Introduction

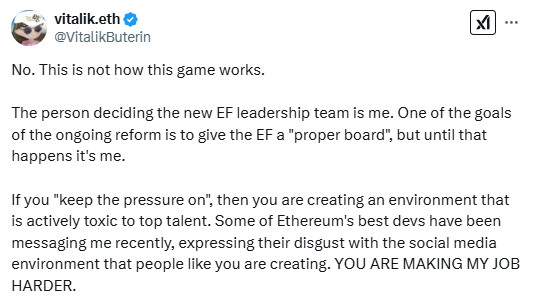

Recently, the Ethereum Foundation (EF) has come under criticism for its ETH sales to cover its operational expenses. While the community argued that the Foundation should develop long-term revenue models, it was also putting pressure on social media with demands for changes in the management of the foundation and the resignation of foundation director Aya Miyaguchi. Ethereum founder Vitalik Buterin responded to the pressure as follows:

Source: X.com

Following these developments between the community and the foundation, EF made an exciting announcement regarding its financial strategy. It opened a new chapter in its financial strategy by allocating ETH to DeFi lending protocols such as Aave and Compound.

This strategic move by the Ethereum Foundation raises many questions about the future of the ecosystem. As Darkex Research Team, we will examine the motivations behind this allocation, its impact on the market, and its possible implications for the future of Ethereum.

Allocations to Aave and Compound

The Ethereum Foundation has taken a significant step in strengthening its commitment to the decentralized finance (DeFi) ecosystem, not only increasing liquidity but also responding to pressure from the Ethereum community. While the community expects more efficient capital management for the long-term sustainability of the Foundation, this new move is seen as a change in strategy towards generating passive income.

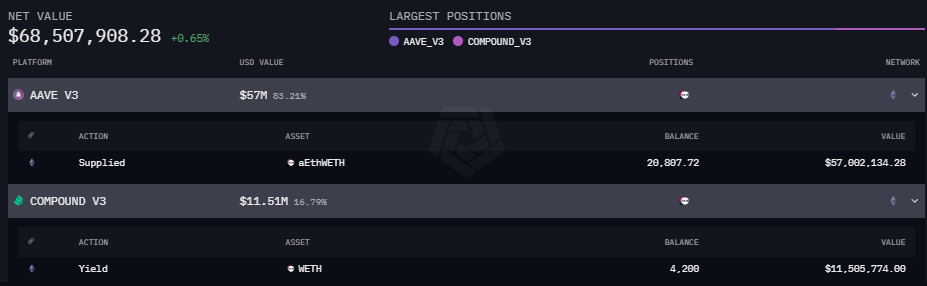

Looking at the distribution realized by the foundation, 4,200 ETH was directed to Compound and the remaining 20,807.72 ETH to Aave.

The Foundation has allocated a total of $68.35 million to the AAVE and Compound protocols. The majority of these funds are in the AAVE V3 platform, totaling $56.87 million, or 83.21% of total assets. In addition, $11.48 million has been allocated to the Compound V3 protocol, representing 16.79% of total assets.

Source: ARKHAM

There are several reasons why the Ethereum Foundation may have allocated more funding to AAVE than to Compound. In the table below, we have compared the AAVE and Compound projects under five main headings.

| CRITERIA | AAVE | COMPOUND |

|---|---|---|

| Borrowing Mechanism | Users can borrow depending on the collateral they deposit. It offers flash loan options such as permissionless borrowing. | Users are required to have a certain collateral factor. Higher margin rates can be requested. |

| Collateralization | Isolated borrowing pools allow for more controlled risk management. | Collateral is generally kept higher, and the system focuses on collateral efficiency. |

| Interest Rates | Users can choose between fixed and variable interest options. | Interest rates are determined algorithmically according to the supply-demand balance; there is no fixed interest rate option. |

| Risk Management | It seeks to minimize borrowing risk by offering security modules and liquidity mining incentives. | It applies stricter collateral rules but is more sensitive to volatility due to rapid changes in interest rates. |

| Liquidity Management | It provides a user-friendly borrowing experience, enabling more flexibility in the market. | It manages liquidity with tighter algorithms but can be more sensitive to sudden market fluctuations. |

Possible Impacts on the Ecosystem

Supporting the DeFi ecosystem is an important strategic step for Ethereum to consolidate its leadership in this space and make decentralized finance more reliable.

Vitalik Buterin has spoken in support of the Foundation’s move. The community has generally welcomed the change. However, some investors remain cautious about whether this is a temporary solution or the start of a larger transformation.

This allocation to DeFi protocols demonstrates that Ethereum continues to be the center of financial innovation, not just a smart contract platform. The platforms to which the Ethereum Foundation (EF) directs its funding are some of the cornerstones of DeFi and are among the most trusted players in the Ethereum-based ecosystem.

The move also offers a broader perspective for ETH holders and investors. The Ethereum Foundation’s passive monetization initiative could improve the long-term sustainability of the ecosystem and restore trust within the community. It could also encourage other actors in the DeFi market to consider similar strategies.

General Evaluation

In line with our report, we can read EF’s move as not only a financial choice, but also a strategic decision to shape the future of the ecosystem. By allocating its ETH holdings to protocols such as AAVE and Compound instead of selling them directly, the Foundation is able to generate approximately $1.5 million in passive income annually. In this way, it creates a sustainable source of income for itself and aims to strengthen the Ethereum ecosystem

We can think of it as a chess move. Instead of selling ETH for short-term cash, the Ethereum Foundation is playing a long-term game by funding DeFi protocols. This helps preserve the value of Ethereum in the market and helps the DeFi ecosystem grow. In particular, investments in large liquidity providers such as AAVE help Ethereum consolidate its financial infrastructure and consolidate its leadership in the decentralized finance world.

In addition, this step by the Ethereum Foundation is also important in terms of rebalancing its relationship with the community. Previously, ETH sales to cover operational expenses were frowned upon by many investors and developers. However, this new model has helped the Foundation show that it is not only a spender, but also an actor that adds value to the DeFi ecosystem. Thanks to the lending strategy, the Ethereum Foundation is responding to the community’s expectations while also ensuring its own long-term financial stability.

And of course, one of the most critical points is the implications of this step for the future of Ethereum. The allocation of a large amount of ETH to DeFi protocols reduces the pressure to sell in the market and expands ETH’s use cases. Ethereum is on its way to becoming not only a smart contract platform, but also the cornerstone of a financial system where large sums of capital can be safely invested.

Click for more Darkex Market Pulse articles.