Introduction

By 2025, as the stablecoin market continues to grow on a global scale, the United States has taken an important step towards establishing a regulatory framework in this area. Passed by the US Senate on June 17, 2025, the GENIUS Stablecoin Act stands out as a critical regulation for the supervision of digital assets, user security and integration with the financial system. This is the first comprehensive legislative initiative on the stablecoin market at the federal level and aims to set the basic building blocks of the sector, particularly reserve standards, licensing, supervision and transparency obligations. The report will present the drafting process of the GENIUS Stablecoin Act, its legislative scope, its potential impact on the sector, and a comparative assessment with global regulations.

The Main Purpose and Starting Point of the GENIUS Act

The GENIUS Stablecoin Act, introduced to the Senate Banking Committee in February 2025, was intended to provide a clear framework for stablecoins at the federal level. After the bill passed the Committee with bipartisan support (18 votes to 6) in March 2025, the filibuster was overcome with 66 votes to 32 in the Senate on May 21, 2025, and the bill was placed on the plenary agenda. In June 2025, the bill was adopted in the Senate by 68 votes to 30. These developments show that the bill went from being a mere committee initiative to receiving approval from one wing of Congress and moving to an advanced stage in the enactment process. The political debate on the bill was also significant. In particular, some senators warned of conflicts of interest as companies associated with former President Trump’s family planned to issue stablecoins. Democratic senators demanded the inclusion of provisions preventing elected officials and their families from becoming stablecoin issuers, but these proposals were not included in the final text. Supporters of the bill argued that regulation was necessary for consumer protection, financial stability and national security.

2025 Stablecoin Regulatory Outlook in the US

Initially, two important bills were on the agenda for stablecoin regulation in the US. The STABLE Act introduced in the House of Representatives and the GENIUS Act developed in the Senate. In April 2025, the House Financial Services Committee passed the STABLE Act by 32 votes to 17. However, this bill is moving along partisan lines with limited Democratic support. In contrast, the GENIUS Act, which passed in the Senate with bipartisan support, offers a more inclusive and technically detailed approach. There are some key differences between the two bills. While the GENIUS Act allows issuers of stablecoins under $10 billion to operate with only a state license, the House bill would subject all issuers to both state and federal supervision. In addition, while the House bill requires reserves to be covered by Federal Deposit Insurance Corporation (FDIC) insurance, the GENIUS Act adopts a more flexible reserve model. These differences may require compromise between the two bills in the final enactment process.

Main Provisions of the Bill Scope and Compatibility

Issuer Identification and Licensing

Issuer Description and Licensing The bill only allows the issuance of stablecoins backed by 100% reserves. These reserves are limited to highly liquid assets such as cash or short-term US Treasury bills. Issuers under $10 billion can operate with state licenses, while those above this limit will be subject to federal licensing or application for an exemption.

Legal Status and Transparency Obligations Stabilcoins are treated as non-securities and are covered by the Bank Secrecy Act (BSA). Issuers are obliged to comply with AML/KYC obligations and must publish monthly reserve reports and be subject to an annual independent audit for that above $50 billion market capitalization.

Prohibitions and Restrictions Algorithmic or unsecured stablecoin models are prohibited. Interest-bearing stablecoins and stablecoin issuance by large technology companies are subject to additional regulatory and capital requirements. The Treasury Department has the authority to ban foreign issuers that do not comply with US sanctions.

Impact on DeFi and Crypto Companies

With the passage of the GENIUS Act, the legal status of stablecoins used in decentralized finance (DeFi) protocols has become clearer. While the 100% reserve requirement has the potential to improve the quality of collateral in the DeFi ecosystem, at the same time, regulatory obligations can create significant operational costs for small and medium-sized DeFi projects. The prohibition of interest-bearing stablecoin models may force a reshaping of the yield strategies implemented on DeFi platforms. These regulations could lead to consolidation in DeFi and the dominance of institutional players.

Global Benchmark MiCA and Digital Dollar

The European Union’s Markets in Crypto Assets Regulation (MiCA) came into force in 2023, introducing reserve transparency, licensing requirements and supervisory obligations for crypto asset issuers. While MiCA’s focus is on consumer protection and financial stability within the European Union, the GENIUS Act provides a more geopolitically and technically based framework as part of the US global digital dollar strategy. MiCA’s more restrictive structure with fixed income regulations leads to the assessment that the GENIUS Act may be more flexible in terms of integration with DeFi.

Conclusion

The GENIUS Stablecoin Act is the most comprehensive stablecoin regulatory initiative to receive Senate approval by 2025. This bill, which aims to cement the US’s global leadership in digital assets, is now one step closer to the President’s signature. If passed by the House, it would establish a federal stablecoin framework for the first time in the US and bring institutional clarity to the crypto asset market. The passage of the bill also provides a new framework of trust in terms of market stability, especially with the reserve structure, transparency obligations and the exclusion of algorithmic models.

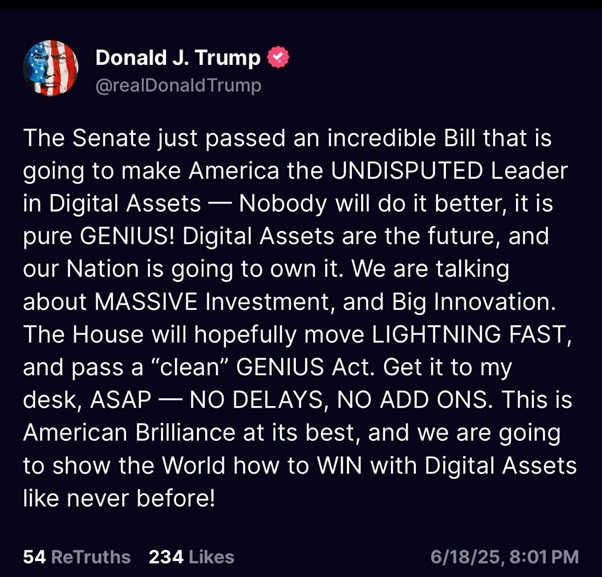

It is noteworthy that this development is not only considered as a technical regulation, but also as a strategic step that is embraced at the political level. On June 18, 2025, former President Donald Trump, in a social media statement following the Senate vote, stated that the GENIUS Act would make America the “undisputed leader” in digital assets and urged the House of Representatives to approve the bill “without delay and without riders”. This statement can be read as an indication that digital assets have become not only a financial but also a political competition.

If the GENIUS Act becomes law, a new era will begin for both US-based Web3 initiatives and the global stablecoin market. The US taking a clear position in the global regulatory race that started with the European Union’s MiCA regulation may increase the geopolitical effects on digital assets in the coming period.

Disclaimer

This content has been prepared by the Darkex Research Team for informational purposes only. It does not constitute investment advice. All risks and responsibilities arising from your investment decisions are solely your own.