Introduction

The US employment data released on Friday took the markets by surprise. Almost no one expected such a strong data set. This data also caused changes in market dynamics.

This week, we will be watching inflation data that may change or reinforce this pricing behavior.

What did the employment data tell us?

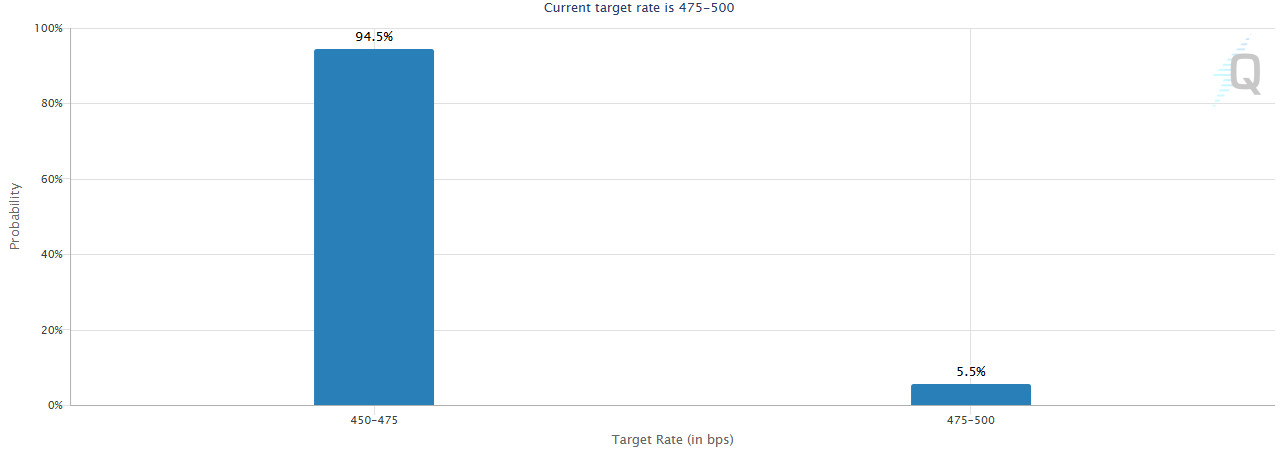

Source: CME Group

The data closely watched by the markets, such as the unemployment rate and the change in non-farm payrolls (NFP), were released for September on Friday. In the US, the unemployment rate was realized as 4.1%, below the expectation of 4.2%, while the NFP was realized as 254K, well above the forecasts of 147K.

The dollar, which depreciated after the US Federal Reserve (FED) started the interest rate cut cycle with a big (50 basis points) step, started to rise after the data in question. Strong expectations that the Federal Open Market Committee (FOMC) will cut the policy rate by 50 basis points once again at its meeting on November 7 have melted away and the expectation of a 25 basis point cut has come to the fore. At the time of writing, according to the CME FedWatch Tool, markets are pricing in a 95% chance of a 25 basis point cut and a 5% chance of leaving the rate unchanged, which was not even a topic of discussion before. In addition to the climb in the US dollar as a result of this situation, US 10-year bond yields have also risen and the rate has risen to 4% for the first time since August.

Source: Bloomberg

Looking at the market reaction after the employment data, it seems logical to conclude that the possibility of a recession in the US has weakened, which has increased risk appetite, but also reduced the likelihood that the Fed will continue on its course of rapid rate cuts.

Digital assets seem to have found an opportunity to gain value after these rallies. We can say that increased risk appetite is the reason behind this. So what will happen next? Will this perception continue? To answer such questions, we will first need to look at the US inflation data to be released on Thursday this week.

Can inflation data influence the direction?

In addition to the macro agenda, tensions in the Middle East and the upcoming US elections continue to be important topics for the markets. However, with the latest employment data, we have seen how much the markets pay attention to the economic developments in the US. Therefore, these data should be closely monitored.

Source: U.S Bureau of Labor Statistics, Trading Economics

Inflation in the world’s largest economy really declined after the FED’s efforts. In August, the annual Consumer Price Index (CPI) stood at 2.5%, the lowest level since February 2021. In September, it is estimated to have fallen to 2.3%. On a monthly basis, CPI is expected to come in at 0.1% (Previous: 0.2%) and core CPI, which excludes food and energy prices, is expected to come in at 0.2% (Previous: 0.3%).

We do not expect the figures, which are in line with expectations or not too far away, to make a major change in the game plan for the markets. It seems that inflation needs to be really out of the ordinary for markets to move to a pricing model outside the framework created by the recent employment data. In this context, we can foresee that very high inflation could have a negative impact on digital assets, while a data set that is well below expectations could have a positive impact. Under the assumption that the US can avoid a recession, low inflation data may mean that the FOMC may be bolder in cutting interest rates. This, in turn, could boost risk appetite with the combination of both falling rates and an economy that avoids recession. This seems to be the best scenario. However, as we have mentioned before, for this effect to take place, we need numbers that are really far from expectations. Therefore, we can say that the upcoming data, apart from the unusual anomaly, is likely to create a perception that digital assets will confirm their recent gains.

Conclusion

The strong US employment data released on Friday has reduced uncertainty in the markets, boosting risk appetite and shifting focus to the upcoming inflation data. These figures could significantly impact future market directions. If the inflation data comes in well below current expectations, it could lead the Fed to take bolder steps in cutting interest rates. This scenario could create a favorable environment for digital assets, especially if combined with low inflation and an economy that avoids recession. However, how the markets respond to these developments will depend on the outcomes of the upcoming inflation data. Thus, a critical week lies ahead for investors, which may lead to increased volatility in the markets.