Source: CME Group

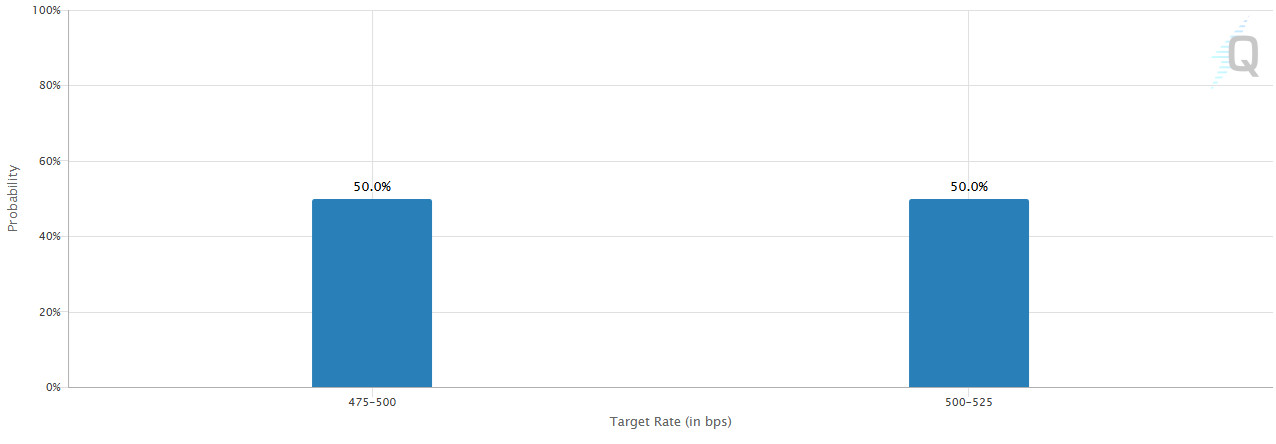

This suggests that the markets are not sure how big a step the Fed will take to start the rate cut cycle. Accordingly, we can say that this issue, which has become a focal point, may cause deep turmoil in the markets at 18:00 (UTC) on Wednesday evening.

Considering the recent statements of FOMC officials and macro indicators, we see a 25 bps rate cut as more likely. In addition, we can say that one of the factors supporting this view is that the FED will include the reaction of the markets to the size of the rate cut in its calculations. We can explain this situation as follows.

In recent months (especially in August and early September) we have seen markets driven by concerns about a recession and also by euphoria over expectations of the size of the Fed’s rate cuts. These two different pricing behaviors operate on different emotions. Recession fears cause bad macro data to negatively impact markets. However, in the absence of recession fears, bad economic data can support the view that the Fed will cut rates faster, which can have a positive impact on markets (Bad data-good market and Bad Data-Bad market models).

The FED’s 50 basis point cut has the potential to have the opposite effect on the markets. In other words, a 50 basis point cut could reinforce the idea that things are really bad in the economy and that’s why the FED pressed the red button. We think that FOMC officials are aware of this situation. Therefore, we can assume that a 25 basis point rate cut by the FED is a more likely scenario in terms of both data, reality and market psychology.

But let’s not forget that markets are full of surprises and it is good to be prepared for every situation.

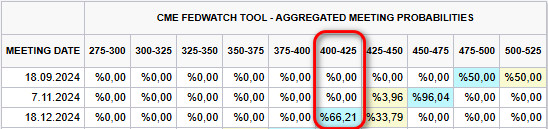

Remaining Meetings of the Year

While we will see the rate cut, the markets will also focus on the FOMC’s expectations on macro data and its thoughts on the level of interest rates going forward, which will be announced with this decision. These figures will also be available in the documents that will be published along with the rate decision.

Source: CME Group