Summary

Global markets are entering a critical phase. Ahead of the upcoming US presidential election and the Federal Reserve’s monetary policy statement, investors will focus on the non-farm payroll change (NFP) data to be released on Friday this week to get insights into the Fed’s rate cut path. The US labor market statistics, which will also be very important for digital assets, will be under the scrutiny of the markets in terms of the direction it may give to prices.

Crypto assets like Bitcoin are increasingly being affected by a growing number of macroeconomic developments. Similar to traditional financial assets, BTC also shows volatility during periods of market uncertainty or after major economic data releases. In this study, we have analyzed the last two years of data to examine the impact of the monthly US non-farm payroll change data on the BTC price. Our aim is to consider the potential impact of NFP data on BTC price movements and to provide useful information for investors who want to follow this impact more closely.

Data and Analysis Method

Based on the last two years of US NFP data and market expectations, we created two categories: days that exceeded expectations (“Above Expected”) and days that fell below expectations (“Below Expected”). Under these categories, we looked at BTC’s price changes on these days and compared the averages.

We used Welch’s Two-Sample t-test to find out whether BTC price changes are significantly different in these two different cases (above and below expectations). We used the R Studio program for statistical calculation. This statistical test helps to determine whether the means of two groups are significantly different. In particular, Welch’s t-test was preferred as it is a suitable test for groups with different variances. According to the results of the analysis, the difference between the price movements of BTC in these two cases was statistically significant. This suggests that BTC reacts to strong or weak signals from the US economy.

Conclusions BTC’s Reaction to Non-Farm Payrolls Data

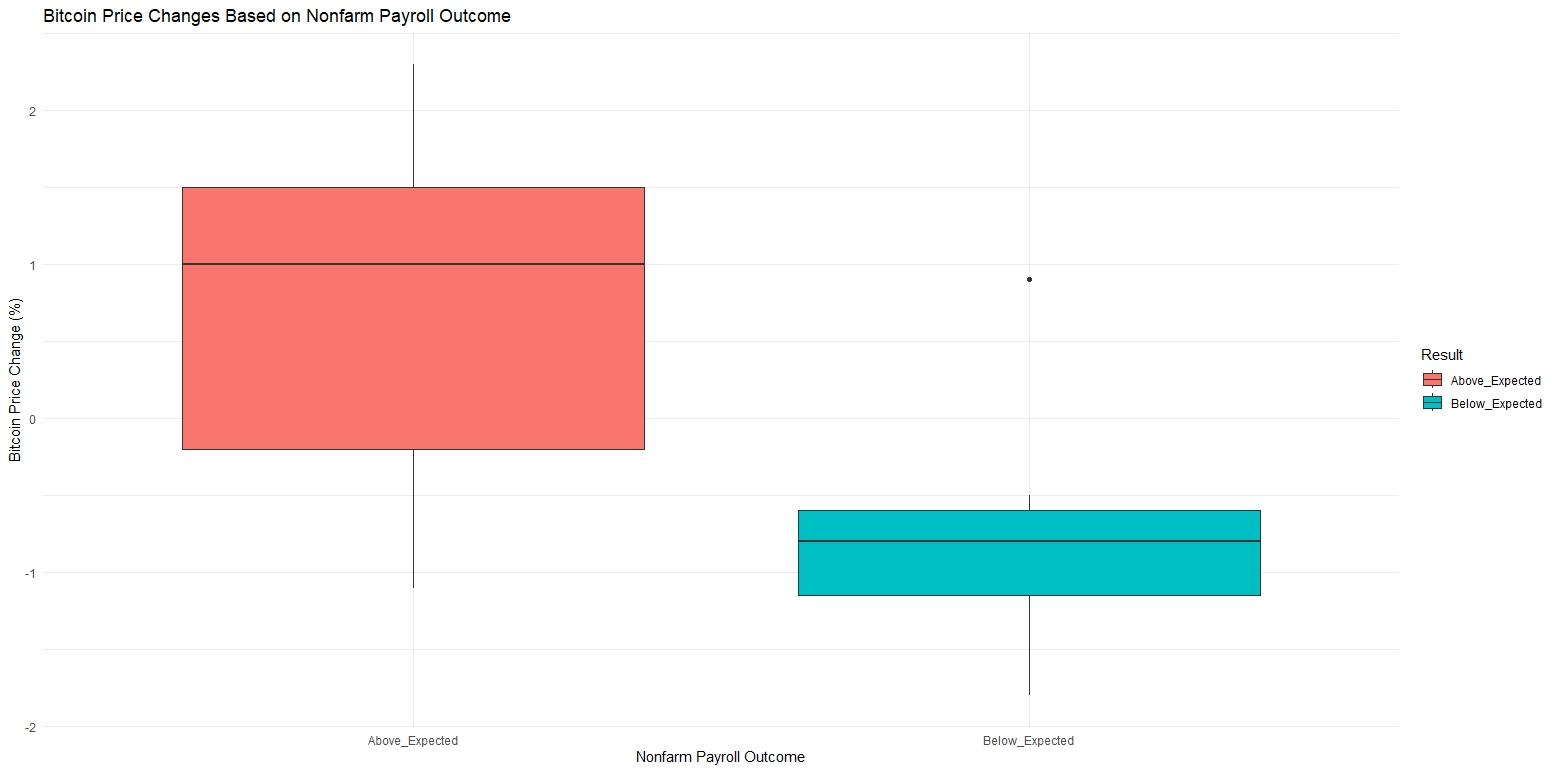

As can be seen in the box chart below, BTC price has been rising by an average of 0.74% on days when the non-farm payrolls data exceeded expectations. This shows that investors reacted positively to the strong employment data and risk appetite increased on these days. On the other hand, BTC’s average price change on the days below expectations is recorded as -0.74% in the negative direction. In this case, weak employment data suggests that investors tend to exit risky assets such as BTC.

Source: Darkex Research Department

A Closer Look at the Graph

The chart shows the distribution of BTC’s price changes on “Above Expected” and “Below Expected” days. We can clearly see that the price changes on the days that exceeded the expectation show a positive trend, while the days that fell below the expectation show a negative trend. There are also outliers that show larger price movements on some days, suggesting that BTC may overreact to employment data on some special days.

Evaluation and Recommendations

This analysis suggests that BTC’s sensitivity to US economic data has increased and that important data, especially non-farm payrolls, could have an impact on BTC price movements. For traders, this suggests that it may be worth keeping a close eye on US labor market data. It may be useful to keep in mind that BTC may show a positive price movement if the non-farm payrolls data exceeds expectations, while declines may be observed when it falls below expectations.

Leaving aside the results we obtained with statistical methods, when we evaluate the pulse and sensitivity of the markets, we can say that the possible impact of the data on the markets will be very difficult to predict before the critical presidential election. Let us remind you that our study takes into account the daily impact. The immediate reaction immediately after the release of the data may be different and other labor statistics should also be considered. We think that a higher-than-expected NFP data may have a negative impact on risky assets by increasing expectations that the FED will not act quickly on interest rate cuts, while in the opposite case, that is, figures that will create expectations of rapid interest rate cuts may create a basis for a moderate rise.

Especially for short-term traders and those interested in intraday trading, paying attention to this data, which is released on the first Friday of every month, can help them be prepared for sudden price changes that may occur in BTC.

Source:

Bureau of Labor Statistics. (n.d.). Employment Situation Summary. U.S. Department of Labor. Retrieved from: https://www.bls.gov/news.release/empsit.nr0.htm

CoinGecko. (n.d.). Historical Data for Bitcoin (BTC). Retrieved from: https://www.coingecko.com/

Investopedia. (n.d.). Nonfarm Payroll: Definition, What It Tells You, and When It’s Released. Retrieved from: https://www.investopedia.com/

Yahoo Finance. (n.d.). Bitcoin Historical Data. Retrieved from: https://finance.yahoo.com/

Wooldridge, J. M. (2015). Introductory Econometrics: A Modern Approach. Cengage Learning.

Taylor, J. B., & Weerapana, A. (2011). Principles of Economics. Cengage Learning.