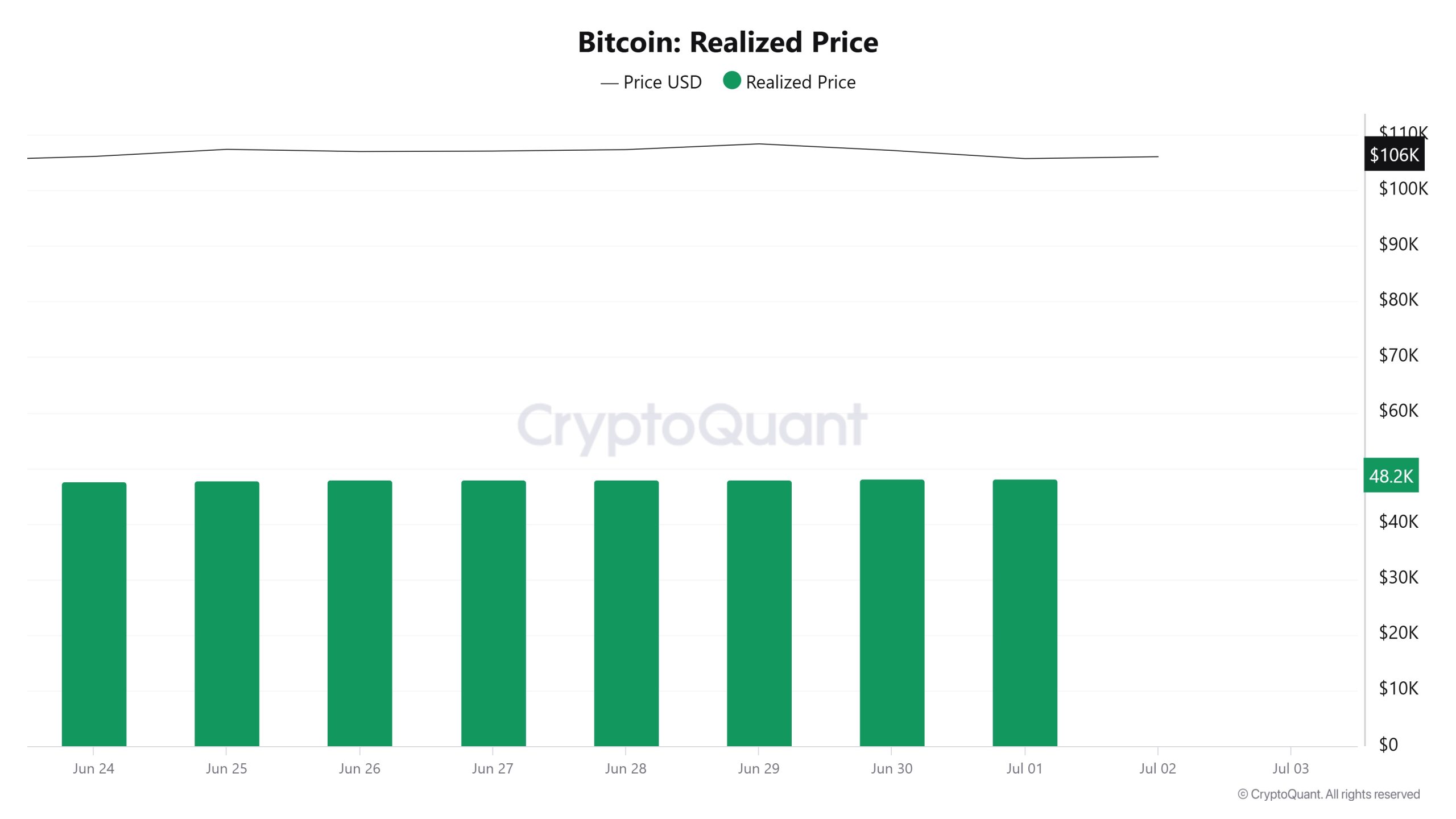

Preço Realizado

On Junho 25th, Bitcoin price was 107,390 while Realized Price was 47,797. As of Julho 1, the Bitcoin price decreased by 1.55% to 105,727, while the Realized Price increased by 0.86% to 48,211.

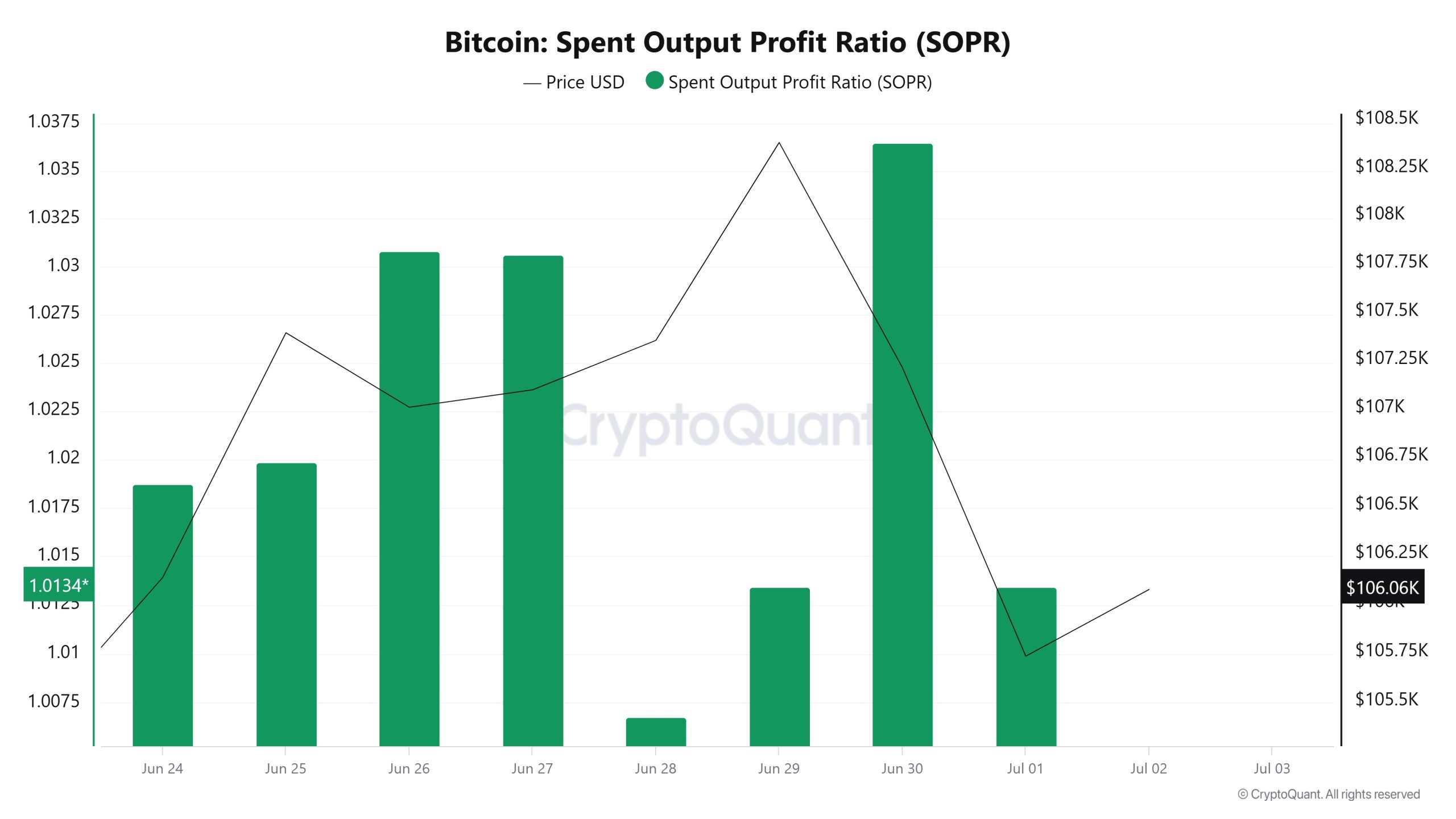

Índice de lucro de produção gasta (SOPR)

On Junho 25, the Bitcoin price was at 107,390 while the SOPR metric was at 1,019. As of Julho 1, the Bitcoin price fell 1.55% to 105,727, while the SOPR metric decreased 0.58% to 1,013.

Derivativos

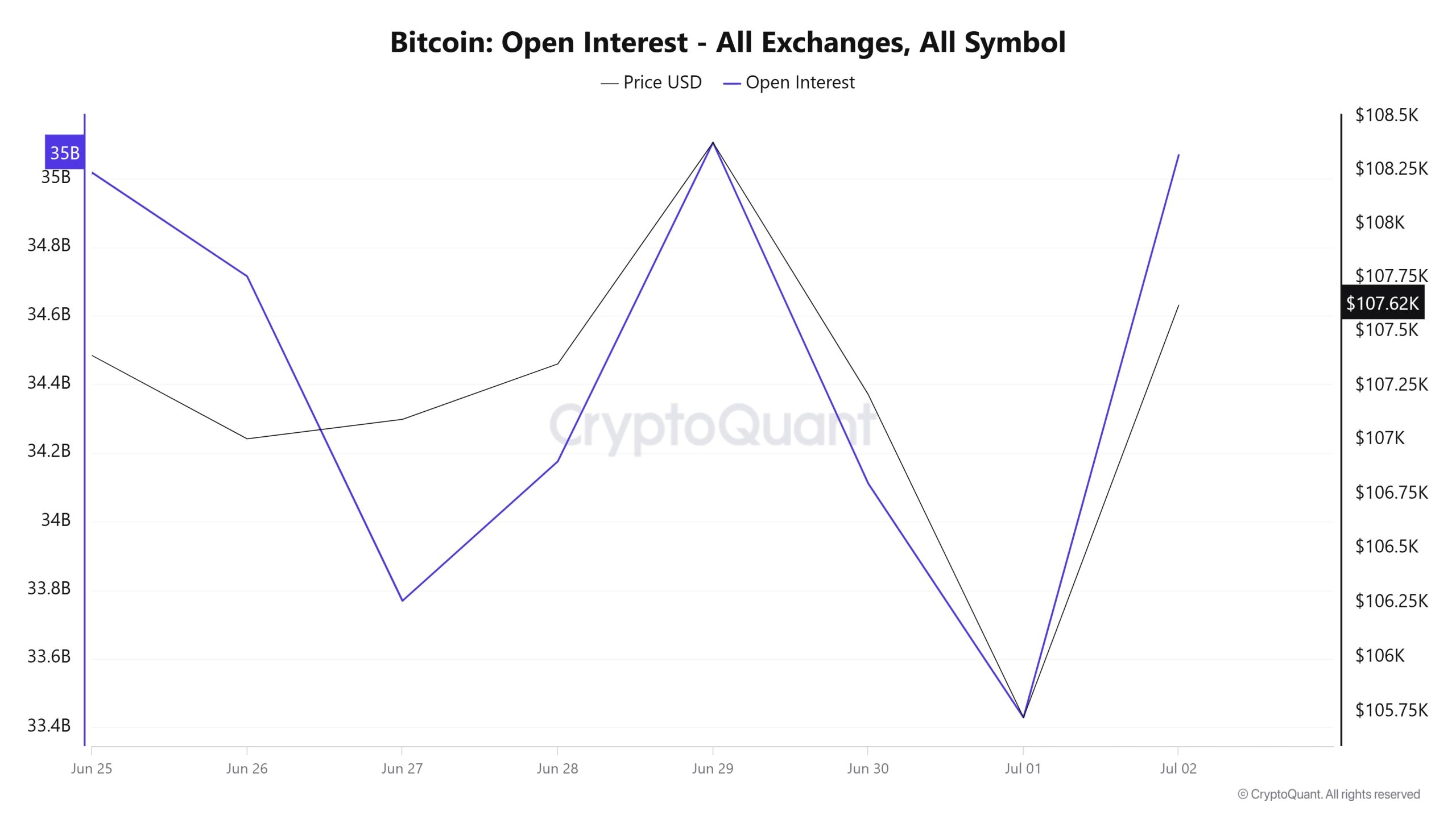

Juros abertos

Bitcoin futures have been quite volatile in recent days, both in terms of price and open interest. On Junho 25, open interest was at $35 billion, but it gradually declined in the following days to $33.8 billion on Junho 27. In the same period, the price also moved downwards, indicating that positions were closed and risk appetite decreased.

As of Junho 28, this situation quickly reversed. Both the price and open interest rose sharply. This sudden move suggests that the number of investors entering the market with renewed expectations has increased and that there is a serious demand, especially on the long side. However, this upward momentum did not last long. Between Junho 30 and Julho 1, both metrics experienced a sharp pullback. This move may indicate that the liquidations or profit realizations that followed the overheating of the market came into play. On Julho 2, open interest rebounded, which can be read as a signal to return to the market. The price has also accompanied this. However, the sharp ups and downs seen in the last few days reveal that the market still carries high uncertainty and there is no clear picture about the direction. The fact that price and open position data move in parallel clearly shows that the market was driven by highly speculative and short-term strategies during this period.

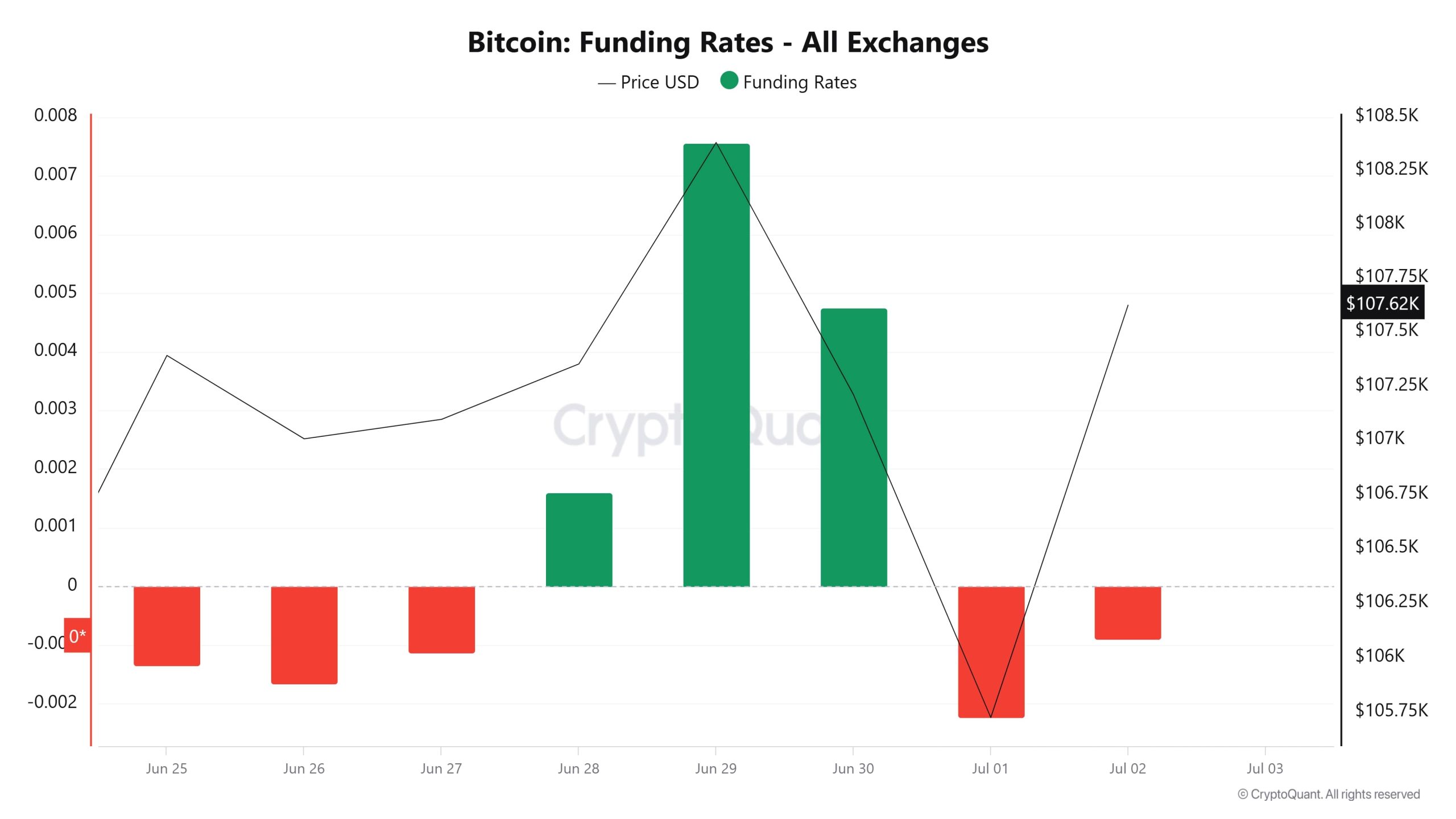

Taxa de financiamento

Negative funding ratios between Junho 25-27 are noteworthy and indicate that short positions are predominant. During this three-day period, while the price followed a sideways-downward trend, it can be said that the market was in a cautious mode. However, starting from Junho 28th, the mood suddenly changes. Funding ratios not only crossed into positive territory, but also jumped above the 0.007 level on Junho 29. This shows that the interest in long trades increased significantly and traders were buying the rise.

But this surge didn’t last long. After Junho 30, both the price and the funding ratio started to decline. On Julho 1, the funding ratio turned negative again, falling to around -0.002. This sharp reversal may reflect the rapid closing of long positions or liquidations after overbought. On Julho 2, the funding ratio is still in negative territory, but the price is showing signs of recovery, which could be interpreted as a re-entry signal.

Overall, the fluctuation in funding rates suggests that futures continue to search for direction and that investors are shifting positions according to short-term opportunities. The sharp pullbacks that come after sudden upward moves clearly reveal how fragile the market is.

Liquidações de longo e curto prazo

With the BTC price moving between 108,700 and 105,100 dollars, 137 million dollars long and 290 million dollars short transactions were liquidated.

| Histórico | Valor longo (milhões de dólares) | Valor curto (milhões de dólares) |

|---|---|---|

| Junho 25th | 9.78 | 47.15 |

| Junho 26th | 19.30 | 35.38 |

| Junho 27th | 17.92 | 133.71 |

| Junho 28th | 0.17 | 3.09 |

| Junho 29th | 4.05 | 36.28 |

| Junho 30th | 21.82 | 27.85 |

| Julho 01 | 64.58 | 7.16 |

| Total | 137.62 | 290.62 |

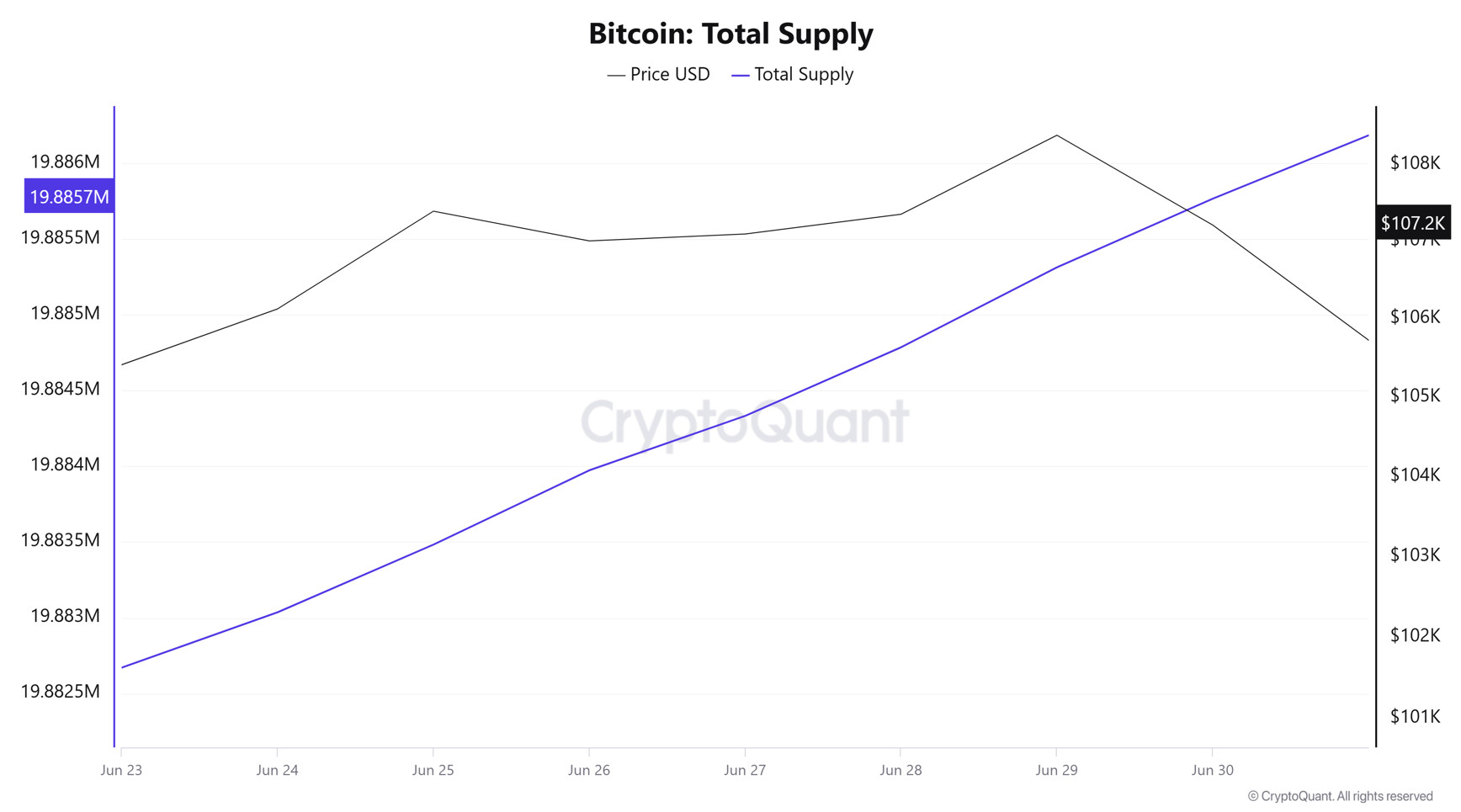

Distribuição de suprimentos

Total Supply: 19,885,767 units, up about 0.015% from last week.

New Supply: The amount of BTC produced this week was 3,096.

Velocity: Velocity, which was 12.85 last week, was 12.79 as of Junho 30.

| Categoria Carteira | 23.06.2025 | 30.06.2025 | Variação (%) |

|---|---|---|---|

| < 1 BTC | 8.4795% | 8.4707% | -0.10% |

| 1 - 10 BTC | 11.4552% | 11.4290% | -0.22% |

| 10 - 100 BTC | 24.6075% | 24.6580% | 0.20% |

| 100 - 1k BTC | 28.9068% | 28.9932% | 0.29% |

| 1k - 10k BTC | 18.3613% | 18.3194% | -0.22% |

| 10k+ BTC | 8.1891% | 8.1292% | -0.73% |

According to the latest weekly data, there was a limited decrease of -0.10% in <1 BTC wallets, while a decrease of -0.23% was observed in the 1-10 BTC range. There were slight increases of +0.21% in the 10-100 BTC segment and +0.30% in 100-1k BTC. The 1k-10k BTC range saw a limited decline of -0.23%, while the 10k+ BTC category saw a more significant decline of -0.73%.

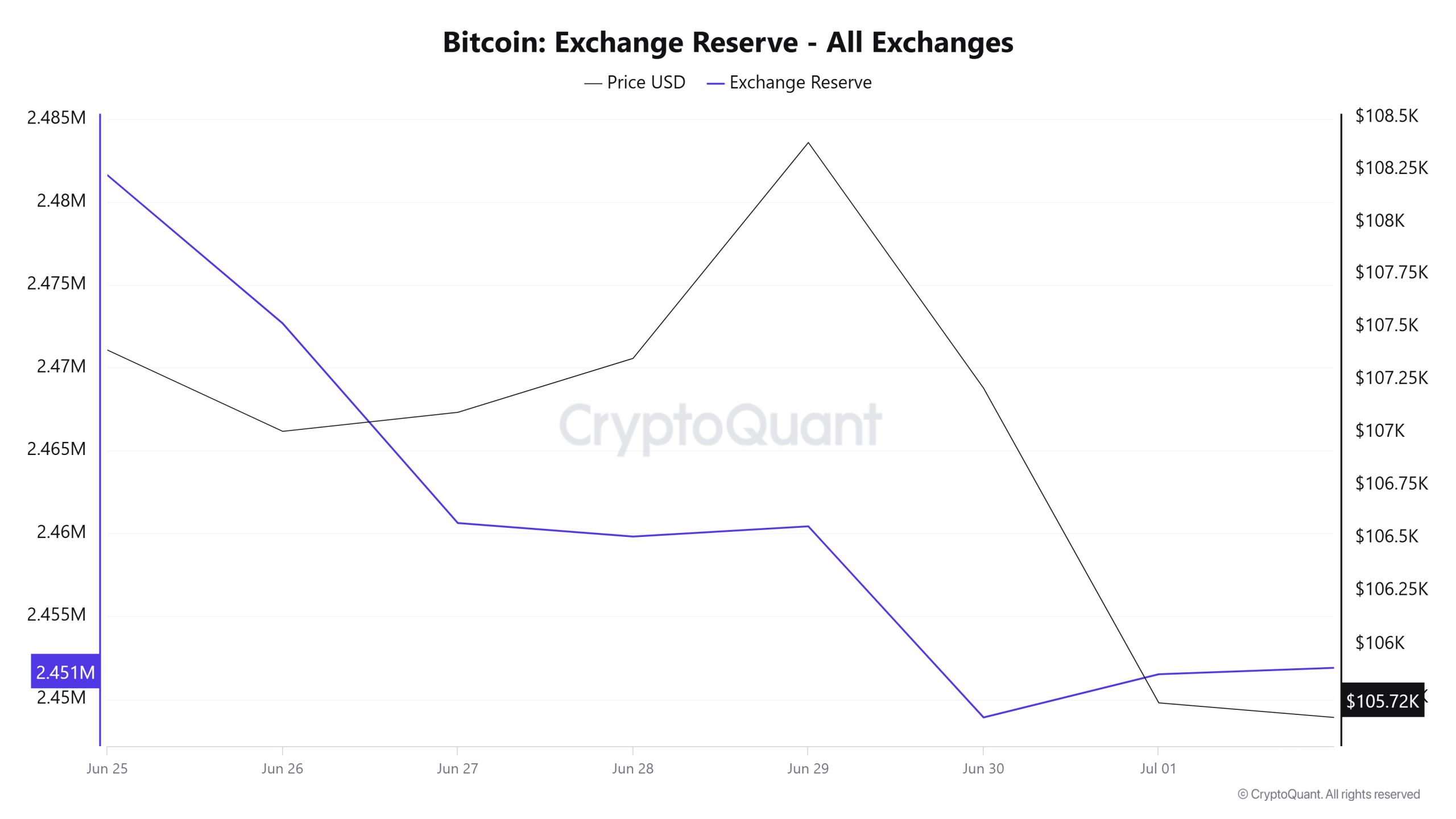

Reserva de câmbio

Between Junho 25 and Julho 1, 2025, Bitcoin reserves on exchanges decreased from 2,481,638 BTC to 2,451,517 BTC. In total, there was a net outflow of 30,121 BTC during this period, reducing reserves by about 1.21%. During the same period, the Bitcoin price fell by 1.5%, from $107,391 to $105,727. The decline in reserves during this period shows that investors tend to transfer their assets off-exchange and prefer to store their assets for the long term. However, the decline in prices despite the decrease in reserves shows that the pressure on the market continues and the short-term risk appetite remains weak. Investors’ cautious approach indicates that price volatility may remain limited in the coming days.

| Data | Fluxo de câmbio | Saída de câmbio | Fluxo de rede do Exchange | Reserva de câmbio | Preço do BTC |

|---|---|---|---|---|---|

| 25-Jun | 29,877 | 31,847 | -1,970 | 2,481,638 | 107,391 |

| 26-Jun | 25,290 | 34,233 | -8,943 | 2,472,695 | 107,005 |

| 27-Jun | 31,634 | 43,692 | -12,058 | 2,460,637 | 107,095 |

| 28-Jun | 8,501 | 9,311 | -810 | 2,459,828 | 107,351 |

| 29-Jun | 5,626 | 5,011 | 615 | 2,460,443 | 108,382 |

| 30-Jun | 24,264 | 35,800 | -11,536 | 2,448,907 | 107,210 |

| 1-Jul | 20,788 | 18,178 | 2,610 | 2,451,517 | 105,727 |

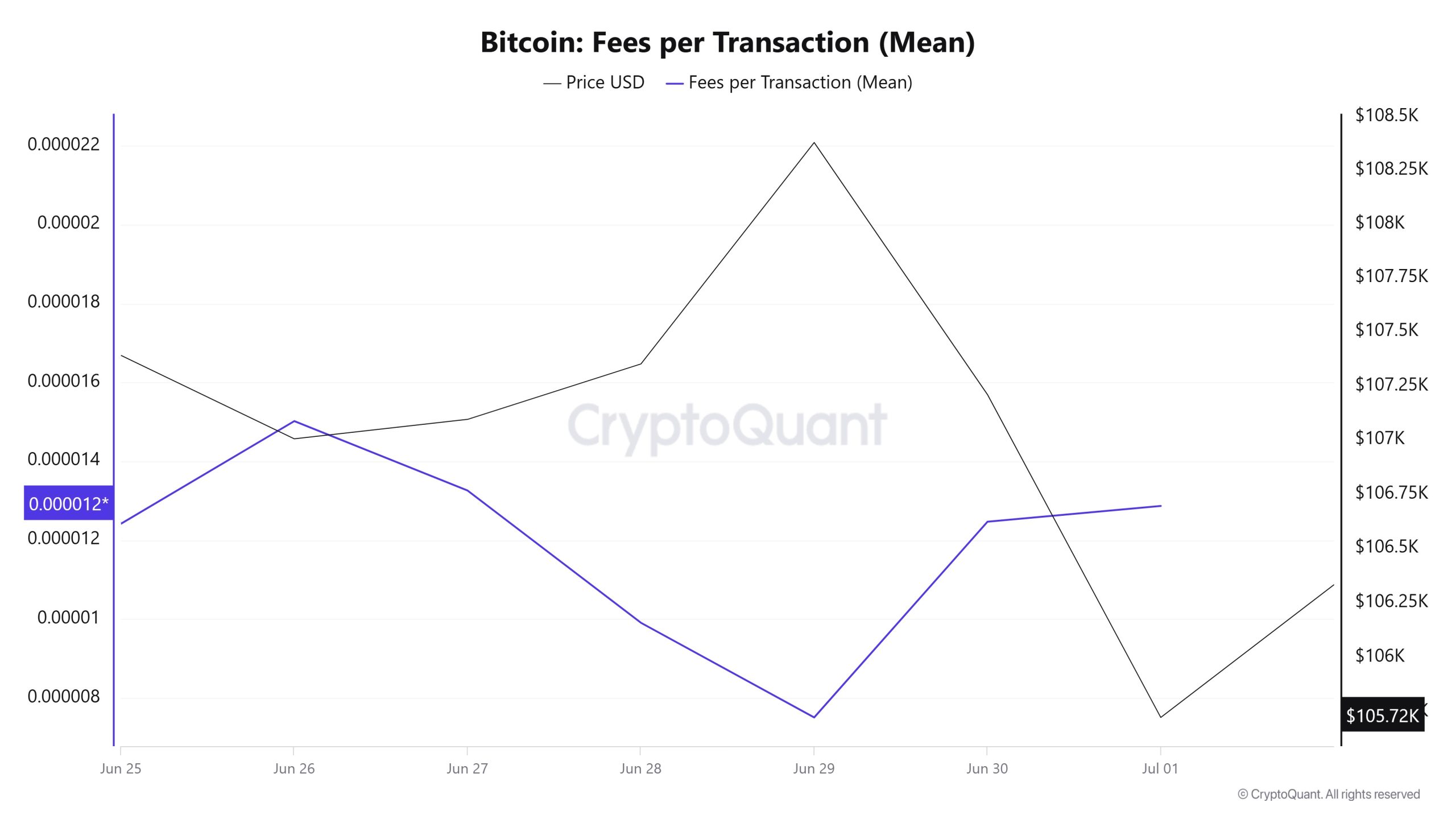

Taxas e receitas

Between Junho 25 and Julho 1, Bitcoin Fees per Transaction (Mean) data shows that this indicator was at 0.00001242 on Junho 25, the first day of the week.

As of Junho 26, a downward trend was observed due to the volatile movements in the Bitcoin price; As of Junho 29, it fell to 0.00000751, reaching the lowest level of the week.

In the following days, Bitcoin Fees per Transaction (Mean) started to rise again and closed at 0.00001287 on Julho 1, the last day of the week.

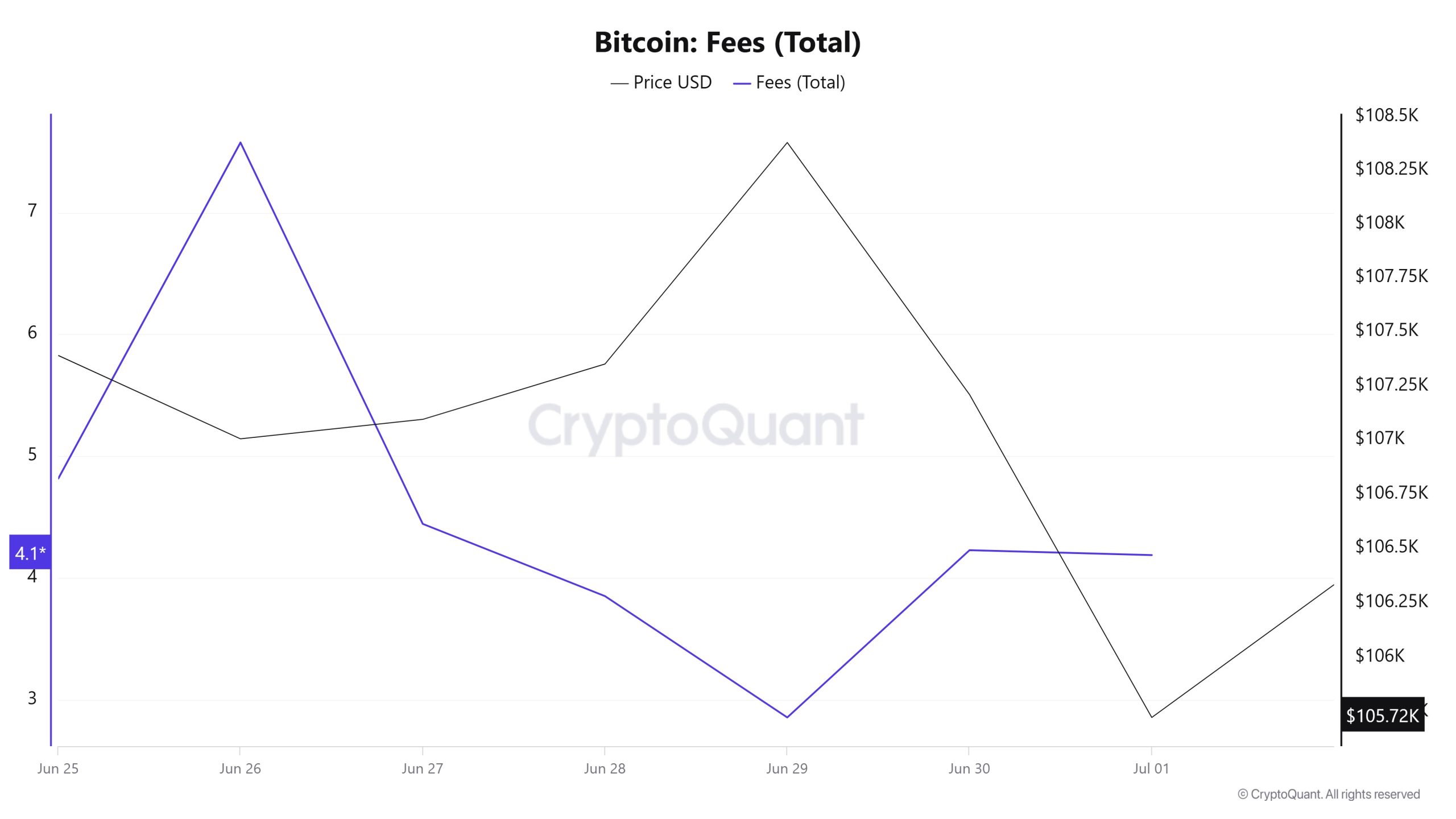

Bitcoin: Taxas (Total)

Similarly, when Bitcoin Fees (Total) data between Junho 25 and Julho 1 are analyzed, it is seen that this indicator was realized at 4.8161778 on Junho 25, the first day of the week.

As of Junho 26, a downward trend was observed due to the volatile movements in the Bitcoin price; as of Junho 29, it fell to 2.85640286, reaching the lowest level of the week.

In the following days, Bitcoin Fees (Total) started to rise again and closed at 4.18857415 on Julho 1, the last day of the week.

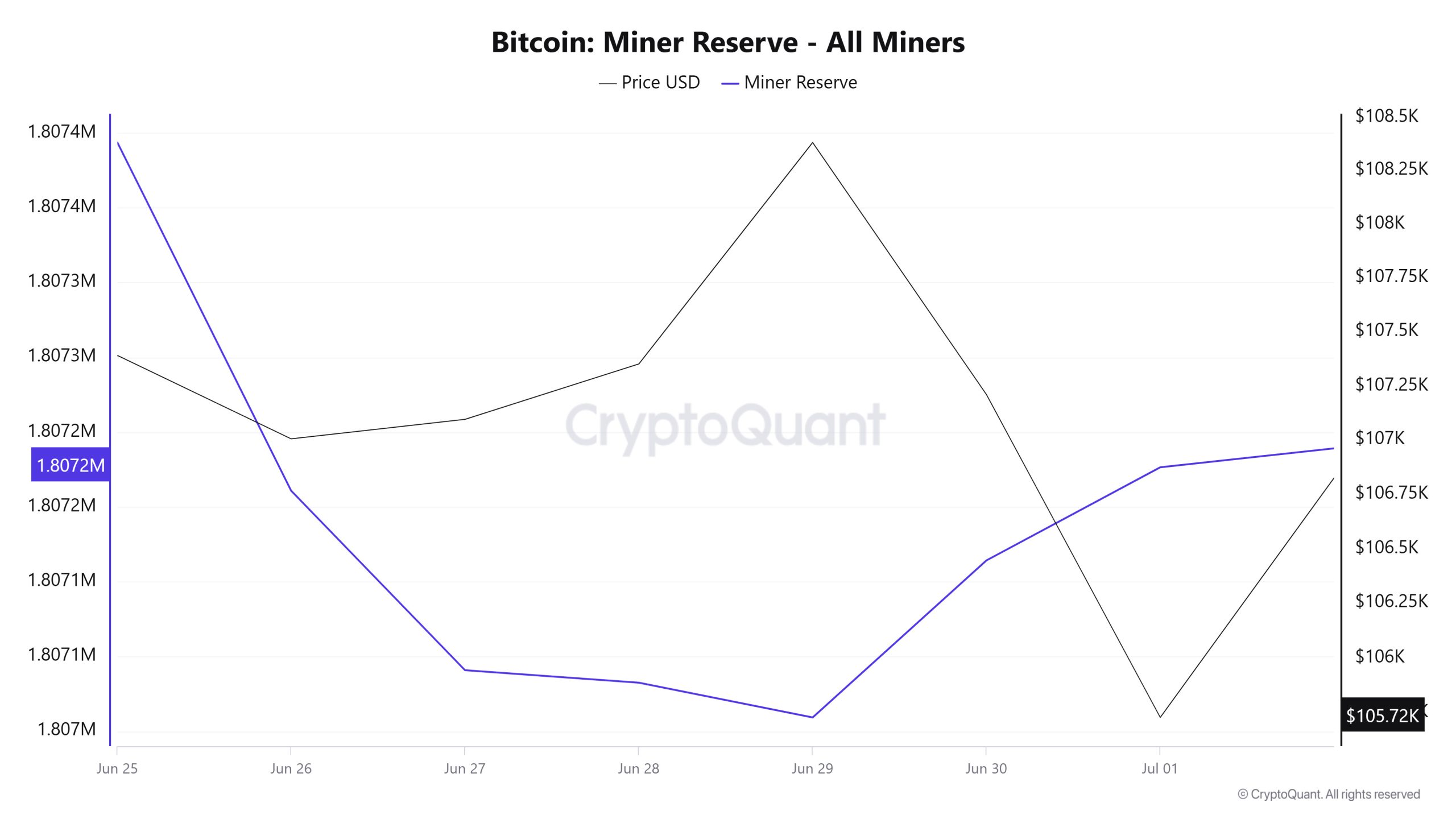

Fluxos do minerador

According to the data obtained from the Miner Reserve table, there was an increase in Bitcoin reserves held in miners’ wallets this week. There was a negative correlation between Bitcoin price and Miner Reserve during the week.

Inflow, Outflow e NetFlow do minerador

Between Junho 25 and Julho 1, 31,357 Bitcoins exited miners’ wallets and 31,367 Bitcoins entered miners’ wallets between the same dates. The Miner Netflow for this week was 10 Bitcoin. Meanwhile, the Bitcoin price was $107,390 on Junho 25 and $105,727 on Julho 1.

Durante a semana, o fluxo líquido (Miner Netflow) foi positivo, pois a entrada de Bitcoin nas carteiras de mineradores (Miner Inflow) foi maior do que a saída de Bitcoin das carteiras de mineradores (Miner Outflow).

| Data | Influxo de mineradores | Fluxo de saída do minerador | Fluxo de rede do minerador |

|---|---|---|---|

| 25 Haz | 6483.82 | 6256.75 | 227.07 |

| 26 Haz | 5236.45 | 5469.25 | -232.81 |

| 27 Haz | 6176.98 | 6296.91 | -119.93 |

| 28 Haz | 2288.53 | 2296.86 | -8.33 |

| 29 Haz | 2793.55 | 2816.81 | -23.27 |

| 30 Haz | 4148.13 | 4043.18 | 104.96 |

| 1 Tem | 4239.68 | 4177.41 | 62.27 |

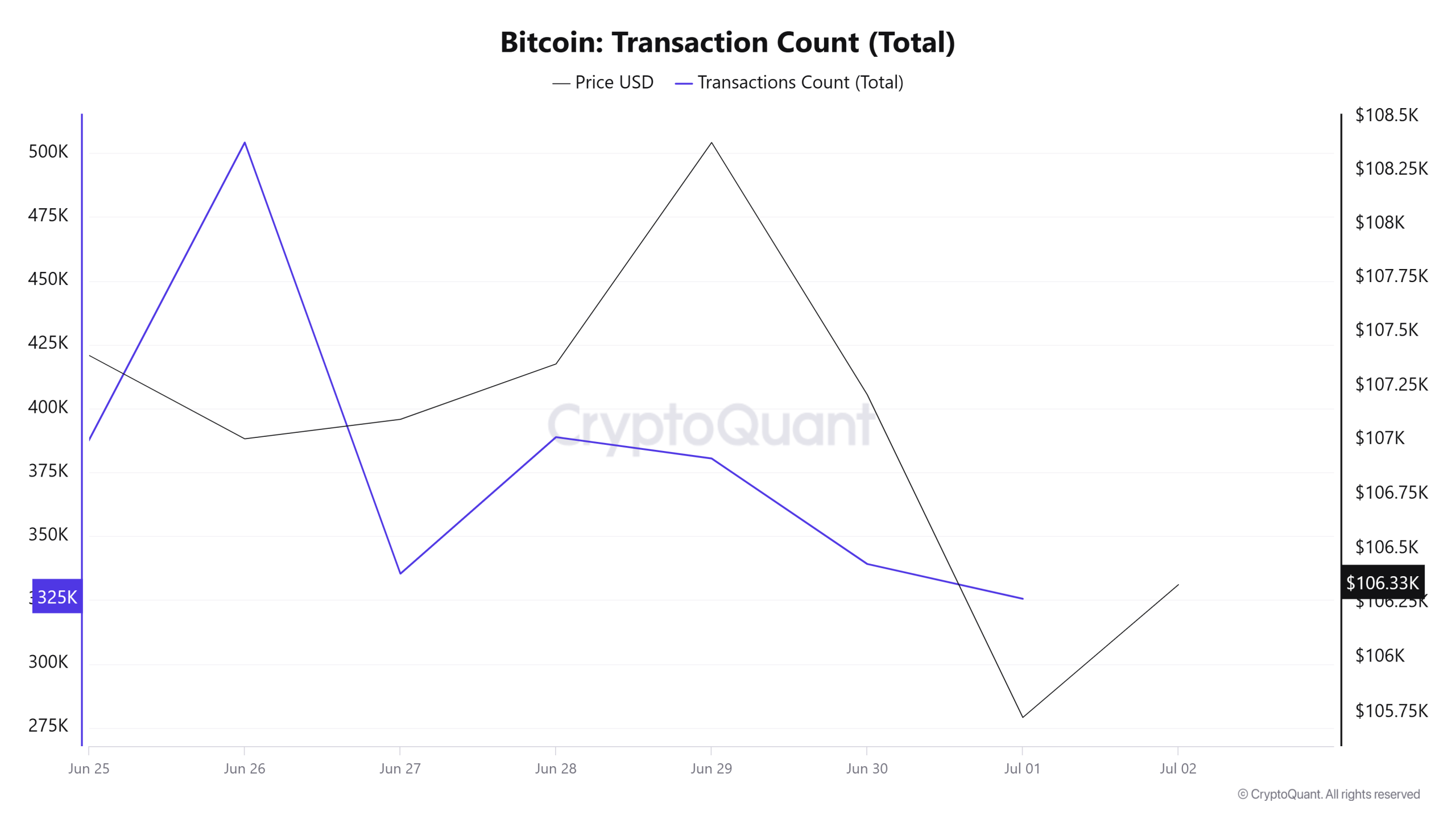

Transação

Last week, there were 2,247,054 transactions on the Bitcoin network, while this week it increased by about 18.42% to 2,661,118. The 504,184 transactions recorded on Junho 26th was the highest transaction volume of the week, while the lowest number of transactions was 325,479 on Julho 1st.

Correlations between price and number of transactions were negative for the week, but the increase in network activity compared to the previous week breaks the negative picture.

Tokens transferidos

While 3,772,565 BTC was transferred last week, this week it increased by approximately 2.65% to 3,872,504 BTC. On Junho 25, the highest token transfer volume of the week was 720,913 BTC, while the lowest token transfer volume was 333,729 BTC on Junho 29. The positive and negative correlations between the amount of BTC transferred on the network and the price have been balanced throughout this week.

Atividades com baleias

Dados sobre baleias

Over the last 7 days, data from the cryptocurrency market showed that whale activity on centralized exchanges was high at the beginning of the process. Towards the middle of the process, these activities declined. When we look at the Exchange Whale Ratio metric, Junho 25, the first day of the 7-day process, measured the rate of whales using central exchanges as 0.478. The peak of the process occurred on Junho 28 and the value was 0.731. When this ratio is above 0.35, it usually means that whales use centralized exchanges frequently. This measurement decreased towards the middle of the process, dropping to 0.464 on Junho 29, marking the low point of the process. It currently stands at 0.621 and centralized exchanges continue to be used frequently. BTC was priced at $105,000 at the beginning of this period and is currently priced at $107,500. This shows that whales are using centralized exchanges in a balanced way. At the same time, total BTC transfers increased by 2% compared to last week, with 3,872,504 BTC moving. The data suggests that BTC is currently under selling pressure from long-term holders and large whales. It also shows that the group of Bitcoin holders with a medium-term maturity of 6 months has recently seen an upward trend in hoarding, while holders with a maturity of 2 years or more have been consistently selling. This has created pressure that will make it difficult for BTC prices to break out despite growing market demand. As a result, when we focus on the movements, the whales’ balanced use of centralized exchanges suggests that Bitcoin may move sideways in a narrow band.

BTC Onchain em geral

| Métrico | Aumento 📈 | Declínio 📉 | Neutro ➖ |

|---|---|---|---|

| Endereços ativos | ✓ | ||

| Desmembramentos | ✓ | ||

| Derivativos | ✓ | ||

| Distribuição de suprimentos | ✓ | ||

| Reserva de câmbio | ✓ | ||

| Taxas e receitas | ✓ | ||

| Fluxos do minerador | ✓ | ||

| Transação | ✓ | ||

| Atividades com baleias | ✓ |

*As métricas e orientações da tabela não descrevem nem implicam, por si só, uma expectativa de futuras alterações de preço para qualquer ativo. Os preços dos ativos digitais podem variar de acordo com muitas variáveis diferentes. A análise onchain e a orientação relacionada têm o objetivo de auxiliar os investidores em seu processo de tomada de decisão, e fazer investimentos financeiros com base apenas nos resultados dessa análise pode resultar em transações prejudiciais. Mesmo que todas as métricas produzam um resultado de alta, baixa ou neutro ao mesmo tempo, os resultados esperados podem não ser observados, dependendo das condições do mercado. Os investidores que estiverem analisando o relatório devem estar atentos a essas advertências.

Aviso legal

As informações, comentários e recomendações sobre investimentos contidos neste documento não constituem serviços de consultoria de investimentos. Os serviços de consultoria de investimento são prestados por instituições autorizadas em caráter pessoal, levando em conta as preferências de risco e retorno dos indivíduos. Os comentários e recomendações contidos neste documento são de caráter geral. Essas recomendações podem não ser adequadas à sua situação financeira e às suas preferências de risco e retorno. Portanto, tomar uma decisão de investimento com base apenas nas informações contidas neste documento pode não resultar em resultados que estejam de acordo com suas expectativas.

OBSERVAÇÃO: Todos os dados usados na análise do Bitcoin onchain são baseados no Cryptoqaunt.