Isolated Margin vs. Cross Margin on Darkex

Choosing the appropriate margin method is vital for effective trading, as it directly affects risk management, position independence, and overall trading strategy. In this article, we explore the key features and differences between Isolated Margin and Cross Margin on Darkex.

Isolated Margin on Darkex

Under Isolated Margin mode, Darkex allows users to manage margin independently for each trading pair.

Independent Margin Accounts

Each trading pair operates with its own isolated margin account. An isolated margin account only accepts specific cryptocurrencies.

For example, only BTC and USDT can be placed in the BTC/USDT isolated margin account. Traders can open multiple isolated margin accounts for different trading pairs.

Position Independence

Positions for each trading pair are fully separate. If additional collateral is required, it does not transfer automatically from other isolated margin accounts or from a cross margin account—even if sufficient assets are available elsewhere.

Users must manually add collateral to continue holding positions.

Collateral Calculation

Collateral levels are calculated solely based on the assets and liabilities within each individual isolated margin account.

Risk Isolation

Risk is contained within each isolated margin account. In the event of liquidation, losses are limited to that specific account and do not affect other positions.

Cross Margin on Darkex

In Cross Margin mode, margin is shared across all trading pairs within a single margin account.

One Unified Cross Margin Account

Each user has one cross margin account, and all trading pairs are managed within this single account.

All assets in the cross margin account are shared among all open positions, allowing profits from one position to support others.

Collateral Calculation

Collateral levels are calculated based on the total asset value and total liabilities of the entire cross margin account.

System Alerts and Liquidation

The system continuously monitors the margin level and may prompt users to add collateral or close positions.

If liquidation occurs, all positions within the account are liquidated.

Key Differences Between Isolated and Cross Margin on Darkex

Margin Allocation

Isolated Margin:

Each trading pair has its own independent margin account, so losses from one pair do not affect others.

Cross Margin:

Margin is shared across all trading pairs, meaning a loss in one position reduces overall account safety.

Risk Management

Isolated Margin:

Risk is limited to a single isolated margin account. Liquidation does not impact other positions.

Cross Margin:

All positions share risk. If maintenance margin requirements are breached, all positions may be liquidated.

Margin Shortfall Handling

Isolated Margin:

Additional margin must be added manually to the affected position.

Cross Margin:

The system automatically draws from total available assets to support positions.

Position Independence

Isolated Margin:

Positions are independent, providing greater control over individual trades.

Cross Margin:

Positions are interconnected, and changes in one affect the entire account margin level.

Number of Accounts

Isolated Margin:

Multiple accounts can be created for different trading pairs.

Cross Margin:

Only one account is used for all trading pairs.

Liquidation Impact

Isolated Margin:

Liquidation affects only the specific trading pair.

Cross Margin:

Liquidation of one position can trigger liquidation of all positions in the account.

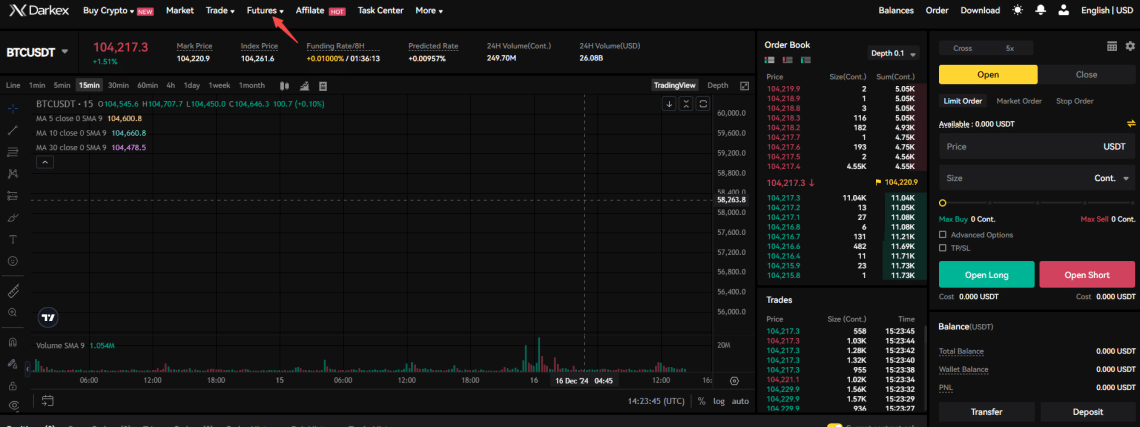

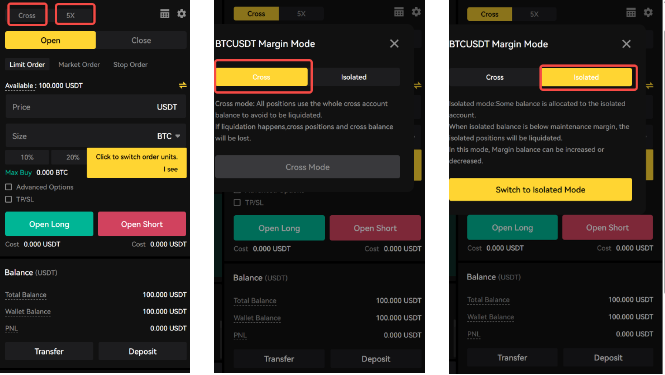

How to trade isolated margin and cross margin on Darkex?

After logging into your Darkex account, click Futures on the page that opens.

On the page that opens, you can mark your trade mode as isolated or cross on the right side

Disclaimer

This article is for informational use only and does not constitute financial advice. Trading on margin carries huge risks, which means that your loss can be even greater than what money you put down at first. Before you use margin trading as an option for investment, therefore always engage in thorough research and make sure to check with some financial advisor who knows both the upsides and downsides of this kind of transaction.

Click for the Isolated Margin training article