FOMC Decisions and Crypto Report

- Investors in global markets focused on the Federal Open Market Committee (FOMC) decisions of the US Federal Reserve to be completed today. On the one hand, the balance sheets of major companies, the results of the negotiations on tariffs and macro indicators are eagerly awaited. On the other hand, in the digital world, the country’s first “Cryptocurrency Report” will be under scrutiny by the US today.

- The outcome of the negotiations between the US and China is expected to be the extension of the tariff truce, and it is stated that Trump will have the last word after the negotiations are completed. Trump also expressed his discontent with China’s energy imports from Russia and Iran.

- Risk appetite in global markets is weak due to the anticipation of critical news. There is a general cautious mood in the markets due to the impact of the aforementioned developments and the consequences of Donald Trump’s decision to shorten the deadline given to Russia to make peace with Ukraine. Nevertheless, the slight recovery in European indices, driven by corporate profits and economic data, is remarkable.

- While the digital ecosystem is also affected by this market attitude, the White House’s Crypto Report may cause divergence in terms of risk appetite. Ahead of today’s critical news from the US, we are watching a flat behavior in major cryptocurrencies. However, Bitcoin and Ethereum gained some value in Asian trading after the close of the US session.

- US macro indicators, the Crypto Report, the FOMC interest rate decision and Powell’s speech, and the balance sheets of Microsoft and Meta Platforms will be in the focus of investors and we can say that a busy day awaits the markets in this parallel. Therefore, it would not be wrong to say that we will have a trading day with high volatility that can determine the direction of the short and medium term trends ahead.

For a detailed review of our twice-daily technical analysis report and the latest developments in digital assets click here.

Eyes on the Critical FOMC Meeting

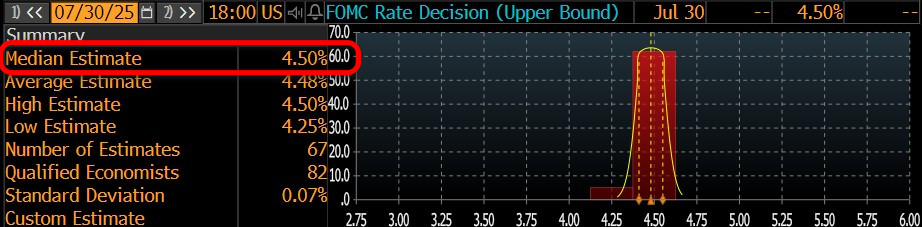

The US Federal Reserve’s (FED) fifth Federal Open Market Committee (FOMC) meeting of the year will be held on July 29-30 and the decisions will be announced on July 30. The FED is not expected to change its policy interest rate. However, what makes the July meeting important is that we may get clues about the timing of the rate cut.

On July 30, investors will be looking for clues in the FOMC statement that could lead to a major change in market expectations. The first thing to look for is whether the interest rate is left unchanged as expected. Half an hour after this decision and the release of the statement, FED Chair Powell will take the podium and hold a press conference.

Will the interest rate change?

Despite Trump’s pressure, after the recent developments and the statements of the FOMC members, according to the Bloomberg survey, a rate cut is not expected from the Board. There may be a surprise decision to cut interest rates, which we see as a very low probability. We define a rate hike as unlikely . According to the CME FedWatch Tool, a rate hike is almost certain. At the September 17 FOMC meeting, at the time of writing, the probability of a 25 basis point cut in the policy rate was priced at around 58%. The main question in Powell’s speech will be whether there will be a rate cut at the next meeting.

Source: Bloomberg

Our base case scenario is that the Fed will end the year with a 25 basis point rate cut in December. Trump’s pressure for a rate cut is likely to intensify and his Fed appointees Chiris Waller and Michelle Bowman have said they would support a rate cut. However, the rest of the FOMC members think that the wait-and-see period should continue, especially since the latest employment report showed stronger-than-expected results and the uncertainty about the impact of Donald Trump’s tariffs on inflation remains. Our expectations that we will continue to see strong data in July’s employment report, our prediction that inflation will not be too innocent of tariff effects, and our assumption that the FOMC will continue to make rational decisions lead us to think that a hasty rate cut could be problematic.

Powell’s Press Conference

On July 30th, FED Chairman Jerome H. Powell will speak at a press conference, as he does after every FOMC meeting, half an hour after the decisions are published. Powell will first read the text of the decision and explain the reasons for the decisions taken. Then, the press conference will be followed by a question and answer session where press members’ questions will be answered. In this part, volatility in the markets may increase a little more.

We do not expect a major change in the stance Powell has taken in his recent speeches. Last time, the chairman maintained his stance that they need more data to get a clearer picture of the impact of the tariffs.

In the face of questions from the press, Powell’s more hawkish stance than before may reinforce expectations and pricing that the Fed will not be in a hurry to resume rate cuts. This may have some negative impact on digital assets. However, his assessments on both economic growth and the labor market, his mention of the necessity of a new interest rate cut, and his messages that more interest rate cuts may be made by the end of the year than the general expectations may increase the risk appetite, and this may have positive effects on cryptocurrencies.

Other Key Macro Indicators to be announced

US – ADP Non-Farm Employment Change; shows the estimated change in the number of people employed in the previous month, excluding the agricultural sector and government, by analyzing payroll data from more than 25 million workers to obtain estimates of employment growth by Automatic Data Processing, Inc (ADP). It usually gives a hint of employment growth 2 days before the employment data released by the government. Usually, lower-than-expected ADP data has a positive impact on digital assets.

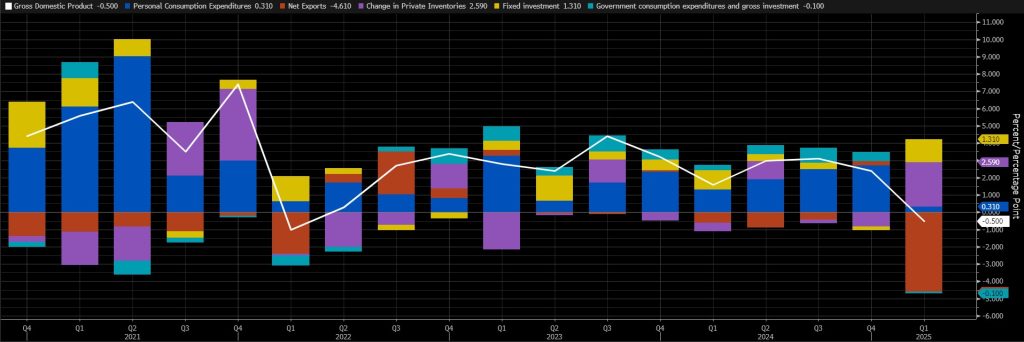

US – GDP Change; Donald Trump’s unpredictable policy choices have been a challenging factor for the whole world. Economic actors have also experienced the challenges of this highly uncertain environment as they build their expectations and plan for the future. There are some outcomes of this situation. The most important one is the slowdown in economic activity… In this respect, it will be important to see how much the US economy grew in the second quarter of the year. According to the Bureau of Economic Analysis, which compiles this statistic, the US economy contracted by 0.5% in the first quarter of 2025 (previous estimate for the period was -0.2%), reflecting the consequences of Trump’s unpredictable policies. This was the first decline since the first quarter of 2022.

This weak figure was primarily due to downward revisions in consumer spending and exports.

Source: Bloomberg

The new data will be the first estimate for the second quarter of the year and is important in this respect and will show how much the effects of Trump (tariffs and Fed pressure) and the tensions in the Middle East during the relevant period have had an impact on consumer behavior or how much the effects of these variables have softened. Our forecast is for the US economy to regain a growth rate of at least 1.5% during the period. Market expectations are concentrated around 2.5% and we do not think this is unusual.

In terms of immediate price reaction, we think that a higher-than-consensus expectation could increase risk appetite and have a positive impact on digital assets. A lower-than-expected GDP data may have a negative impact from this point of view.

Highlight of the Day

Important Economic Calender Data

| Time | News | Expectation | Previous |

|---|---|---|---|

| — | U.S. White House First Crypto Report | — | — |

| — | Robinhood Markets (HOOD), post-market | — | — |

| — | Conflux (CFX) Quarterly Community Call | — | — |

| — | IOST (IOST) Bitkub Airdrop | — | — |

| 12:15 | US ADP Nonfarm Employment Change (Jul) | 77K | -33K |

| 12:30 | US GDP (QoQ) (Q2) | 2.5% | -0.5% |

| 18:00 | FOMC Statement | — | — |

| 18:00 | FED Interest Rate Decision | 4.50% | 4.50% |

| 18:30 | FOMC Press Conference | — | — |

Information

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations.

*General Information About Our Forecasts

In addition to the general market expectations, the forecasts shared in this report are based on econometric modelling tools developed by our research department. Different structures were considered for each indicator, and appropriate regression models were constructed in line with data frequency (monthly/quarterly), leading economic indicators and data history.

The basic approach in all models is to interpret historical relationships based on data and to produce forecasts that have predictive power with current data. The performance of the models used is measured by standard metrics such as mean absolute error (MAE) and is regularly re-evaluated and improved. While the outputs of the models guide our economic analysis, they also aim to contribute to strategic decision-making processes for our investors and business partners. Data is sourced directly from the FRED (Federal Reserve Economic Data) platform in an up-to-date and automated manner, so that every forecast is based on the latest economic data. As the research department, we are also working on artificial intelligence-based modelling methods (e.g. Random Forest, Lasso/Ridge regressions, ensemble models) in order to improve forecast accuracy and react more sensitively to market dynamics. The macroeconomic context should be taken into account in the interpretation of model outputs, and it should be kept in mind that there may be deviations in forecast performance due to economic shocks, policy changes and unforeseen external factors. With this monthly updated working set, we aim to provide a more transparent, consistent and data-driven basis for monitoring the macroeconomic outlook and strengthening decision support processes.

Legal Notice

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.