Market Compass

Tariff Agenda Ahead of Critical Employment Data

- On the agenda of global markets, the most important topic that determines the direction of asset prices continues to be “tariffs”. US President Donald Trump announced that he will impose tariffs of at least 10 percent on countries with a trade surplus with the US. Most of the tariffs will come into effect on August 7th.

- With the news of tariffs reaching up to 41% (Switzerland 39%, Canada 35%), we observed a general risk-off mood in the world and the dollar continued to appreciate.

- Following the selloff in Asian stock markets, European indices also declined today. Wall Street futures contracts point to a negative opening. The fact that the balance sheets of some large companies such as Amazon did not meet the expectations of investors is also effective in pricing.

- On the other hand, we see that Trump has started to increase the pressure on the US Federal Reserve (FED) on the interest rate cut issue. However, recent macro indicators, such as higher-than-expected economic growth (GDP) and the PCE Price Index (a measure of inflation) have signaled that the FED’s rate cut path this year may not be as fast as previously expected.

- Although we are at a pivotal turning point for the future of crypto assets and their wider adoption, developments in global markets have kept investors from taking risks, and expectations of US regulations for digital assets have been largely priced in, leaving the door open for losses in the last 24 hours.

- The decline in risk appetite also had an impact on digital assets. Major cryptocurrencies suffered significant losses. The July employment data to be announced for the US economy later in the day may be decisive in terms of pricing behavior. Apart from the impact of this data set on the current investment climate, we think that the price of digital assets may recover after the recent sharp losses, assuming that there will be no new and surprising developments over the weekend.

For a detailed review of our twice-daily technical analysis report and the latest developments in digital assets click here.

Critical US Employment Data

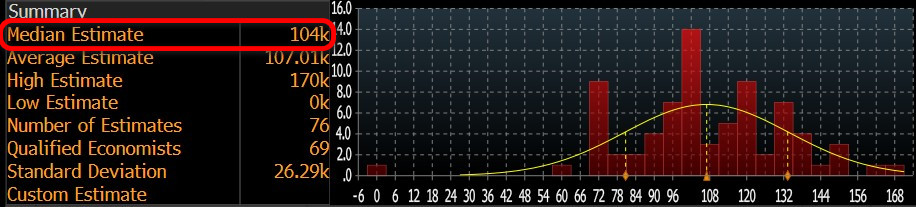

Leaving the month of July behind, markets will be receiving July Non-Farm Payrolls (NFP) data today, which will provide clues about the tightness of the financial ecosystem in the coming period, which will provide information about the interest rate cut course of the US Federal Reserve (FED). In addition, March figures such as average hourly earnings and the unemployment rate will also be monitored.

In June, the US economy added 147K jobs (Market Expectation: 111K).

Source: Bloomberg

Our forecast for the highly sensitive NFP data is that the US economy added over 130K jobs in the non-farm sectors in July. At the time of writing, the consensus (median estimate) in the Bloomberg survey is more pessimistic, around 104K.

Source: Bloomberg

We believe that if the NFP data for July, which will be published in the shadow of Trump’s tariff-centered foreign policy, the deterioration that it may create domestically and the pressure created by his statements about FED Chairman Powell, is slightly below expectations, this will be priced as a potential metric that may create an expectation that the FED may act more boldly to lower the interest rate, thus increasing risk appetite and having a positive impact on financial instruments, including digital assets. We think that a slightly higher-than-expected data may have a similar but opposite effect.

Other Macro Indicators for the US Economy to be released today.

ISM Manufacturing PMI: The Purchasing Managers’ Index (PMI) is a diffusion index based on surveyed purchasing managers in the manufacturing industry. Conducted by The Institute for Supply Management (ISM), this survey of approximately 300 purchasing managers asks respondents to assess the relative level of business conditions, including employment, production, new orders, prices, supplier deliveries and inventories. It is usually published monthly on the first business day after the end of the month, with a score above 50.0 indicating that the sector is expanding and below 50.0 indicating contraction. In general, a lower-than-expected ISM Manufacturing PMI is expected to have a positive impact on digital assets by pricing in expectations regarding the monetary policy course of the US Federal Reserve (FED). However, in some cases, it may also lead to pricing based on the strength of the economy. In this case, figures above expectations have a positive effect on digital assets.

Highlight of the Day

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| – | Sui (SUI) 44MM Token Unlock | – | – |

| – | Helium (HNT) Halving | – | – |

| 12:30 | US Average Hourly Earnings (MoM) (Jul) | 0.3% | 0.2% |

| 12:30 | US Nonfarm Payrolls (Jul) | 104K | 147K |

| 12:30 | US Unemployment Rate (Jul) | 4.2% | 4.1% |

| 14:00 | US ISM Manufacturing PMI (Jul) | 49.5 | 49.0 |

| 14:00 | US Michigan Consumer Sentiment (Jul) | 62.0 | 61.8 |

Information

*The calendar is based on UTC (Coordinated Universal Time) time zone. The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

*General Information About Our Forecasts

In addition to the general market expectations, the forecasts shared in this report are based on econometric modelling tools developed by our research department. Different structures were considered for each indicator, and appropriate regression models were constructed in line with data frequency (monthly/quarterly), leading economic indicators and data history.

The basic approach in all models is to interpret historical relationships based on data and to produce forecasts that have predictive power with current data. The performance of the models used is measured by standard metrics such as mean absolute error (MAE) and is regularly re-evaluated and improved. While the outputs of the models guide our economic analysis, they also aim to contribute to strategic decision-making processes for our investors and business partners. Data is sourced directly from the FRED (Federal Reserve Economic Data) platform in an up-to-date and automated manner, so that every forecast is based on the latest economic data. As the research department, we are also working on artificial intelligence-based modeling methods (e.g. Random Forest, Lasso/Ridge regressions, ensemble models) in order to improve forecast accuracy and react more sensitively to market dynamics. The macroeconomic context should be taken into account in the interpretation of model outputs, and it should be kept in mind that there may be deviations in forecast performance due to economic shocks, policy changes and unforeseen external factors. With this monthly updated working set, we aim to provide a more transparent, consistent and data-driven basis for monitoring the macroeconomic outlook and strengthening decision support processes.

Legal Notice

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.