Fear & Greed Index

Source: Alternative

Change in Fear and Greed Value: +18

Last Week’s Level: 16

This Week’s Level: 34

This week, Trump’s announcement that XRP, SOL, ADA and Ethereum would be included in the strategic reserve system increased investors’ willingness to take risks. This was reflected in the market as extreme fear began to give way to a partial shift towards greed. The Fear & Greed Index rose to 34 on signs of cautious optimism, indicating a clear recovery in investor sentiment. On the other hand, although uncertainties such as the tariffs to be imposed from April 2 and tariff-related arrangements between China and Mexico still exist, the strategic reserve move eased the fear pressure on the index and supported risk appetite.

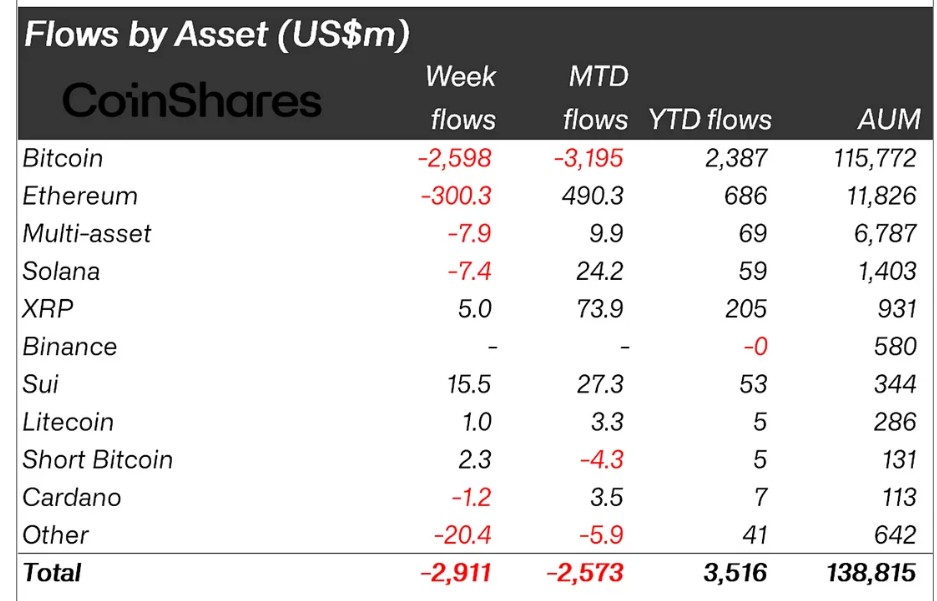

Fund Flows

Overview

The hawkish statements made by FED huge selling pressure on the markets. FED this week on digital asset investment products White House Chief Cryptocurrency Officer David Sacks that President Donald Trump signed an executive order to create a strategic Bitcoin reserve announced. Last week saw record outflows totaling USD 3.8 billion.

Fund Inputs:

- Ripple (XRP): There has been a new development in the long-running legal battle between the US Securities and Exchange Commission (SEC) and Ripple. Former White House official and investor Anthony Scaramucci suggested that the SEC may have withdrawn its lawsuit against Ripple. With this development, Ripple saw an entry of $ million. 5.0

- SUI: Canary SUI ETF in Delawarewas registered. It saw with this news. 15.5 million $ entries

- Litecoin (LTC): Litecoin saw an inflow of $1.0 million this week as discussions on the crypto strategic reserve dominated the market.

- Short Bitcoin: Inflows into short bitcoin positions totalled $2.3 million.

Fund Outflows

- Bitcoin (BTC): In the first week of March, sentiment data fell to extreme fear levels after a long absence. This shook investor confidence, causing Bitcoin to fall to the $78,000 level, and the market faced severe selling pressure. With this decline, Bitcoin saw outflows of $2.59 billion last week.

- Ethereum (ETH): Trump signed an executive order to create a strategic Bitcoin reserve based on seized Bitcoin assets, but announced no additional purchases, causing volatility in the markets. The ETH network saw outflows of $300 million.

- Multi-asset: Outflows in digital mutual funds this week were $82.6 million from the BlackRock ETHA ETF and $64.3 million from the Grayscale ETHE ETF. In total, Multi assets saw outflows of $7.9 million.

- Solana (SOL): Whale Alert reported that a SOL whale moved 71.95 SOL worth approximately $494,153 million to Coinbase Institutional. Solana a total $7.4 million on this newssaw .outflow of

- Cardano (ADA): Trump finally signed an executive order for a crypto strategic reserve, but the order confirmed that the US will not buy XRP or other altcoins. It saw a $1.2 million exit in the process.

- Other: Markets have fully priced in the expectation that the Federal Reserve will deliver at least three rate cuts in 2025. Alt coins saw $20 million outflows.

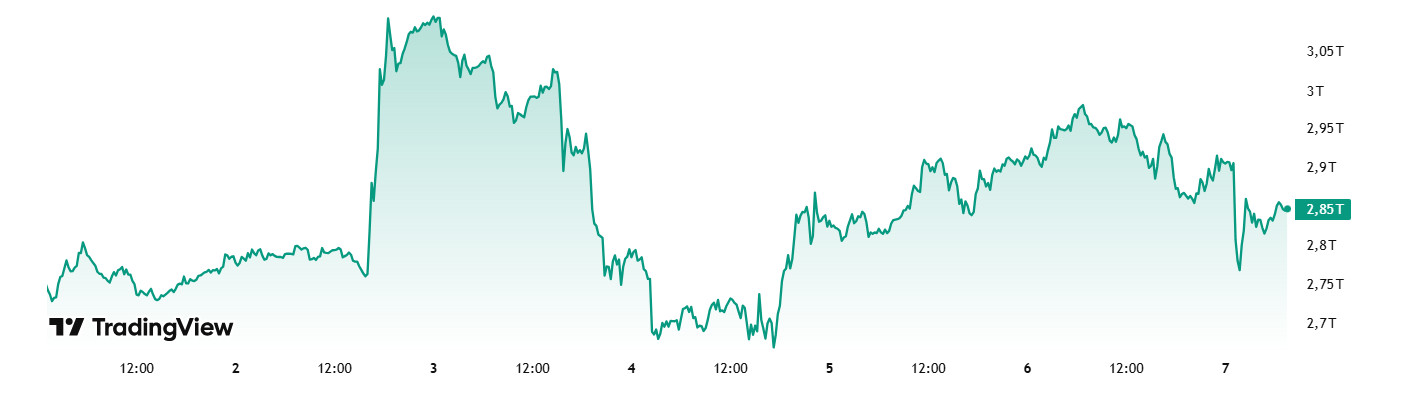

Total Market Cap

Source: Tradingview

Last Week Market Capitalization: 3.09 trillion Dollars

This Week Market Capitalization: 2.85 trillion Dollars

After closing at $3.09 trillion last week, the cryptocurrency market fell another 8.00% this week to $2.59 trillion. In the process, about $ 247.54 billion was wiped off the market capitalization and returned to the levels found in November 2024.

Total 2

While Total 2 started the week with a market capitalization of $1.23 trillion, it continues to stay above the $1 trillion level, showing a decline of 123.34% with an outflow of approximately $10.08 billion during the week. Thus, altcoins, which make up 38.71% of the cryptocurrency market, accounted for 49.82% of the total loss this week.

Total 3

The Total 3 index experienced a drop of 8.74% with a loss of $80.53 billion. Total 3, which accounts for 29.4% of the crypto market, represents 32.53% of the market loss this week. This shows that the declines in Bitcoin and Ethereum have been slower than in other altcoins.

The sharp price movements in Bitcoin severely affected all altcoins, especially Ethereum. The crypto market continued to fluctuate this week, especially due to consecutive outflows in Spot Bitcoin and Ethereum ETFs and important statements by the US to become a crypto reserve.

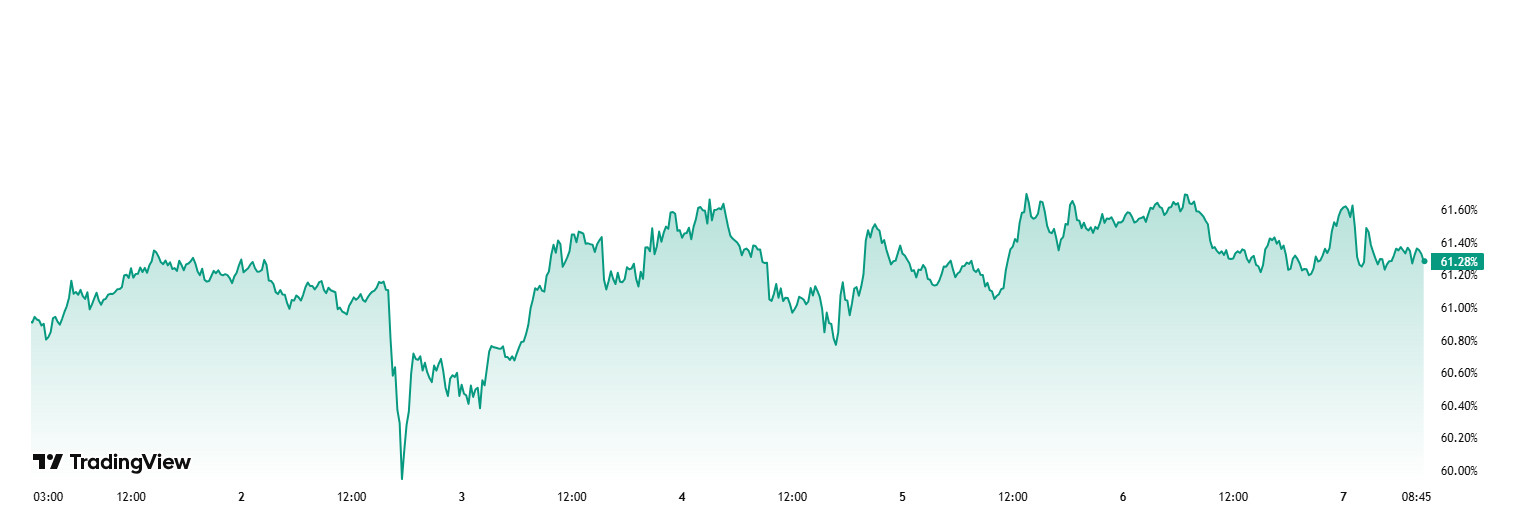

Bitcoin Dominance

Source: Tradingview

Bitcoin Dominance

BTC dominance, which started at , rose to 61.66% and is currently at 61.28%.the week 60.40%This week, an increase in BTC dominance was observed as a result of the executive order signed by US President Trump on the creation of a Bitcoin strategic reserve. In addition, the reserve bill Texas strategic Bitcoin was approved by a 25-5 vote in the plenary session.Senate With Trump’s move, the US states’ strategies to create Bitcoin reserves may accelerate in the coming period, and the interest of institutional and individual ETF investors may increase significantly depending on these strategies. With the likely increased buying appetite, we can expect BTC dominance to rise to 62% – 63% levels in the new week.

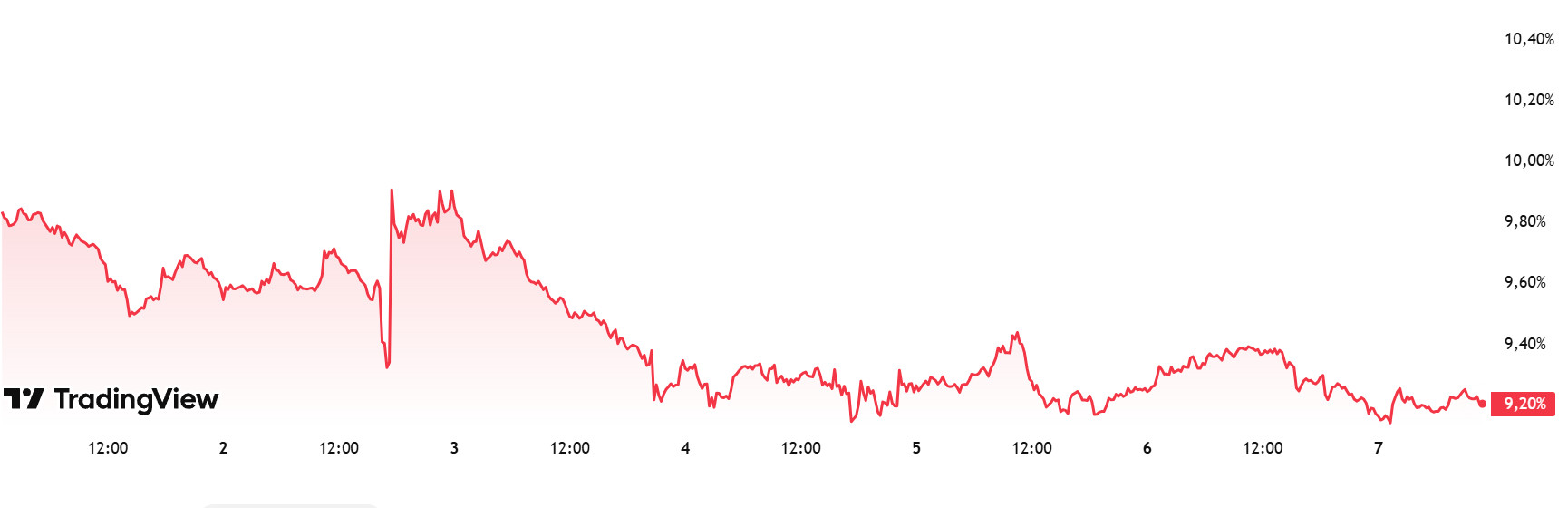

Ethereum Dominance

Source: Tradingview

Weekly Change:

Last Week’s Level: 9.81%

This Week’s Level: 9.20%

Ethereum dominance 9in the first week of February 2025recovered slightly to 10after falling as low as .88% .23% . However, the dominance, which entered a downtrend again with the selling pressure in this region, continued to be significantly suppressed in the last two-week period.

In this direction, the 9followed as of the current week, Ethereum dominance, which fell below level .25% maintained its negative outlook on a weekly basis, with .a total net outflow of 112.7 million dollars in Spot Ethereum ETFs between February 28 and March 6, 2025

In the same period, a reverse trend was observed in Bitcoin dominance and a positive trend was exhibited in contrast to Ethereum dominance.

On the other hand, the decline in Ethereum dominance in a week when the overall market, especially Bitcoin, was under pressure, reveals that the market’s risk appetite has decreased.

In this context, Ethereum dominance ended last week 9at, 9as of the current week.81%while it is hovering around .20%

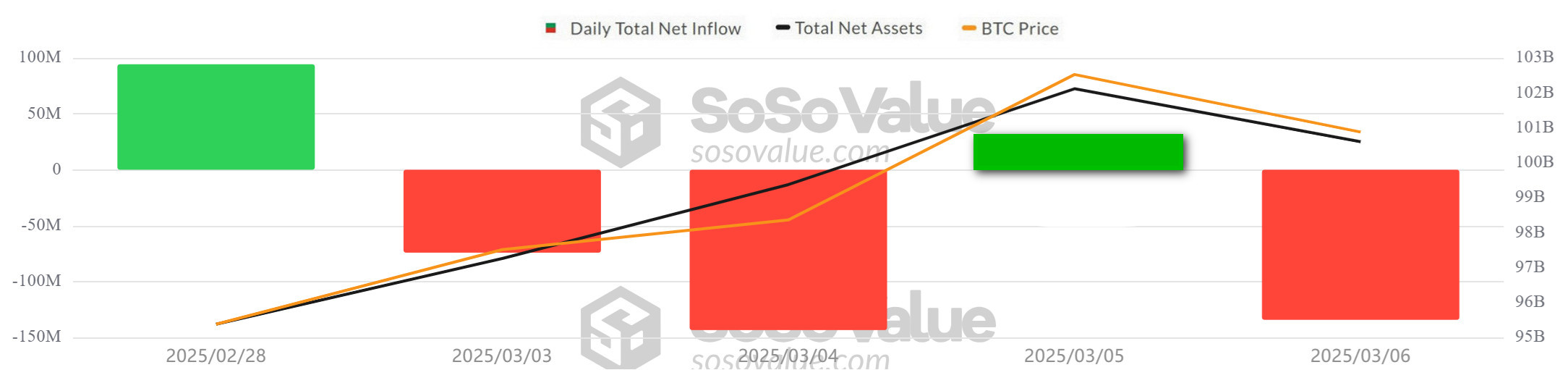

Bitcoin Spot ETF

Source: SosoValue

Featured Developments

- Netflow Status: Between February 28 and March 06, 2025, Spot Bitcoin ETFs saw net outflows totaling $235.6 million. The BlackRock IBIT ETF saw net outflows of $334.3 million and the Grayscale GBTC ETF saw net outflows of $122.2 million. In contrast, Ark ARKB ETF ($190.2 million) and Fidelity FBTC ETF ($129.9 million) stood out with net inflows.

- Bitcoin Price: Bitcoin, which opened at $84,668 on February 28, 2025, experienced a 6.16% increase on a weekly basis and closed at $89,887 on March 06. The daily net inflows in the ETF continued to affect the rise and fall in the Bitcoin price.

- Cumulative Net Inflows: Spot Bitcoin ETFs saw a total net outflow of $235.6 million between February 28 and March 06, 2025, while cumulative net inflows fell to $36.62 billion by the end of the 288th trading day.

| DATE | COIN | PRICE | ETF Flow (mil$) | ||

|---|---|---|---|---|---|

| Open | Close | Change % | |||

| 28-Feb-25 | BTC | 84,668 | 84,299 | -0.44% | 94.3 |

| 03-Mar-25 | 94,222 | 86,192 | -8.52% | -74.2 | |

| 04-Mar-25 | 86,192 | 87,245 | 1.22% | -143.5 | |

| 05-Mar-25 | 87,245 | 90,566 | 3.81% | 22.1 | |

| 06-Mar-25 | 90,566 | 89,887 | -0.75% | -134.3 | |

| Total for 28 Feb – 06 Mar 25 | 6.16% | -235.6 | |||

Between February 28 and March 06, 2025, the Bitcoin price recovered, while outflows continued in total in Bitcoin ETFs. Uncertainties in global markets continued to negatively affect the cryptocurrency market. Statements made by the US caused fluctuations in the cryptocurrency market. US tariff policies and the intensification of global trade wars continue to weaken investor confidence by increasing pressure on the market. Continued outflows from Bitcoin ETFs indicate that the selling pressure created by ETFs on Bitcoin price will continue. While market fluctuations are expected to continue in the short term, the direction of investor interest in the long term will be influential in terms of the direction of the market.

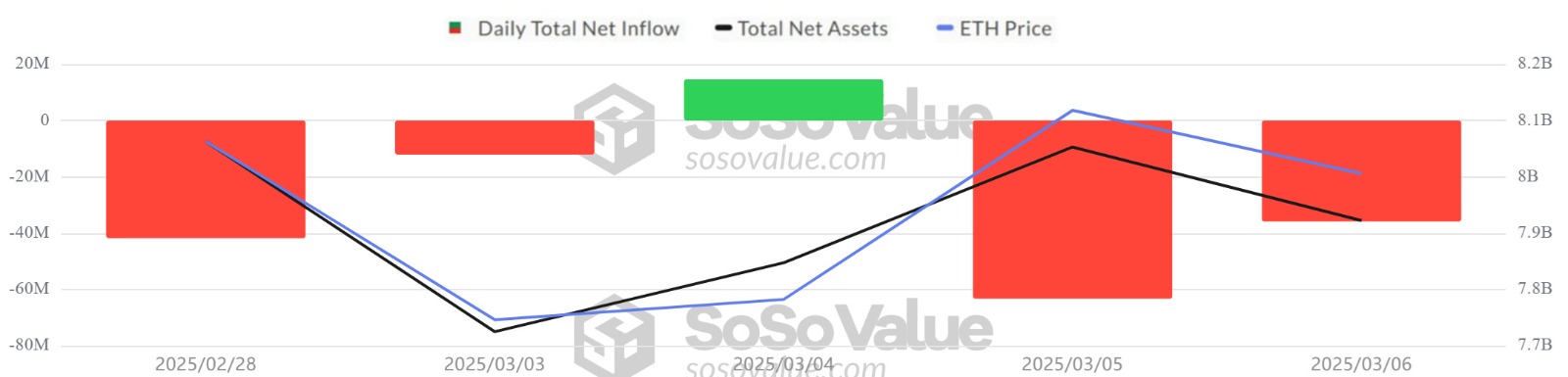

Ethereum spot ETF

Source: SosoValue

Between February 28 and March 6, 2025, Spot Ethereum ETFs saw a total net outflow of $112.7 million. In particular, outflows of $82.6 million from BlackRock ETHA ETF and $64.3 million from Grayscale ETHE ETF were noteworthy. The total net inflows of spot Ethereum ETFs fell to $2.75 billion at the end of the 156th trading day. Ethereum opened the day at $2,306 on February 28, 2025 and closed at $2,201 on March 6, 2025. On a weekly basis, Ethereum price decreased by 4.55%.

| DATE | COIN | PRICE | ETF Flow (mil$) | ||

|---|---|---|---|---|---|

| Open | Close | Change % | ETF Flow | ||

| 28-Feb-25 | BTC | 84,668 | 84,299 | -0.44% | 94.3 |

| 03-Mar-25 | 94,222 | 86,192 | -8.52% | -74.2 | |

| 04-Mar-25 | 86,192 | 87,245 | 1.22% | -143.5 | |

| 05-Mar-25 | 87,245 | 90,566 | 3.81% | 22.1 | |

| 06-Mar-25 | 90,566 | 89,887 | -0.75% | -134.3 | |

| Total for 28 Feb – 06 Mar 25 | 6.16% | -235.6 | |||

Between February 28 and March 6, statements from the US caused major fluctuations in the crypto market. In particular, Ethereum opened at $2,517 on March 3, 2025, following statements made by US President Donald Trump over the weekend, but Trump’s new statements on tariffs on the same day had a negative impact on global markets and caused Ethereum to lose about 15% of its value. This led to accelerated outflows from ETFs, adding to the overall weakness in the market. In the coming week, from ETFs if uncertainties in the market persist outflows may continue, which could put downward pressure on the Ethereum price. US economic policies and new regulatory steps by the Trump administration will play a critical role in determining the direction of the market.

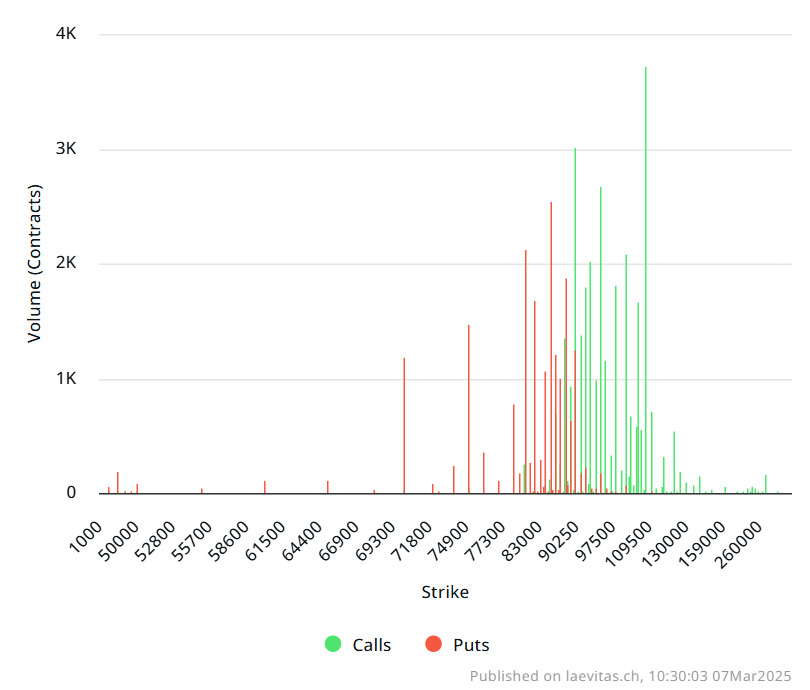

Bitcoin Options

Source: Laevitas

Deribit Data: Deribit data shows that approximately BTC options contracts with a notional value of $2.36 billion expire today. Tony Stewart, an advisor to Deribit, the largest crypto options exchange, said, “The fact that the Trump SR expansion fell on a Sunday surprised many. The immediate reaction of traders was. to close put contracts and buy call contractsBut what Trump said and what Trump and Congress can do are different. Faith was more moderate than the Spot reaction. The buying in the range with some short selling, TPing and adjusting strategies95,000 – 110,000 was two-way. But given the volumes, option flows lagged behind the Spot enthusiasm.” He said.

Laevitas Data: When we examine the chart, put options it is seen that are concentrated in the band between . Call options are 78,000 – 91,000 dollarsconcentrated between and the concentration decreases towards the upper levels. At the same time$ 87,500 – 110,500 , resistance has formed in the $ $ ,000 band. On the other hand, there 87,000 – 90are 3.59K put options at the $ ,000 level85, where there is a peak and there is volume after this levela decrease in . However, it is seen that call options peaked at $ 108,000 with 5.27K units. When we look at the options market, we see that the market is in the decision-making process. Although there is a slight bull dominance, the slight rise in open interest data in the coming period shows us that the bull is more likely.

Option Expiration

Put/Call Ratio and Maximum Pain Point: In the last 7 days data from Laevitas, the number of call options compared to last week increased by 66% to 156.81K. In contrast, the number of put options increased by 6% to 107.33K . The put/call ratio for options was set at . A put/call ratio of 0.50.5 indicates a balanced market. among tradersBitcoin’s maximum pain point is set at $89000. , In the next 7 days, there are at the time of writing7.57K call and 6.3K put options.

LEGAL NOTICE

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.