What Awaits Us?

U.S. Macro Economic Data

ADP Private Sector Nonfarm Employment Change Data – November 5

In an environment where official employment data cannot be released, ADP indicators have the potential to chart a course for the markets.

*Nonfarm Payrolls (NFP) – Tentative

This data, which shows the strength of employment in the U.S. economy, will play a key role in the Fed’s assessments regarding the direction of the interest rate path.

*Consumer Price Index (CPI) – Tentative

The consumer inflation data for September will shape market inflation expectations.

FOMC Meeting Minutes – November 19

The minutes of the Fed’s October 29 FOMC meeting may shed light on the path of interest rate cuts.

*Gross Domestic Product (GDP) – Tentative

Growth data for the US economy will be released.

*Personal Consumption Expenditures (PCE) – Tentative

PCE data, which the Fed highlights as an inflation indicator, will be released.

*Due to the U.S. government shutdown, the release of some macroeconomic indicators may be delayed or canceled.

Other Developments

US Midterm Elections – November 4

The US midterm elections include gubernatorial and state legislature elections in some states, as well as mayoral races. On November 4, the races in New Jersey and Virginia, in particular, will be closely watched.

U.S. Government Shutdown Process

The U.S. federal government officially shut down for the first time since 2019 on Tuesday, September 30, at midnight, as the new budget was not approved by the end of the 2025 fiscal year. While the federal government shutdown does not bring the entire U.S. economy to a halt in the short term, it creates delays and uncertainty in many sectors.

SEC Spot ETF Decisions

- November: Franklin XRP Spot ETF Approval Expected

- November: Nasdaq Crypto Basket ETF Index

- November: Franklin Solana Spot ETF Approval Expected

Crypto Insight

| Market Overview | Current Value | Change (30d) |

|---|---|---|

| Bitcoin Price | 108,900 $ | -4.73 📉 |

| Ethereum Price | 3,850 $ | -8.60% 📉 |

| Bitcoin Dominance | 59.60% | +1.37% 📈 |

| Ethereum Dominance | 12.76 | -2.80 📉 |

| Tether Dominance | 5.04% | +11.77% 📈 |

| Total Market Cap | $ 3.64 T | -6.17% 📉 |

| Fear and Greed Index | Fear (34) | Neutral (50) |

| Altcoin Season Index | 32/100 | 56/100 |

| Crypto ETFs Net Flow | $ -552.10 M | |

| Open Interest – Perpetuals | $ 3.44 B | |

| Open Interest – Futures | $ 908.04 B |

*Prepared on October 30, 2025, at 12:33 pm (UTC)

::contentReference[oaicite:0]{index=0}

Metrics – Summary of October

Flow by Asset

| Asset | Week 1 | Week 2 | Week 3 | Week 4 | Net Total $ (m) |

|---|---|---|---|---|---|

| Bitcoin (BTC) | 3,552 | 2,671 | -946 | 931.0 | 6,208.0 |

| Ethereum (ETH) | 1,483.2 | -912.4 | 205.1 | -168.7 | 607.2 |

| XRP (Ripple) | 219.7 | 14.7 | 73.9 | 84.3 | 392.6 |

| Solana (SOL) | 177.1 | 16.1 | 156.1 | 29.4 | 378.7 |

| Litecoin (LTC) | 1.2 | – | 1.0 | 0.3 | 0.5 |

| Cardano (ADA) | 0.5 | -0.4 | 3.7 | 1.1 | 4.9 |

| SUI | 3.4 | 0.6 | 5.9 | -8.5 | 1.4 |

| Others’ | 9.5 | 33.2 | 15.6 | 0.1 | 58.4 |

Interest in digital assets reached remarkable levels in October. With total monthly inflows reaching $7 billion, a general upward trend was observed in the crypto market. Bitcoin regained investor confidence with a net inflow of $6.208 billion. Ethereum lagged behind Bitcoin, recording inflows of $607.2 million. Ripple (XRP) was one of the notable altcoins with inflows of $392.6 million. Investments in Solana continued to increase, while Litecoin remained weak in terms of investor interest. Cardano (ADA), however, showed a decline in investor interest with only $4.9 million in inflows. Nevertheless, despite weak inflows in other altcoins, they contributed to increasing market diversity.

Total Market Cap

The cryptocurrency market lost approximately $145 billion in value this month, recording a 3.8% decline in total market value. This brought the market value down to $3.71 trillion. Although the value reached a record high of $4.27 trillion during the month, it failed to sustain this level. In contrast, the monthly low was $3.24 trillion. These figures show that the market fluctuated within a wide range of approximately $1.03 trillion (equivalent to about 27% of the total market) throughout the month. This volatility reveals that the market continues to be highly volatile on a monthly basis and carries high risk.

U.S Spot ETF

October stood out as a period of record institutional inflows into Spot Bitcoin ETFs. Throughout the month, there was a total net inflow of $4.10 billion. Thus, at the end of the 452nd trading day, the cumulative total net inflow into Spot Bitcoin ETFs reached $61.83 billion. In particular, heavy inflows into BlackRock’s IBIT ETF during the first week of the month were noteworthy. IBIT’s strong performance reinforced its leadership in the ETF market, while Fidelity FBTC and Bitwise BITB funds also contributed. In contrast, net outflows were observed in Grayscale GBTC and ARKB ETFs.

October 2025 was a volatile month for spot Ethereum ETFs, but overall, positive inflows dominated. A total of $852.5 million in net inflows was recorded throughout the month. Strong inflows into BlackRock’s ETHA ETF, particularly in the first half of the month, drove the overall picture upward. However, volatile flows in Fidelity and Grayscale funds indicated that investors were beginning to manage their short-term positions more cautiously. The sharpest outflows were seen during the week of October 13, but inflows returned on October 27-28, turning the flow direction positive again. By the end of October, the cumulative total net inflow into Spot Ethereum ETFs had risen to $14.67 billion as of the 320th trading day.

Options Data

Approximately $13.94 billion worth of BTC contracts will expire by the end of this month in the Bitcoin options market. Call options totaled 844,500 contracts expiring in the $116,000–$123,000 range, while put options totaled 748,950 contracts expiring in the $100,000–$108,000 range. The put/call ratio stands at 1.038, with the maximum pain point averaging $115,200.

As of October 31, Ethereum options worth $2.52 billion in ETH contracts will expire. The total number of call options stands at 377,699, with a particularly high concentration of over 16,000 in the $4,000–$4,200 range. Put options stand at a total of 270,896, with a noticeable concentration in the $3,800–$3,900 range. The put/call ratio is at 0.72, and the maximum pain point is calculated at $4,100. The total value of options contracts expiring this month will be approximately $2.52 billion.

CryptoSide – November

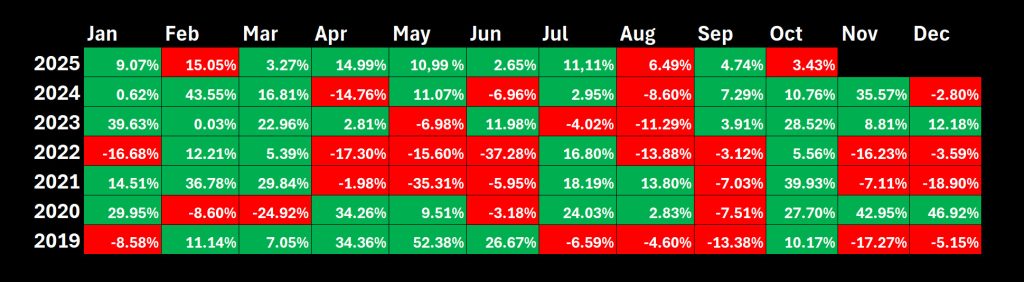

Bitcoin’s October Performance: The Uptober Cycle Has Broken Down

Historically, October has been one of the strongest months for Bitcoin, but this year the picture is different. Bitcoin, which recorded an average increase of 19.04% in October, is preparing for a negative close after a six-year hiatus. Having broken this cycle in 2014 and 2018, BTC appears to be dashing expectations again in 2025.

November: The Month with the Highest ROI

November, along with October, can be considered prime time for Bitcoin investors. Since 2013, this month has seen double-digit increases almost every year, with an average value increase of 46.02%. The only exceptions were 2018, 2019, 2021, and 2022, which saw negative closes, while last year Bitcoin gained 37.29%. It is worth noting that this rise was the result of the rally triggered by the US elections and President Trump’s crypto promises.

However, despite these strong statistics, it is important to remember that markets are highly sensitive and volatile in response to macroeconomic dynamics and geopolitical developments. Therefore, the positive expectations for November should be evaluated with a cautious strategy.

*Prepared on 10/30/2025 at 12:37 pm. (UTC)

Source: Darkex Research Department

“Monthly Return Will be Added”

US Midterm Elections: These midterm elections are generally seen as an indicator of nationwide support for or opposition to the president’s policies. The president’s party usually loses some seats in midterm elections. Furthermore, winners at the state and local levels may play important roles in future presidential elections.

U.S. Government Shutdown Process: The government crisis in the U.S. continues. The federal government has been shut down since October 1 due to Republicans and Democrats failing to reach an agreement on the budget and Congress failing to approve a temporary budget bill before the start of the new fiscal year. An analysis examining the effects of the shutdown under three scenarios, assuming it ends in 4, 6, and 8 weeks, indicates that the shutdown will delay federal spending and negatively impact the economy. In this context, it continues to exert pressure on the markets.

Spot ETF: A critical period for the crypto sector begins in November. The decisions made by the US Securities and Exchange Commission (SEC) will be decisive for the markets and altcoins.

Market Pulse

The Trump Factor

The cryptocurrency market experienced a historic day on the evening of October 10. US President Donald Trump’s harsh remarks regarding tariffs to be imposed on China negatively impacted traditional capital markets and the value of digital assets in an unprecedented manner. Although the shock subsided in the following days and markets showed signs of recovery, crypto assets experienced a challenging period due to the influence of various dynamics.

Apart from this shocking development, the most important developments for global markets in October (as US macro indicators were not released due to the government shutdown) were concentrated in the last week of the month. Of the critical data, we only received inflation figures, albeit delayed, and the numbers were generally below expectations. However, we had a limited data set on the labor market, and the most important figures that could provide clues about the Federal Reserve’s (FED) interest rate cut path were these, along with recent developments. The data release calendar remains uncertain as this article is being written, as the US government is still shut down. Therefore, in this month’s strategy report, we will simply assess the US economy as follows: “The labor market is weak, and inflation is still far from being a major problem.” On the other hand, the strategic decisions made by some large companies, such as Amazon, to lay off employees in order to cut costs can be seen as signs that the labor market is not moving in the right direction during this period of data blindness. In addition, the “hawkish rate cut” from the Federal Open Market Committee (FOMC) meeting and the constructive meeting between Trump and Chinese leader Xi in North Korea were noted as important developments in September.

Trump’s First Election Test

Assuming that important data such as non-farm payrolls will remain under wraps and will not be released, the first major test for the markets and Trump will come on November 4. The US midterm elections include gubernatorial and state legislature elections in some states, as well as mayoral races.

Investors view the upcoming elections as an indication of whether Americans approve of the policies Trump has implemented so far. In other words, the November elections will reveal how much the public embraces Trump’s policy choices and will also serve as a response to his potential second term. The races in New Jersey and Virginia, in particular, will be closely watched. The November 2025 elections will be seen not only as a midterm election but also as a test for Trump.

Government Shutdown and Tariffs

It is very difficult to say how much longer the US government will remain shut down. Although the dispute between Republicans and Democrats continues, we have seen some signs of softening, but President Trump’s tough stance on this issue has not changed much. Therefore, uncertainty and difficulty in forming an opinion on the matter continue.

President Trump’s tariff policies, which have plunged global markets into a unique fog, remain the most critical variable on the agenda. Following the meeting between the US and Chinese leaders in North Korea, some constructive steps were taken and progress was made. However, the issue still seems far from being resolved, and it is suggested that negotiations could take months . Therefore, despite this positive development, it seems we are still far from saying that tariff uncertainty has been eliminated, due to Trump’s unpredictable stance.

November Roadmap

As mentioned above, it is extremely difficult to shed light on the map without data to guide the way in an environment where macro indicators are not disclosed. If the government’s secrecy ends and the country’s statistical agencies resume operations, we may be able to access this valuable information within the month. However, for now, we must chart a course assuming that these data sets will not be published.

At this stage, we can say that the first major test for the markets will be the local elections in the US, as mentioned. Of course, developments regarding the government’s state of closure and announcements on tariffs will remain on our agenda. Furthermore, expectations regarding the FOMC’s path on interest rate cuts will be the most important “market behavior capture tool” under our lens, as they will influence pricing behavior.

There will be no FOMC meeting in November. However, any developments and data that shape expectations for the meeting to be completed on December 10 will be decisive in financial instrument prices as “input.” From this perspective, PMI indicators, the ADP Private Sector Nonfarm Employment Change expected to be announced on November 5, and the FOMC meeting minutes on November 19 will be under our scrutiny.

The emerging new dynamics will be reflected in the equation we use for our market direction forecasts. Naturally, we will make updates accordingly. However, our main trajectory for digital assets remains upward, and we anticipate that the ecosystem will continue to positively impact the value of major cryptocurrencies in the coming months. Separately, potential developments regarding US tariffs, expectations regarding the health of the US economy, and geopolitical dynamics could make November another challenging period. In parallel, we are developing a projection that we may see horizontal changes within a wide band in the medium term. Regarding the macro outlook, we will continue to share potential updates in our monthly strategy reports as we begin to receive data that will broaden our investment horizon.

Legal Notice

The investment information, comments, and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in outcomes that align with your expectations.