PAZAR PUSULASI

Are Trade Wars Starting?

Global markets are witnessing a historic period. On Nisan 2, US President Donald Trump announced the highly anticipated new tariffs and the numbers were much harsher than expected. In addition to the 10% minimum rate, the different rates imposed on the US’s most important trading partners such as China and the European Union (EU) shook the markets.

Trump’s tariff weapon needs to be analyzed from several different angles. The first is the potential pressure on the US economy from these tariff changes, and the second is the potential for higher inflation. The stagflation that these two variables – slow economic growth (or even contraction) and rising inflation – could produce in the world’s largest economy is a real concern for investors.

We believe that it would be wrong to ignore the rest of the world and that we need to look behind the curtain. Assessing the damage caused by the tariffs only in terms of the US economy would be to confine ourselves to a narrow perspective. In fact, in addition to the damage that other major economies will suffer, the fight that Trump has started could spread to counter-tariffs and spread to a large economic region, making things completely unmanageable.

Save the Date: Nisan 9

On Cuma, China may have made the first countermove of the “trade wars”. The world’s second largest economy announced an additional 34% tariff on US goods, adding fuel to Trump’s fire. Following this announcement, the already existing depreciation in global markets accelerated again. Prime Minister Ishiba of Japan, another mega-economy, said that there is a national crisis looming, while world leaders are trying to decide on an appropriate response to Trump.

It seems that Europe and other countries will follow suit. The high tariffs imposed by the US on individual countries will go into effect on Nisan 9th. China has given the same date. In other words, we are in for a busy agenda until Nisan 9th, both in terms of the war between the world’s two largest economies and if other countries join the race.

Will there be negotiations on tariffs? And if so, what will be the outcome? Which countries will be subjected to high tariffs by the US on Nisan 9th, and which ones will manage to find a compromise with Trump? We will try to find the answers to these questions until Nisan 9th, and we will see whether a “trade war”, the likes of which the world has never seen before, will begin and paralyze global trade, or whether we will come back from the brink of a crisis.

Nisan 10 – US Consumer Price Index: CPI

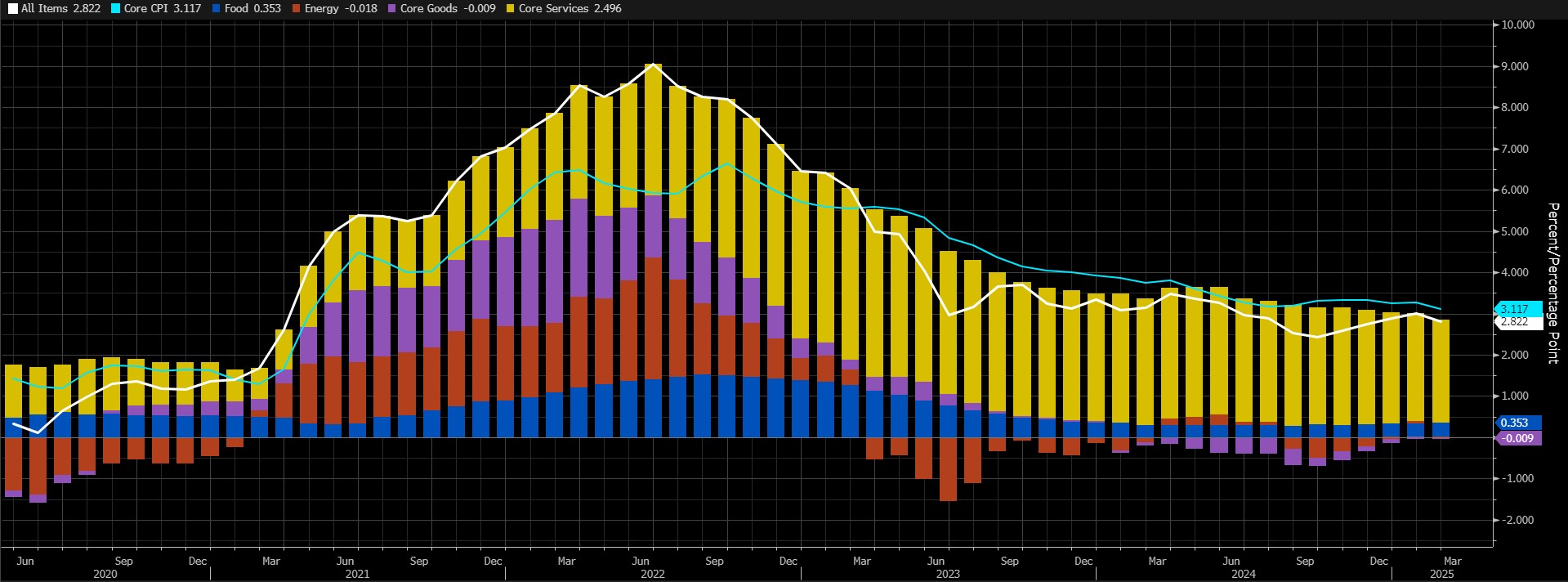

The Consumer Price Index (CPI) change in Şubat was realized at 2.8% on an annualized basis. In Eylül 2024, this data pointed to the lowest inflation increase since Şubat 2021 with a reading of 2.4%. So since Eylül, the CPI has been pointing to higher increases, until the Şubat data. We can say that the FED has followed a criticizable path on inflation recently. With its focus shifting to the labor market rather than controlling inflation, the interest rate cuts last year seem to have disrupted the control on price increases. Moreover, the new US President Trump’s pro-economic growth and pro-spending stance and the additional costs that tariffs may bring increase the risk of inflation becoming a bigger problem in the future. Still, the Şubat data broke a streak of 4 consecutive months of rising inflation and perhaps gave Powell and his team some relief. However, we think it is not right to say anything based on only one data for now.

Kaynak: Bloomberg

As can be seen in the chart above, core services continue to have the largest share in the overall price level. Our expectation is for a monthly increase of 0.15% and an annual CPI of around 2.73%. Nevertheless, the market will react according to the consensus expectation.

A lower-than-expected CPI reading could mean that the FED will be in a better position to cut interest rates, which could have a positive impact on digital assets. A figure that exceeds forecasts, on the other hand, has the potential to exert pressure by reinforcing expectations that the FED will not rush into another rate cut.

Digital Compass

We consider it a very important development that a strategic crypto reserve is on the agenda in the US, the locomotive of the world economy. However, the fact that the markets had already priced in the “best case scenario” combined with the “less than perfect” news on this issue put pressure on digital assets. We continue to keep the strategic reserve issue in our equation as a positive variable for cryptocurrencies in the long run. On the other hand, we think that we may continue to see pressure in the medium term with the lack of new news flow that will create enthusiasm in the crypto market and further concerns that economic activity may slow down in global markets, especially with Trump’s tariffs. In the short term (in general), markets will continue to be sensitive to macro indicators and Trump’s actions regarding the announced tariffs

DARKEX ARAŞTIRMA DEPARTMANI GÜNCEL ÇALIŞMALAR

Darkex Aylık Strateji Raporu - Nisan

JP Morgan Forecast: Tether’s Possible Strategy Under Stablecoin Bills

Global Economic Uncertainties, the ONS Gold Price and Bitcoin’s Lack of

2025 First Quarter: Bitcoin Market Volatility and Macroeconomic

Intent-Based Solutions and De-Fi Liquidity

The 5 Altcoins Least Affected by the Drop in

Buraya tıklayın diğer tüm Market Pulse raporlarımız için.

ÖNEMLİ EKONOMİK TAKVİM VERİLERİ

Buraya tıklayın Haftalık Darkex Kripto ve Ekonomi Takvimini görüntülemek için.

BİLGİ

*Takvim UTC (Koordineli Evrensel Zaman) zaman dilimini temel alır.

İlgili sayfada yer alan takvim içeriği güvenilir veri sağlayıcılardan temin edilmektedir. Takvim içeriğinde yer alan haberler, haberlerin açıklanma tarihi ve saati, önceki, beklenti ve açıklanan rakamlardaki olası değişiklikler veri sağlayıcı kurumlar tarafından yapılmaktadır.

Benzer durumlardan kaynaklanabilecek olası değişikliklerden Darkex sorumlu tutulamaz. Veri açıklamalarının içeriğinde ve zamanlamasında meydana gelebilecek olası değişiklikler için Darkex Takvim sayfasını veya günlük raporlarda yer alan ekonomik takvim bölümünü de kontrol edebilirsiniz.

Yasal Uyarı

Bu dokümanda yer alan yatırım bilgi, yorum ve tavsiyeleri yatırım danışmanlığı hizmeti niteliği taşımamaktadır. Yatırım danışmanlığı hizmeti, yetkili kuruluşlar tarafından kişilerin risk ve getiri tercihleri dikkate alınarak kişiye özel olarak verilir. Bu dokümanda yer alan yorum ve tavsiyeler genel niteliktedir. Bu tavsiyeler mali durumunuz ile risk ve getiri tercihlerinize uygun olmayabilir. Bu nedenle, sadece bu dokümanda yer alan bilgilere dayanarak yatırım kararı vermeniz beklentilerinize uygun sonuçlar doğurmayabilir.