MARKET COMPASS

Tariff Uncertainty

In global markets, Trump’s statements on “tariffs” continue to be the major dynamic affecting pricing behavior. In his latest comments, the President hinted that 25% tariffs could be imposed on the European Union (EU), albeit causing confusion, which was another factor that negatively affected risk appetite. On Wednesday, Trump stated that he plans to impose “reciprocal” tariffs of 25% on European automobiles and other goods, while tariffs on Mexico and Canada will take effect on April 2, instead of the previously set date of March 4.

In addition to this main topic, Zelensky’s visit to the US tomorrow after the reconciliation between the US and Ukraine, the efforts to form a government in Germany after the elections and the record high outflows from Bitcoin spot ETFs are among the agenda items for investors. Today, the macro agenda may start to come to the fore a little more.

The economic calendar is busy today and the macro data agenda may be watched a bit more closely after the latest CB Consumer Confidence data. Among this data set, US economic growth (GDP) data will stand out, while Federal Open Market Committee (FOMC) members’ statements will also be under scrutiny.

The Problem of Economic Growth in the US

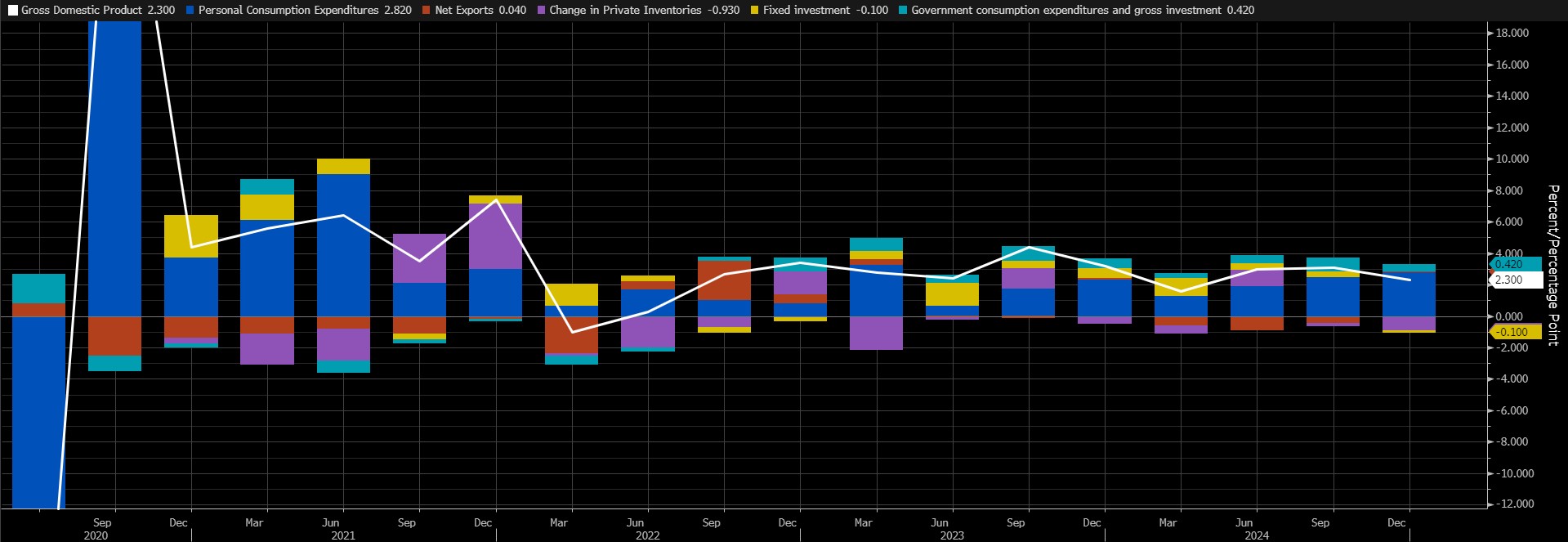

The world’s largest economy grew at an annualized rate of 2.3% in Q4 2024, the slowest pace in three quarters and a more conservative pace of growth than the 3.1% in Q3 and the 2.6% forecast. The new data to be released today will be the Bureau of Economic Analysis’ second estimate for the final quarter of last year. According to data from Bloomberg, no change is expected from the first published figure of 2.3%.

Source: Bloomberg

In the first data released for this quarter, personal consumption expenditures, which are the driving force of the US economy, were again the largest contributor to economic growth. We do not expect a significant change in this. We also do not think that we will see a significant deviation from the median forecast of 2.3%. Although it is fair to say that the first quarter growth data will be more important in the coming months, it is worth noting that a potentially large revision in the GDP data to be released this week could affect pricing behavior.

At this stage, there are two possible scenarios. We believe that a GDP growth figure that is slightly above or slightly below the forecasts will drive the expectations regarding the monetary policy of the US Federal Reserve (FED). In this context, a GDP data that is slightly below forecasts (such as 2.2%-2.1%) may increase risk appetite in the markets by supporting expectations that the FED will be bolder for a new interest rate cut, which in turn may pave the way for the appreciation of digital assets. A slightly higher-than-expected data (2.4%-2.5%) could support the perception that the FED will wait longer to cut rates in a hurry. In such a case, losses may be observed in asset classes that are considered to be relatively riskier. In the second scenario, we need to consider the case where GDP comes in significantly different from expectations. A surprise reading of 2% or below could trigger concerns that growth in the world’s largest economy is indeed problematic. While this would likely bring the Fed closer to another rate cut, concerns about growth (and perhaps recession) could cause a significant shift in risk appetite, which could put selling pressure on financial instruments, including digital assets. It is worth underlining that a significantly positive data, although we think it will not have as much impact as bad pricing, may increase risk appetite and provide a basis for rises.

In sum, US growth data will be an important input for all markets. However, its importance for financial markets can be reduced to how far away from expectations we will see a number that will surprise the markets. While we consider it unlikely that we will see a set of data that will affect pricing behavior and cause a shake-up, we do not rule out the scenario that we could see sharp price changes if we see surprise data.

HIGHLIGHTS OF THE DAY

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| – | Sonic SVM (SONIC) – Mobius Mainnet launch | – | – |

| – | Delysium (AGI) – AMA session | – | – |

| – | SKALE (SKL) – DAO Community Call | – | – |

| – | USD Coin (USDC) – Circle Dev Summit Denver, Denver, USA | – | – |

| 13:30 | US GDP (QoQ) (Q4) | 2.3% | 2.3% |

| 13:30 | US Initial Jobless Claims | 222K | 219K |

| 13:30 | US Core Durable Goods Orders (MoM) (Jan) | 0.2% | 0.3% |

| 14:15 | FOMC Member Schmid Speaks | – | – |

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

LEGAL NOTICE

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorised institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based only on the information contained in this document may not result in results that are in line with your expectations.