Market Compass

Macroeconomic Indicators After the FOMC

The cryptocurrency market experienced a trading week marked by flat price movements. Bitcoin started the week around $90,000, dipped below that level during the week, but managed to trade above $94,000. At the time of writing this report, on Friday, it was around $92,300. This can be considered low volatility for the cryptocurrency market, especially for a week with a critical Federal Open Market Committee (FOMC) meeting scheduled…

In fact, expectations regarding the US Federal Reserve’s (FED) interest rate decision were fully priced in, and the relatively limited impact on the markets can be attributed to this. However, regarding the coming years, the potential negative effects of no change in the “dot plot” table showing FOMC members’ interest rate projections, despite markets hoping to see more signs of interest rate cuts, were absorbed by the announced $40 billion asset purchase program.

Our view for major digital assets, which have navigated a critical week unscathed, remains that the stabilization will continue (for December). The price behavior we observed last week also confirmed this for now. Now, the attention of global market participants is turning to the macro indicators to be announced next week.

The decisions of the European Central Bank (ECB), which is expected to keep its policy interest rate unchanged on Thursday, and the Bank of Japan (BoJ), which may raise interest rates on Friday morning, will feature prominently on our central bank agenda. No surprises are expected from the ECB, but statements from the BoJ will need to be closely monitored. Alongside news of interest rate hikes from the Far East, messages that this could be the start of a new cycle of rate hikes may lead to significant changes in asset prices. This could be a factor that dampens risk appetite.

From the other side of the Atlantic Ocean, we will receive many macro indicators this week. Among these, the US non-farm payrolls (NFP) data will be of critical importance, as it could shed light on the Fed’s interest rate cut path. Inflation figures from the world’s largest economy will also be under close scrutiny by investors. We will examine these data sets in detail below.

December 16 – U.S. Employment Data

We can safely say that one of the most critical data points that could not be released on its normal schedule due to the government shutdown is the non-farm payrolls (NFP) data. In a way, this situation, which has left the markets in the dark, has also put the US Federal Reserve (Fed) officials in the same position. One of the significant negative outcomes of the government shutdown is that we will not see the employment data for October. On December 16, we will receive the labor market statistics for November. The NFP will be the focal point among the data sets that will provide valuable information about the FED’s next interest rate change move.

In its August report, the Bureau of Labor Statistics (BLS) made one of the deepest downward revisions in history to its previously announced data for previous months, revealing that the employment market in the world’s largest economy may not be as tight and strong as previously thought. This data caused the FED to change its stance on interest rates, leading to a reshuffling of the cards in financial markets. On September 5, after seeing the NFP data for August, the release of the figures was disrupted due to the government shutdown ( ). The new NFP data for November, to be released on December 16, will shed light on the Federal Open Market Committee’s (FOMC) interest rate cut path for the coming year.

Source: Bloomberg

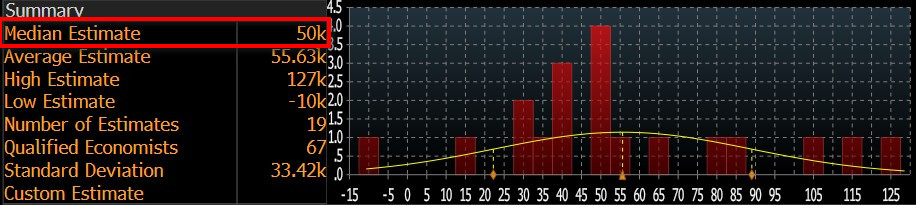

Given the high market sensitivity surrounding the NFP data, our forecast suggests that the U.S. economy may have achieved a higher-than-expected increase in non-farm employment in November. At the time of writing, although the number of forecasts entered is low, we see that the consensus (median forecast) in the Bloomberg survey is around 50,000, which is more pessimistic (This expectation figure may change later with new forecasts and new surveys, and most likely will change. However, it is still important to see the approximate analyst forecasts and understand market expectations. It would be beneficial to closely follow Darkex’s newsletters for current forecasts). The average of the forecasts is around 55,000.

Source: Bloomberg

We believe that if the November NFP data falls below expectations, it could strengthen expectations that the Fed may be more aggressive in lowering interest rates, thereby increasing risk appetite and having a positive impact on financial instruments, including digital assets. We believe that data above expectations could have the opposite effect.

December 18 – US Consumer Price Index: CPI

One of the key macro indicators that could provide insight into the Federal Reserve’s (Fed) interest rate cut path will be November inflation, specifically the change in the Consumer Price Index (CPI) (October inflation will not be released due to the government shutdown). Given the current challenging environment, CPI data, which could signal the direction of the path, will be closely monitored as it may influence pricing behavior.

Source: Bloomberg

The annual inflation rate in the US rose from 2.9% in August to 3% in September 2025, reaching its highest level since January. However, this figure was below the 3.1% forecast. Annual core inflation fell from 3.1% to 3%, while markets had expected it to remain at 3.1%. Compared to the previous month, CPI rose 0.3%, falling below August’s 0.4% and forecasts of the same level. We calculated our annual CPI forecast for November at 2.89%.

A CPI figure below market expectations could be interpreted as giving the Fed more leeway on interest rate cuts, which could have a positive impact on digital assets. A figure exceeding forecasts, on the other hand, could reinforce expectations that the Fed may hesitate to implement another rate cut, potentially putting pressure on the market.

Other Important Macroeconomic Indicators or Developments

December 15 – U.S. Empire State Manufacturing Index; This is a diffusion index based on a survey of manufacturers in New York State. It is published monthly, around the middle of the current month, and values above 0 indicate improving conditions, while values below 0 indicate deteriorating conditions. It covers approximately 200 manufacturers in New York State and is compiled from a survey asking participants to assess the relative level of general business conditions. Data above forecasts could have a positive impact on digital assets.

December 16 – U.S. ADP Weekly Employment Change; This data was first published by Automatic Data Processing, Inc (ADP) in October 2025. It is high-frequency private sector employment data based on a four-week moving average and tends to be more volatile than the monthly ADP Employment Report. It is also known as NER Pulse, short for National Employment Report. In summary, it shows the estimated average weekly change in the number of people employed over the previous four weeks, excluding the agricultural and public sectors. It is released on the first Tuesday of each week, approximately two weeks after the four-week period ends. s are skipped in weeks when the monthly ADP Employment Report is released. Job creation is closely monitored because it is an important leading indicator of consumer spending, which constitutes a large part of overall economic activity. During periods when market pricing is heavily influenced by the Fed’s monetary policy decisions, data exceeding expectations is expected to have a negative impact on digital assets, while figures below expectations are expected to have a positive impact.

December 16 – U.S. Retail Sales Data; It is an important measure of consumer spending, which accounts for a large part of overall economic activity. It shows the change in the total value of retail-level sales and is published monthly, about 16 days after the end of the month. A separate measure of the change in the total value of retail-level sales excluding automobiles is called core retail sales. The retail sales data set is generally expected to have a positive impact on digital assets if it is below expectations.

December 16– U.S. Flash Manufacturing PMI; is a leading indicator of economic health. Businesses react quickly to market conditions, and purchasing managers have perhaps the most up-to-date and relevant estimate of the company’s outlook for the economy. The Purchasing Managers’ Index (PMI) is a survey of nearly 800 purchasing managers that asks respondents to assess the relative level of business conditions, including employment, production, new orders, prices, supplier deliveries, and inventories. A reading above 50.0 indicates that the sector is expanding, while a reading below 50.0 indicates contraction. There are two versions of this report, Flash and Final, published about a week apart. The Flash version is released on a preliminary and monthly basis, approximately 3 weeks into the current month. A reading below the forecast is expected to produce a positive result for crypto assets.

December 18 – Initial Jobless Claims; This shows the number of people who filed for unemployment insurance for the first time during the previous week and is published weekly, usually on the first Thursday after the week ends. Although it is a lagging indicator, the number of unemployed is considered an indicator of overall economic health because consumer spending is highly correlated with labor market conditions. Market impact can vary from week to week, and market participants tend to focus more on this data when they are more sensitive to recent developments or when macro indicators related to the labor market are at extreme levels.

Important Economic Calender Data

Click here to view the weekly Darkex Crypto and Economy Calendar.

Information

*The calendar is based on UTC (Coordinated Universal Time) time zone. The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for any changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

Legal Notice

The investment information, comments, and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in outcomes that align with your expectations.