About Mantra (Om)

Mantra DAO, which has stood out in the field of decentralized finance in recent years, turned its direction to RWA (Real World Assets) in 2024. OM token stood out as the asset at the center of this transformation. The project created a positive perception in the market with airdrop campaigns, staking opportunities and regulatory compliance messages. However, the project’s token distribution and structure raised questions among some investors early on.

Source: TradingView

Om Collapse Process

On April 12, the OM token plummeted by nearly 90% in a very short period of time, falling from $6 to 0.37 cents, quickly losing more than 90% of its $6 billion market capitalization. This unexpected drop caused surprise and concern for both individual and institutional investors. In the aftermath, speculative rumors about insider trading as the cause of the collapse were widely circulated in the market. The cause of the collapse still remains unclear. As Darkex Research department, we have summarized the reasons for this collapse under several headings with the data and information we have obtained.

-

Suspicion of Insider Information

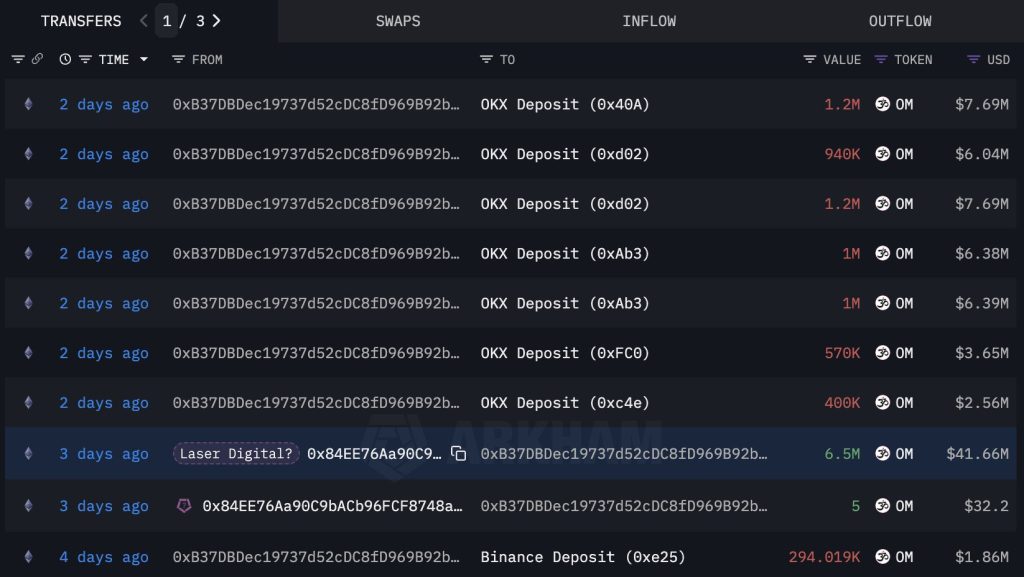

On-chain analysis prior to the collapse revealed some remarkable large transfers. These movements were interpreted by some market participants as insider trading. Among the prominent findings were the transfer of large amounts of OM tokens to multiple exchanges a few days before the collapse, the observation of token movements totaling tens of millions of dollars, and the transfers taking place in short time intervals.

Source: Arkham

Binance explained that the price movements started outside their platform, while the Mantra DAO team described it as “a result of forced liquidations” in the markets. However, market observers differed on whether this explanation alone was sufficient.

It is unclear whether these timings and transaction sizes were coincidental or coordinated in advance. But the closure of the Telegram community group has raised concerns among investors about a lack of communication and transparency issues, prompting the market to ask: “Could something have been planned?”

“We have determined that OM market movements were triggered by reckless forced closures of OM account holders initiated by centralized exchanges,” Mantra co-founder John Mullin said on April 13 via X. “The timing and depth of the collapse suggests that account positions were closed very abruptly without adequate warning or notice.

Source: X

In addition, the following three reasons are among the main components of the collapse.

- Short positions opened during periods of low trading volume, especially during Asian hours,

- Successive liquidation of highly leveraged futures transactions,

- Centralization of token distribution, i.e. a large number of tokens in a limited number of wallets,

- Team Interventions and Cremation Process

In the aftermath of the collapse, Mantra DAO founder JP Mullin said the team would take various steps amid mounting community pressure after he denied allegations of insider selling.

These included burning tokens from some wallets that were found to have violated the rules during the airdrop process and announcing buyback plans. These steps were seen by some investors as “an effort to repair the damage”. For others, however, these interventions were only temporary solutions that focused on the symptoms, not the root causes of the crisis.

Community Trust and Communication Issues

Following this process, the following issues came to the fore:

- Crisis communication did not meet expectations in terms of timing and content.

- The weakening of points of connection with the community, for example the closure of the Telegram group, has created a disconnect in the flow of information.

- The lack of transparency around wallet movements and decisions made has negatively impacted community trust.

- These points caused serious damage to the relationship of trust that had built up around the project.

General Evaluation

When we evaluate the process, the sharp decline in Mantra (OM) seems to be the result of a complex process of technical weaknesses, centralization issues, alleged insider movements and communication deficiencies.

While the team has taken several steps to remedy the situation, more comprehensive reforms may be needed to rebuild trust in the long term. In particular, transparency, fair governance and increased community representation are critical to the project’s sustainability and protection from similar crises. But time will tell if the current loss can be reversed. We would like to remind investors that incidents like this one are a reminder of how decisive factors such as token distribution, liquidity conditions and team transparency are for the health of projects.