What Awaits Us?

U.S. Macroeconomic Data

Personal Consumption Expenditures (PCE) – December 5

The PCE data, which is the Fed’s preferred inflation indicator, will be released.

FOMC Meeting – December 10

The Fed’s interest rate decision and Powell’s remarks following the meeting will shape market expectations regarding the interest rate path and risk appetite.

Nonfarm Payrolls (NFP) – December 16

This data, which shows the strength of employment in the US economy, will play a key role in the Fed’s assessments regarding the direction of the interest rate path.

Consumer Price Index (CPI) – December 18

The consumer inflation data for September will shape market expectations regarding inflation.

Gross Domestic Product (GDP) – December 23

Q3 data on the US economy will be released with a delay.

Crypto Events

Ethereum Fusaka Hard Fork – December 3

The most significant technological event in December is Ethereum’s Fusaka upgrade.

SEC Investor Advisory Committee Meeting – December 4

The SEC Investor Advisory Committee will hold an online public meeting to discuss stock tokenization.

SEC Crypto Task Force Roundtable Meeting – December 15

The SEC’s Crypto Task Force will host a public roundtable meeting on the theme of “Financial Oversight and Privacy.”

U.S. Senate Crypto Regulations – Uncertain

The U.S. Senate is preparing to vote on a comprehensive new regulatory bill regarding the structure of the crypto market in December.

SEC Spot ETF Decisions – Uncertain

In December, the SEC is expected to accelerate its decision-making and/or filing updates regarding spot crypto ETF applications.

Crypto Insight

| Market Overview | Current Value | Change (30d) |

|---|---|---|

| Bitcoin Price | $91,270 | -19.98📉 |

| Ethereum Price | $3,018 | -26.83%📉 |

| Bitcoin Dominance | 59.30% | -0.74%📉 |

| Ethereum Dominance | 11.85% | -9.29📉 |

| Tether Dominance | 6.01% | +24.92%📈 |

| Crypto Total Market Cap | $3.07 T | -0.28%📉 |

| Fear and Greed Index | Extreme Fear (22) | Neutral (50) |

| Altcoin Season Index | 22 / 100 | 27 / 100 |

| Crypto ETFs Net Flow | $ +81.90M | |

| Open Interest – Perpetuals | $ 829.86B | |

| Open Interest – Futures | $ 4.28B | |

*Prepared on 11/27/2025 at 12:33 pm (UTC)

Crypto Market Metrics – Summary of November

Flow by Crypto Asset

| Assets | 1st Week | 2nd Week | 3rd Week | 4th Week | Net Total $ (m) |

|---|---|---|---|---|---|

| Bitcoin (BTC) | -946 | -932 | -1,378 | -1,267 | -1,880.645 |

| Ethereum (ETH) | 57.6 | -438.0 | -688.8 | -589.0 | -1,658.2 |

| XRP (Ripple) | 43.2 | 28.2 | -15.5 | 89.3 | 145.2 |

| Solana (SOL) | 421.1 | 118.4 | -8.3 | -156.2 | 375.0 |

| Litecoin (LTC) | 1.5 | – | 3.3 | – | 4.8 |

| Cardano (ADA) | 0.7 | -0.1 | 0.4 | 0.3 | 1.3 |

| SUI | 9.4 | -3.8 | 3.5 | -5.0 | 4.1 |

| Others | 43.4 | 29.1 | 5.0 | 1.0 | 78.5 |

“Flow Data based on CoinShares Reports”

In November, total outflows from digital assets approached $1 billion, while inflows showed a noticeable weakness. Bitcoin recorded a net outflow of $1.880 billion, while Ethereum recorded a net outflow of $1.658 billion. Ripple stood out positively with inflows of $145.4 million. While inflows continued in Solana, the weak outlook for Litecoin persisted. Cardano also saw only a limited recovery with inflows of $1.3 million. Other altcoins attracted a total of $78.5 million in inflows.

Crypto Total Market Cap

The cryptocurrency market lost approximately $564 billion in value this month, experiencing a 15.45% decline in total market capitalization. With this decline, the market value fell to $3.09 trillion. Although the market value reached a record high of $3.7 trillion during the month, it failed to remain at that level. On the other hand, the monthly low was recorded at $2.73 trillion. These figures show that the market fluctuated within a wide range of approximately $0.97 trillion throughout the month, equivalent to about 35.52% of the current total market. This volatility demonstrates that the crypto market has high monthly volatility and that the risk level remains strong.

U.S. Spot Crypto ETF Markets

November stood out as one of the weakest months of the year for Bitcoin ETFs. A total of $3.54 billion in net outflows was seen throughout the month. Heavy selling, particularly in large funds, turned the overall picture sharply negative. Looking at individual funds, net outflows of $2.22 billion from BlackRock’s IBIT ETF, $490.2 million from Fidelity’s FBTC, and $293.9 million from ARKB stood out. This situation revealed a marked decline in institutional investors’ appetite for risk. As a result of the strong outflows seen during this period, the cumulative net inflow of Spot Bitcoin ETFs fell to $57.615 billion as of the 472nd trading day.

For Ethereum ETFs, November was the weakest performing month in recent times. A total of $1.50 billion in net outflows occurred throughout the month. The outflows from Ethereum ETFs showed that investors took a distinctly cautious stance after the strong inflows in October. Looking at the funds, net outflows of $1.09 billion from the BlackRock ETHA ETF and $215.2 million from the Grayscale ETHE fund stood out. While sales-oriented flows dominated nearly all major funds throughout the month, the cumulative net inflow of Spot Ethereum ETFs fell to $12.88 billion as of the 340th trading day due to the impact of total net outflows.

Crypto Options Markets

Approximately $26.75 billion worth of BTC contracts will expire by the end of this month in the Bitcoin options market. Call options totaled 701,100 contracts at expiration, concentrated in the $105,000–$115,000 range, while put options totaled 526,490 contracts at expiration, concentrated in the $80,000–$90,000 range. The put/call ratio stands at 0.96, with the maximum pain point averaging $100,750.

In Ethereum options, ETH contracts worth $1.74 billion will expire on November 28, the last trading day of the month. The total number of call options is 385,590, while put options total 190,684. The put/call ratio is 0.49, and the maximum pain point is calculated at $3,400.

CryptoSide – December

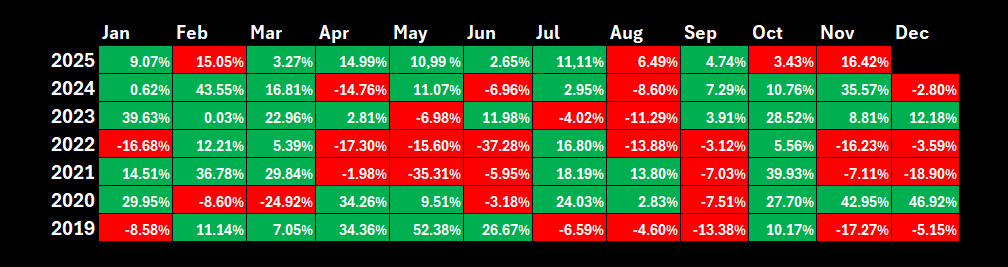

Bitcoin’s November Performance: The Cycle Surprised Again

Although November is historically considered one of Bitcoin’s strongest periods, this year the picture has reversed expectations. With an average November return of 41.21%, BTC is preparing to close the month in the red for the first time in two years. Having broken this statistical cycle in 2018, 2019, 2021, and 2022, Bitcoin appears to be similarly defying expectations in 2025. This highlights that red closes have become more frequent in November in recent years.

December: Historically Cautious Performance

December is one of the periods for Bitcoin that does not offer a clear direction, with volatile performance. Looking at historical data, it is seen that the increases mostly reached double-digit gains, while the declines were more limited and balanced. BTC’s most notable December performance was in 2020, with a 46.92% increase. Following the positive atmosphere in October and November last year, December closed with a 2.85% decline, but this year, the opposite scenario is unfolding. Looking at the overall average, December continues to be a positive month for Bitcoin, with a gain of approximately 4.75%.

*Prepared on 11/27/2025 at 12:37 pm (UTC).

Source: Darkex Research Department

Some Events That Will Affect the Crypto Market in December

SEC Investor Advisory Committee Meeting

The SEC Investor Advisory Committee will hold a public meeting to discuss new generation financial asset areas such as stock tokenization. Investor protection, regulatory needs, and the current state of the market will be discussed at the meeting. These discussions serve as an important reference for the integration of traditional finance and new technologies. The committee’s recommendations may influence future decisions.

SEC Crypto Task Force Roundtable Meeting

The SEC’s Crypto Task Force will host a roundtable discussion on the theme of “Financial Oversight and Privacy.” The meeting will explore the balance between the regulation of crypto markets, transparency requirements, and user privacy. Participants will include industry representatives, legal experts, and regulators. The outcomes have the potential to shape the SEC’s approach to crypto assets.

U.S. Senate Cryptocurrency Regulations

The U.S. Senate is working on a comprehensive regulatory bill for the cryptocurrency market and aims to vote on the draft in December. This bill is expected to affect the operating conditions of cryptocurrency exchanges, user protection, and taxation processes. Due to the broad scope of the regulation, uncertainty prevails in the market. The possible outcomes will closely affect the future of the cryptocurrency ecosystem in the U.S.

SEC Spot ETF Decisions

The SEC’s decisions on other spot crypto ETF applications are one of the most critical processes expected to accelerate in December. File updates and revisions for new applications will also intensify during this period. If approved, spot ETFs could greatly facilitate access to crypto for traditional investors.

Ethereum Fusaka Hard Fork

Ethereum’s Fusaka upgrade is a major protocol update aimed at improving the network’s performance and security. This hard fork offers improvements, particularly in transaction efficiency, scalability, and developer experience. It also includes the activation of some EIPs that optimize network costs. It is considered one of the most important technological developments of December.

Market Pulse

A Turbulent Quarter and the Final Month of the Year…

The past two months have been very difficult for digital asset investors. Cryptocurrencies, which suffered heavy losses in October and November, came under pressure due to several different dynamics. Similar variables and metrics already waiting in our notes seem likely to continue driving asset prices in the final month of the year. So, will investors finally be able to breathe a little easier in December? We’ll explore this question from different angles.

The AI Bubble and FED Expectations…

The two issues that most affected risk appetite in global markets were concerns about AI-based companies and changes in expectations regarding the US Federal Reserve’s (FED) monetary policy path. Despite Nvidia’s better-than-expected third-quarter results, concerns that technology companies may be overvalued have not been fully alleviated. Market expectations regarding the Federal Open Market Committee’s (FOMC) interest rate cut path have also undergone sharp shifts. Finally, statements from influential FOMC members such as Williams pushed expectations for the FOMC meeting on December 10 to 80% at the time this report was prepared, up from 30% in previous weeks according to CME’s FedWatch Tool.

Old-New Agenda Items

Beyond the two dynamics mentioned above, we believe there may be some topics that have had little impact on asset prices in recent weeks but could come back into focus in the final month of the year. The first is the Ukraine-Russia peace process led by US President Trump. Recent reports suggest Russia is more willing to pursue peace than before. Possible positive surprises regarding the war, now approaching its fourth year, could provide a much-needed catalyst for the markets. However, it is also necessary to closely monitor the friction between China and Japan, which has been creating tension in recent days. China issued a warning, stating that it would defend itself if Japan intervened in the Taiwan Strait. According to some sources, the Japanese government is considering deploying missiles near the region.

On the other hand, we will continue to monitor President Trump’s stance on tariffs. Following his meeting with Xi in North Korea, the US President made relatively optimistic statements, but while indicating that negotiations would continue in the “coming months,” he signalled that a final agreement would require a long time. Nevertheless, we believe the trajectory in this regard is leaning toward optimism. The phone call between the two leaders in late November and Trump’s announcement that he will visit China in April can also be seen as developments pointing in this direction.

Should We Expect a Santa Claus Rally?

The last month of the year is always special for financial markets. Rebalancing portfolios, setting expectations, and new macroeconomic and political projections can provide some clues for the rest of the year. However, if we were to make a prediction about how December might unfold, considering the events of the last two months and the dynamics mentioned above, it seems we can speak of a relatively more optimistic path. As our regular readers know very well, we had a more pessimistic view for October and November. Our latest assessment should not be interpreted as meaning we expect a “very very good period,” but it would not be wrong to expect a breathing space where stabilization could come to the fore and wounds could be healed, albeit slowly.

To answer the question in the title of this section, we must say that we should not expect a Santa Claus rally. However, after the losses experienced in the last two months, a potential stabilization process should not be overlooked. To understand this more clearly, macro developments, especially on the US front, will be under our scrutiny. The data that is starting to come in, albeit delayed, with the reopening of the government, and the FOMC statement will shed more light on our path. Therefore, for the answer to the question of what awaits us in December, we will detail the relevant items on our calendar below.

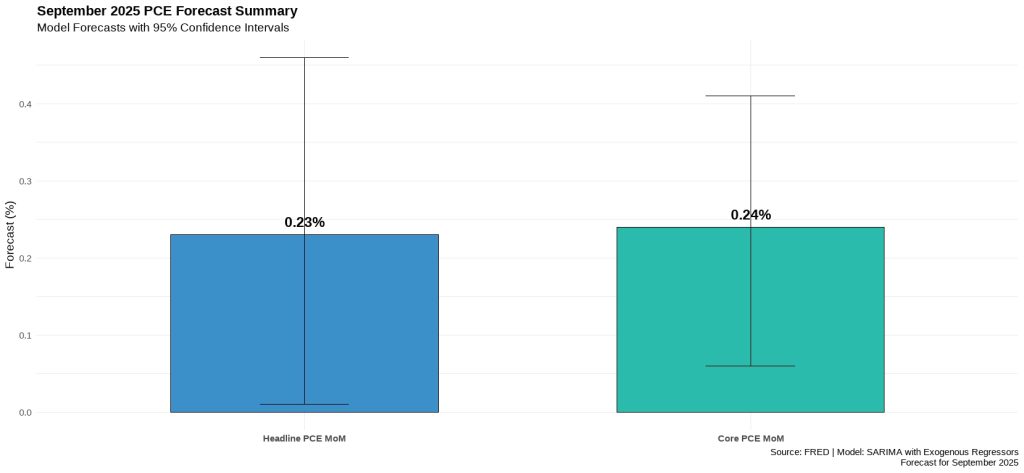

December 5 – The Fed’s Favourite Inflation Indicator: PCE

Markets will be closely watching the delayed release of September’s Personal Consumption Expenditures (PCE) data, seeking clues about whether the Federal Open Market Committee (FOMC) will decide on an interest rate cut at its December 10 meeting, as well as the timing and path of any rate cuts. Additionally, the data for November was scheduled for December 19, but the release date for this data will also be rescheduled. This indicator is known as the preferred indicator used by FOMC officials to monitor changes in inflation.

Source: Bloomberg

According to the latest data, core PCE rose 0.2% in August compared to the previous month. The service sector accounted for the largest share of the price increase. On an annual basis, core PCE rose 2.91%. We expect core PCE data for September to show an increase of around 0.24%.

Source: Darkex Research

Data that comes in above market expectations could support expectations that the Fed may be cautious about cutting interest rates, reducing risk appetite and putting pressure on digital assets. Data that falls below expectations, on the other hand, could have the opposite effect and pave the way for gains.

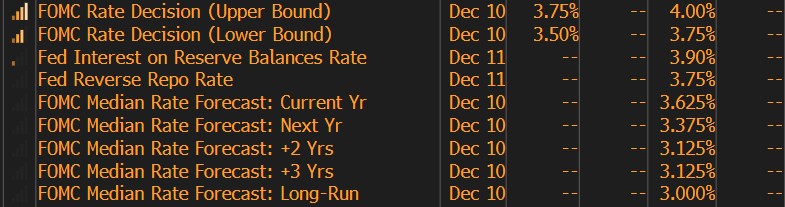

December 10 – Bated Breath, Eyes on the FOMC Meeting…

The US Federal Reserve (Fed) will hold its final Federal Open Market Committee (FOMC) meeting of the year on December 9-10, with decisions announced on December 10. The FOMC is expected to cut its policy interest rate by 25 basis points (according to the CME FedWatch Tool at the time of writing this report), and the decisions, justifications, and statements made will be of critical importance to global markets.

In August, the Bureau of Labor Statistics (BLS) revised the largest backward-looking nonfarm payrolls change data seen since Covid-19 in 2020, raising doubts about the strength of the job market. Powell changed his rhetoric following this sharp shift in the labour market and drew attention to the weak employment market in his statements at the end of August. Following this message, markets priced in interest rate cuts, and the Fed also cut interest rates. However, at the press conference following the September FOMC meeting, Powell stated that a new rate cut in December was not a foregone conclusion, which put rate cut expectations on hold. In the following weeks, important FOMC members such as Williams, Waller, and Daly sent rate cut messages, bringing this agenda back to the forefront, and markets began to view a new rate cut step as almost certain.

In summary, we witnessed sharp turns in market expectations regarding the December meeting. At this stage, we believe several scenarios are emerging for the FOMC’s next move. First, it is important to note that we have not seen such a clear divergence of views among FOMC members during Powell’s tenure. Members hold differing views on the priority of inflation and employment. Inflation in the world’s largest economy is not rising rapidly , but it is far from the Fed’s target level of 2% and is not showing any meaningful decline. The employment market is cooling, but there is no chaotic picture on that front either. This equation is causing members to disagree and making decision-making truly difficult. At this point, we believe the Board must decide which is more damaged (employment or inflation) and which would be easier to fix. It will be crucial for Powell and his team to find common ground on this issue.

Under these assumptions, in line with the style of the Fed and Powell, we believe the first of the scenarios we mentioned will be “cut rates to meet market expectations, speak cautiously about the future.” Powell has used this approach in previous years, conveying the message, “We are cutting rates, but we will most likely wait for the future.” In a way, we can call this scenario the “hawkish rate cut” model. We can say that the second and alternative route is to keep rates steady and signal a cut for the January meeting, when more data will be available. Powell could use the disruption in data flow due to the government shutdown as an excuse for this. However, on this path, the Chairman will need to convince the members who favour a cut, plunging the markets into another seven weeks of uncertainty.

Both possibilities have their benefits and negative outcomes. Our expectation is largely that the FOMC could decide on an interest rate cut. However, with the Committee itself so divided, we cannot approach this as comfortably as the markets’ expectations and argue that we must be open to surprises.

Now, to better prepare investors for FOMC day, we will detail what to expect step by step on December 10.

Decision Day

- Will interest rates be cut as expected?

Let’s briefly summarize the process awaiting us on the evening of December 10. First, markets will focus on whether the Fed will cut its policy rate. As mentioned above, according to the CME FedWatch Tool, markets are expecting a 25-basis-point cut at the time of writing this report. However, it is important to remember that these expectations may change with new developments.

Source: Bloomberg

If the Fed cuts rates by 25 basis points as expected, we do not expect a new pricing in the markets because of this decision. If it keeps rates unchanged, we may see a reaction where the dollar gains value, risk appetite decreases, and instruments considered relatively risky, including crypto assets, lose value.

On the other hand, in another surprise scenario, if the Fed cuts interest rates by 50 basis points, we may see this reflected much more positively in digital assets. However, we consider this possibility to be very weak. An interest rate hike is not one of the options on the table.

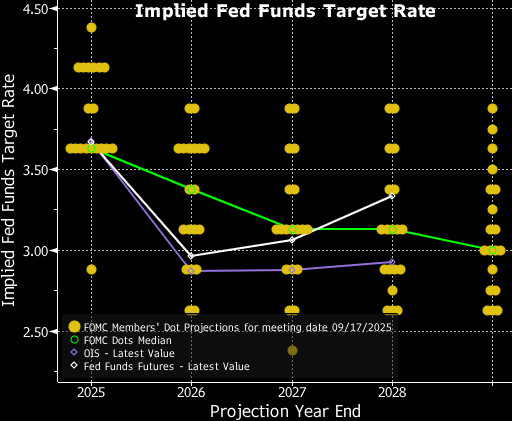

- Economic Projections and Dot Plot Chart:

The FOMC publishes forecasts on certain economic indicators and how the policy rate may change in the coming periods at four of its eight meetings throughout the year. The meeting on December 9-10 will be one of these. Therefore, these documents, which will be published simultaneously with the interest rate decision, will be another important set of information affecting prices.

The Fed’s view on the health of the economy is, of course, very important. We can understand this perspective by examining how officials expect macroeconomic data to change in the coming period. Changes in the projections will be closely monitored, and in particular, possible updates to the PCE price index (the indicator the Fed uses to track inflation) will provide information about the path of interest rate cuts. A strong upward revision could mean that the Fed will not be overly hasty in cutting interest rates in the coming period, while a downward revision could imply relatively faster cuts. We see the likelihood of a downward revision to this data as low.

Source: Bloomberg

The same document will include a table known as the “dot plot,” which shows FOMC members’ projections for changes in the policy interest rate. In the image above, you can see the average expected rates from the dot plot published at the September meeting. Here too, a downward revision could complete the equation of digital assets gaining value due to weak dollar demand. Although unlikely, an upward revision could have the opposite effect.

- Fed Chair Powell’s Press Conference:

Half an hour after the FOMC statement, policy rate decision, economic projections, and dot plot table are announced, all eyes will turn to Chair Powell’s press conference. Powell will first explain the decisions and their rationale from behind the podium and then move on to the section where questions from the press will be accepted. Volatility in prices may increase during this segment.

The significance of the Chairman’s speech will vary depending on the nature of the decisions outlined above. However, Powell’s messages regarding how the path of future interest rate cuts will take shape will be critical. If Powell signals that significant interest rate cuts could be made in 2026, we will see a positive impact on digital assets. In the opposite scenario, pressure may arise. It should also be noted that Powell’s term ends in May 2026, and it is clear that Trump will not renominate him. In fact, he is expected to announce his replacement before Christmas. Therefore, it would be more accurate to evaluate Powell’s statements within this projection and investment horizon.

December 16 – US Employment Data

We can safely say that one of the most critical pieces of data that could not be released according to the normal schedule due to the government shutdown is the non-farm payrolls (NFP) change. In a way, this situation, which has left the markets in the dark, has also put the US Federal Reserve (Fed) officials in the same position. One of the significant negative outcomes of the government shutdown is that we will not see the employment data for October. On December 16, we will receive the labour market statistics for November. The NFP will be the focal point among the data sets that will provide valuable information about the FED’s next interest rate change move.

In its August report, the Bureau of Labor Statistics (BLS) made one of the deepest downward revisions in history to its previously announced data for previous months, revealing that the employment market in the world’s largest economy may not be as tight and strong as previously thought. This data caused the FED to change its stance on interest rates, leading to a reshuffling of the cards in financial markets. On September 5, after seeing the NFP data for August, the release of the figures was disrupted due to the government shutdown. The new NFP for November, to be released on December 16, will shed light on the Federal Open Market Committee’s (FOMC) interest rate cut path for the coming year.

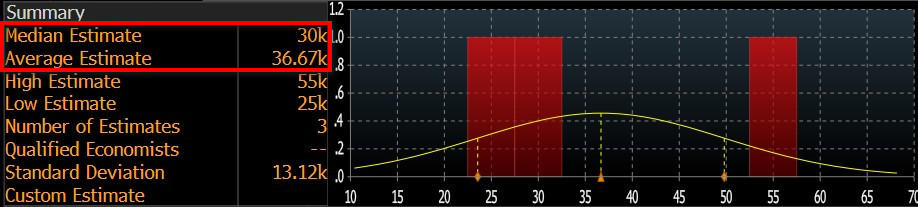

Source: Bloomberg

Given the high market sensitivity to NFP data, our forecast suggests that the U.S. economy may have achieved stronger-than-expected job growth in non-farm sectors in November. At the time of writing, although the number of forecasts entered is low, we see that the consensus (median forecast) in the Bloomberg survey is around 30,000, which is more pessimistic (This expectation figure may change later with new forecasts and new surveys, and most likely will change. However, it is still important to see the approximate analyst forecasts and understand market expectations. It would be beneficial to closely follow Darkex’s weekly newsletters for current forecasts). The average of the forecasts is around 37,000.

Source: Bloomberg

We believe that if the November NFP data falls below expectations, it could strengthen expectations that the Fed may be more aggressive in lowering interest rates, thereby increasing risk appetite and having a positive impact on financial instruments, including digital assets. We believe that data above expectations could have the opposite effect .

December 18 – US Consumer Price Index: CPI

One of the key macroeconomic indicators that could provide insight into the Federal Reserve’s (FED) interest rate cut path will be the November inflation rate, specifically the change in the Consumer Price Index (CPI) (October inflation data will not be released due to the government shutdown). Given the current challenging economic environment, CPI data that could signal the direction of the rate path will be closely monitored, as it may influence pricing behaviour.

Source: Bloomberg

The annual inflation rate in the US rose from 2.9% in August to 3% in September 2025, reaching its highest level since January. However, this figure was below the 3.1% forecast. Annual core inflation fell from 3.1% to 3%, while markets had expected it to remain at 3.1%. Compared to the previous month, CPI rose by 0.3%, falling below August’s 0.4% and matching forecasts. Our forecast is that the monthly CPI data could come in at 0.29% in November.

A CPI figure below market expectations could be interpreted as giving the Fed more leeway on interest rate cuts, which could have a positive impact on digital assets. A figure exceeding forecasts, on the other hand, could reinforce expectations that the Fed may hesitate to implement another rate cut, potentially putting pressure on the market.

December 23 – US GDP Change

One of the key indicators that could not be released on schedule due to the government shutdown was GDP Change, which we can define as economic growth. We were unable to learn in a timely manner how the world’s largest and most important economy performed in the third quarter of the year, and of course, this introduced an additional element of uncertainty into the decision-making mechanisms of economic actors. Under normal circumstances, after the completion of the relevant three-month period, we would see GDP data for that quarter under the “Advance” designation in the following month. The following month, the “Preliminary” data, with the necessary revisions and adjustments, would be published, and then the “Final” data would be released the month after that. This time, however, we did not see and will not see the “Advance” figure for the third quarter of 2025. The relevant statistical agency cancelled the release of this data and announced that it would publish the Preliminary data on December 23. Therefore, for now, we have no choice but to follow the schedule set by the Bureau of Economic Analysis (BEA) for the data.

As can be seen in the graph below, we are seeing fluctuations in GDP in recent periods. US President Donald Trump’s policies on tariffs and the behaviour of economic decision-makers in this uncertain environment play a significant role in this. Changes in the Net Exports item reflect this. With these changes in the item, the US economy contracted by 0.6% in the first quarter of the year and grew by 3.8% in the second quarter. This figure marked the highest economic expansion seen since the 4.7% growth in the third quarter of 2023.

Source: Bloomberg

The new data to be released will be the first figures we see for the third quarter of the year. It is still difficult to quantify and measure the impact of Trump’s policies on economic units and consumer behaviour. The new data to be released will enable healthier and longer-term projections regarding the direction of economic growth.

In terms of the immediate market reaction, we believe that data exceeding consensus expectations could increase risk appetite and have a positive impact on digital assets. Conversely, GDP data falling below expectations could have a negative impact from this perspective.

December 25 – Christmas Day (U.S. Markets Closed)

On Wednesday, December 24, U.S. markets will close early due to the Christmas holiday, and on Thursday, December 25, Christmas Day, they will be closed. Towards the end of the year, and especially during the Christmas week, liquidity in global markets decreases and irregular volatility is observed. Although stock exchange and bank holiday calendars vary slightly around the world, most exchanges and brokers are open except for Christmas and New Year holidays. When banks are closed, liquidity in the markets decreases and speculative trading plays a more dominant role in determining the direction of the market. This situation can lead to abnormally low and, at the same time, high volatility. Therefore, it would be beneficial for investors to be more cautious during this time of year.

*General Information About Forecasts

In addition to general market expectations, the forecasts shared in this report are based on econometric modelling tools developed by our research department. Different structures were considered for each indicator, and appropriate regression models were constructed in line with data frequency (monthly/quarterly), leading economic indicators, and data history.

The basic approach in all models is to interpret historical relationships based on data and to produce forecasts that have predictive power with current data. The performance of the models used is measured by standard metrics such as mean absolute error (MAE) and is regularly re-evaluated and improved. While the outputs of the models guide our economic analysis, they also aim to contribute to strategic decision-making processes for our investors and business partners. Data is sourced directly from the FRED (Federal Reserve Economic Data) platform in an up-to-date and automated manner, ensuring every forecast is based on the latest economic data. As the research department, we are also working on artificial intelligence-based modelling methods (e.g., Random Forest, Lasso/Ridge regressions, ensemble models) to improve forecast accuracy and react more sensitively to market dynamics. The macroeconomic context should be considered when interpreting model outputs, and it should be noted that forecast performance may deviate due to economic shocks, policy changes, and unforeseen external factors. With this monthly updated working set, we aim to provide a more transparent, consistent, and data-driven basis for monitoring the macroeconomic outlook and strengthening decision support processes.

Legal Notice

The investment information, comments, and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in outcomes that align with your expectations.