MARKET COMPASS

Are Trade Wars Starting?

Global markets are witnessing a historic period. On April 2, US President Donald Trump announced the highly anticipated new tariffs and the numbers were much harsher than expected. In addition to the 10% minimum rate, the different rates imposed on the US’s most important trading partners such as China and the European Union (EU) shook the markets.

Trump’s tariff weapon needs to be analyzed from several different angles. The first is the potential pressure on the US economy from these tariff changes, and the second is the potential for higher inflation. The stagflation that these two variables – slow economic growth (or even contraction) and rising inflation – could produce in the world’s largest economy is a real concern for investors.

We believe that it would be wrong to ignore the rest of the world and that we need to look behind the curtain. Assessing the damage caused by the tariffs only in terms of the US economy would be to confine ourselves to a narrow perspective. In fact, in addition to the damage that other major economies will suffer, the fight that Trump has started could spread to counter-tariffs and spread to a large economic region, making things completely unmanageable.

Save the Date: April 9

On Friday, China may have made the first countermove of the “trade wars”. The world’s second largest economy announced an additional 34% tariff on US goods, adding fuel to Trump’s fire. Following this announcement, the already existing depreciation in global markets accelerated again. Prime Minister Ishiba of Japan, another mega-economy, said that there is a national crisis looming, while world leaders are trying to decide on an appropriate response to Trump.

It seems that Europe and other countries will follow suit. The high tariffs imposed by the US on individual countries will go into effect on April 9th. China has given the same date. In other words, we are in for a busy agenda until April 9th, both in terms of the war between the world’s two largest economies and if other countries join the race.

Will there be negotiations on tariffs? And if so, what will be the outcome? Which countries will be subjected to high tariffs by the US on April 9th, and which ones will manage to find a compromise with Trump? We will try to find the answers to these questions until April 9th, and we will see whether a “trade war”, the likes of which the world has never seen before, will begin and paralyze global trade, or whether we will come back from the brink of a crisis.

April 10 – US Consumer Price Index: CPI

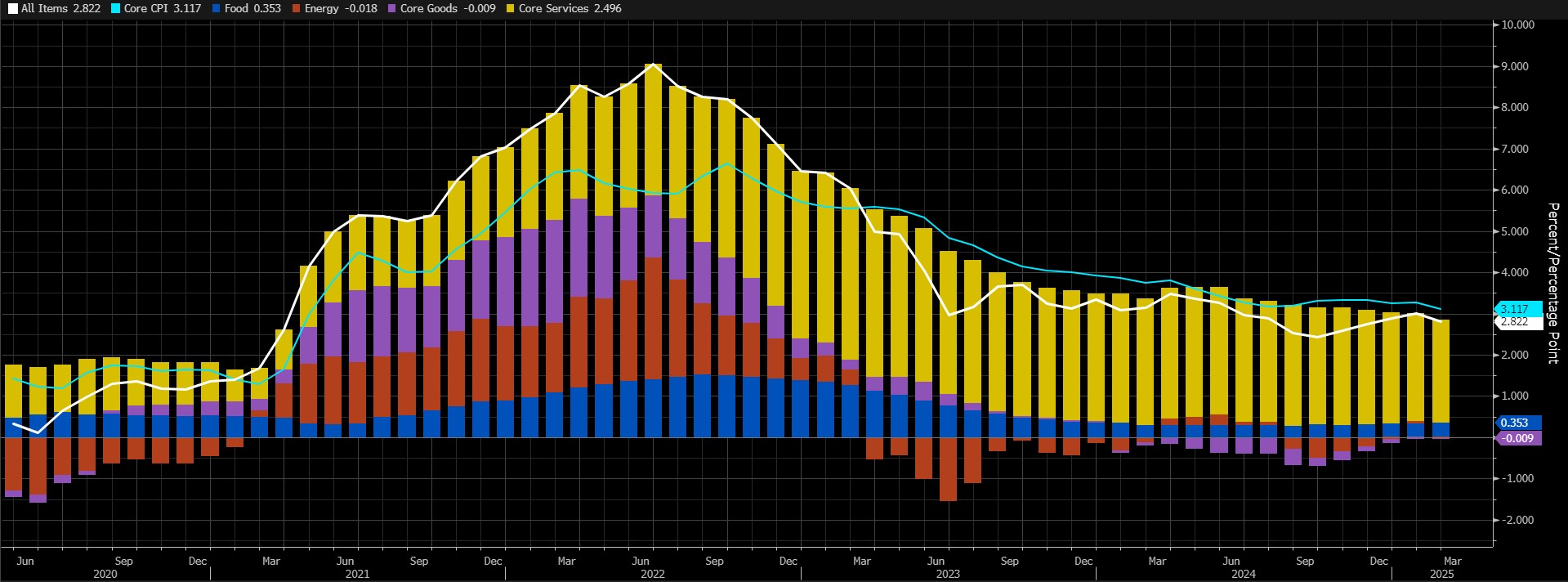

The Consumer Price Index (CPI) change in February was realized at 2.8% on an annualized basis. In September 2024, this data pointed to the lowest inflation increase since February 2021 with a reading of 2.4%. So since September, the CPI has been pointing to higher increases, until the February data. We can say that the FED has followed a criticizable path on inflation recently. With its focus shifting to the labor market rather than controlling inflation, the interest rate cuts last year seem to have disrupted the control on price increases. Moreover, the new US President Trump’s pro-economic growth and pro-spending stance and the additional costs that tariffs may bring increase the risk of inflation becoming a bigger problem in the future. Still, the February data broke a streak of 4 consecutive months of rising inflation and perhaps gave Powell and his team some relief. However, we think it is not right to say anything based on only one data for now.

Source: Bloomberg

As can be seen in the chart above, core services continue to have the largest share in the overall price level. Our expectation is for a monthly increase of 0.15% and an annual CPI of around 2.73%. Nevertheless, the market will react according to the consensus expectation.

A lower-than-expected CPI reading could mean that the FED will be in a better position to cut interest rates, which could have a positive impact on digital assets. A figure that exceeds forecasts, on the other hand, has the potential to exert pressure by reinforcing expectations that the FED will not rush into another rate cut.

Digital Compass

We consider it a very important development that a strategic crypto reserve is on the agenda in the US, the locomotive of the world economy. However, the fact that the markets had already priced in the “best case scenario” combined with the “less than perfect” news on this issue put pressure on digital assets. We continue to keep the strategic reserve issue in our equation as a positive variable for cryptocurrencies in the long run. On the other hand, we think that we may continue to see pressure in the medium term with the lack of new news flow that will create enthusiasm in the crypto market and further concerns that economic activity may slow down in global markets, especially with Trump’s tariffs. In the short term (in general), markets will continue to be sensitive to macro indicators and Trump’s actions regarding the announced tariffs

DARKEX RESEARCH DEPARTMENT CURRENT STUDIES

Darkex Monthly Strategy Report – April

JP Morgan Forecast: Tether’s Possible Strategy Under Stablecoin Bills

Global Economic Uncertainties, the ONS Gold Price and Bitcoin’s Lack of

2025 First Quarter: Bitcoin Market Volatility and Macroeconomic

Intent-Based Solutions and De-Fi Liquidity

The 5 Altcoins Least Affected by the Drop in

Click here for all our other Market Pulse reports.

IMPORTANT ECONOMIC CALENDAR DATA

Click here to view the weekly Darkex Crypto and Economy Calendar.

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

Legal Notice

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.