Breakdowns

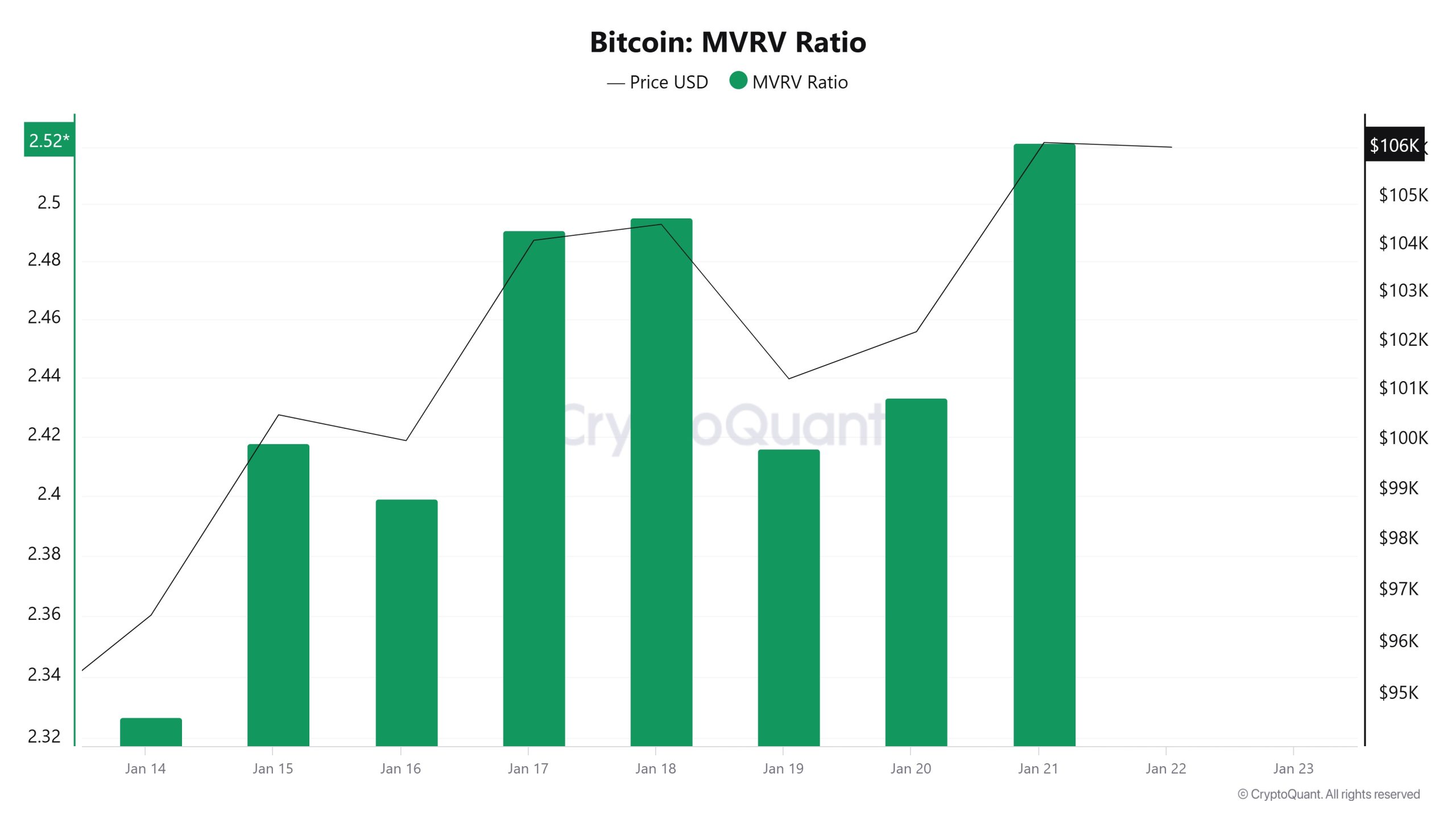

MRVR

On Janeiro 15, the Bitcoin price was 100,503 while the MVRV Ratio was 2.41. As of Janeiro 21, the Bitcoin price was at 106,164, while the MVRV Ratio was 2.52. Compared to last week, Bitcoin price increased by 5.63% and MVRV Ratio increased by 4.56%.

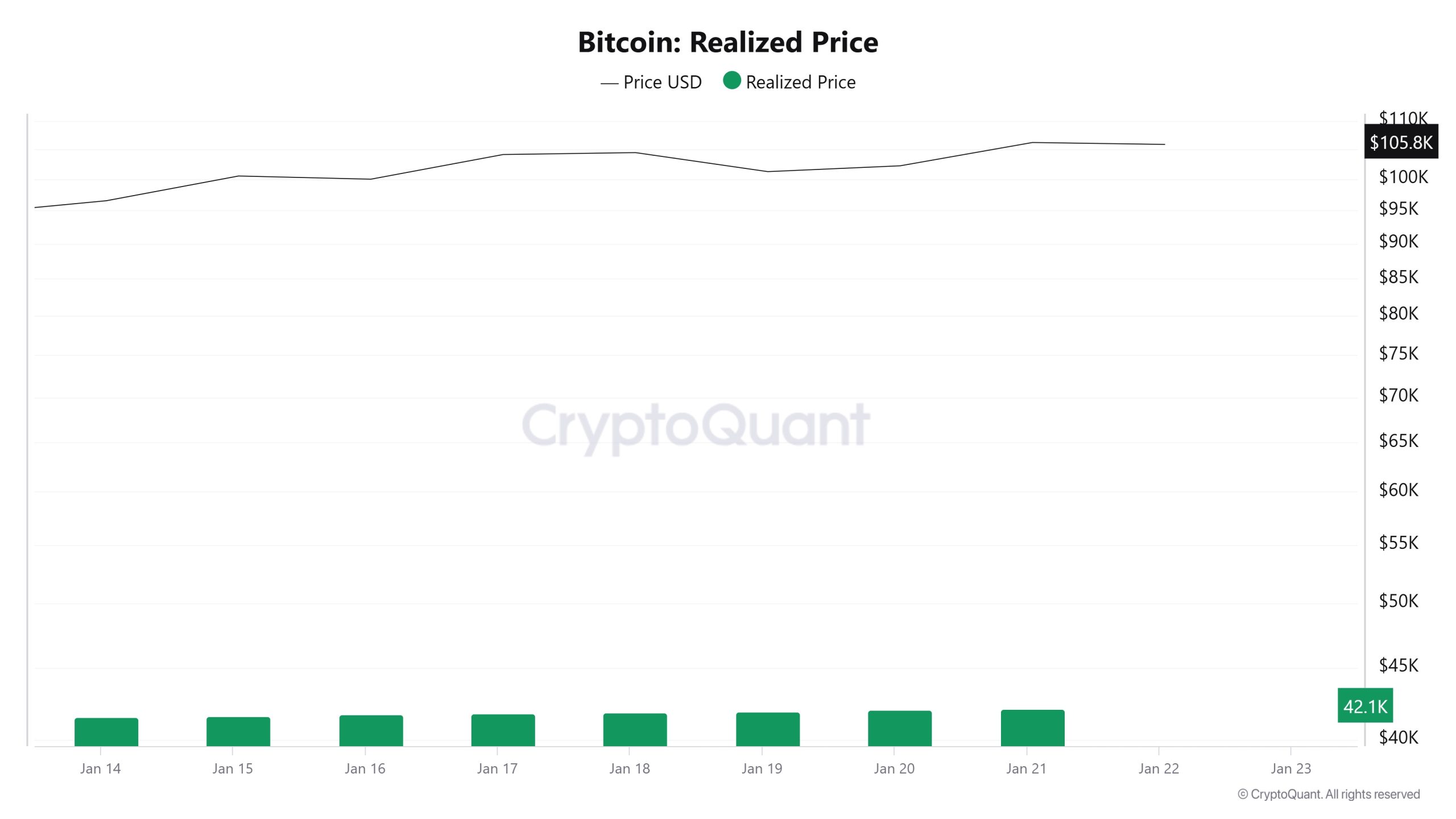

Realized Price

On Janeiro 15, the Bitcoin price was 100,503 while the Realized Price was 41,571. As of Janeiro 21, Bitcoin price rose to 106,164 while Realized Price increased to 42,101. Compared to last week, Bitcoin price increased by 5.63% and Realized Price increased by 1.27

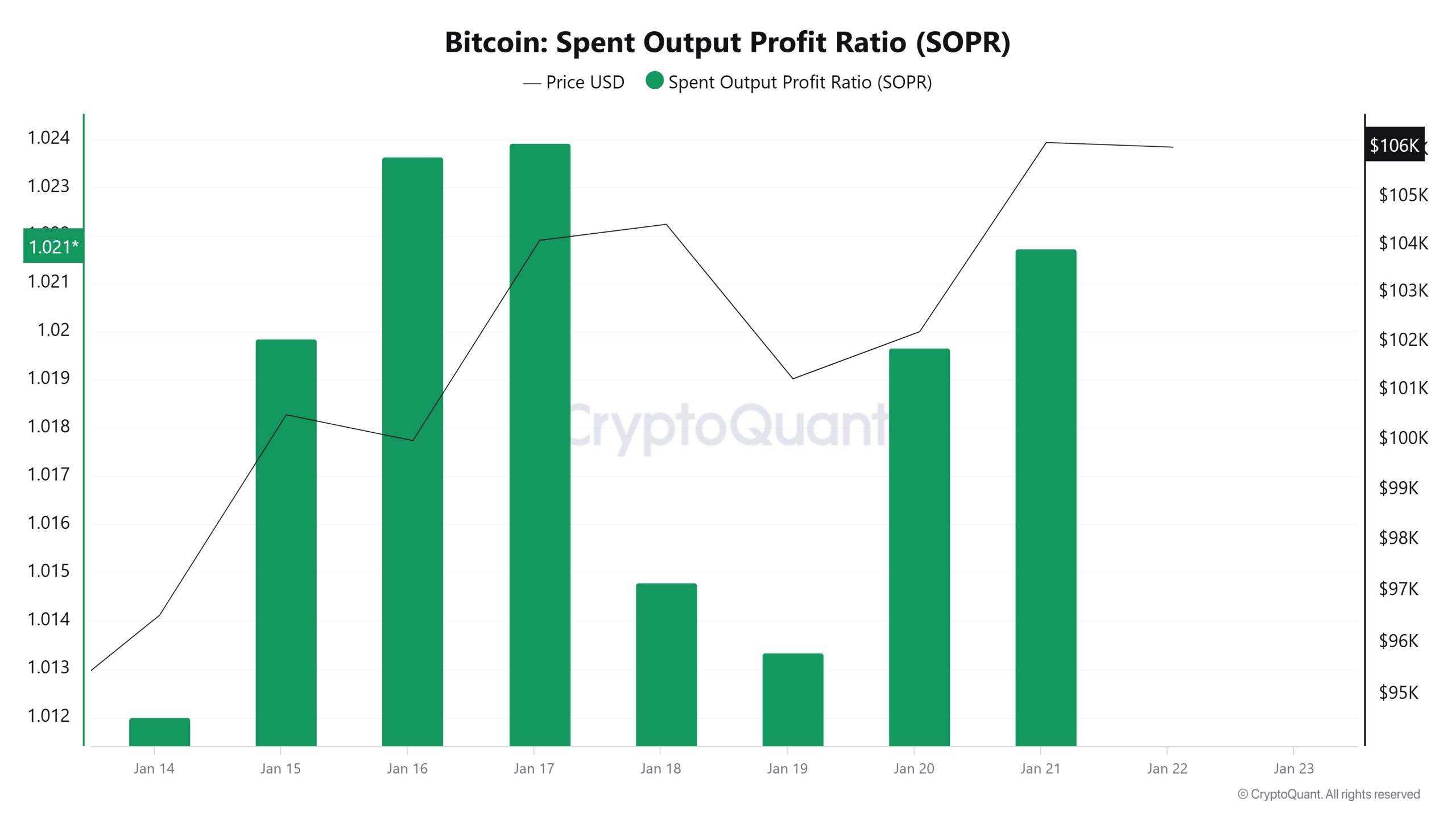

Spent Output Profit Ratio (SOPR)

On Janeiro 15, the Bitcoin price was at 100,503 while the SOPR metric was 1.01. As of Janeiro 21, the Bitcoin price was at 106,164 while the SOPR metric was at 1.02. Compared to last week, the Bitcoin price has increased by 5.63% and the SOPR metric has increased by about 1%.

Derivatives

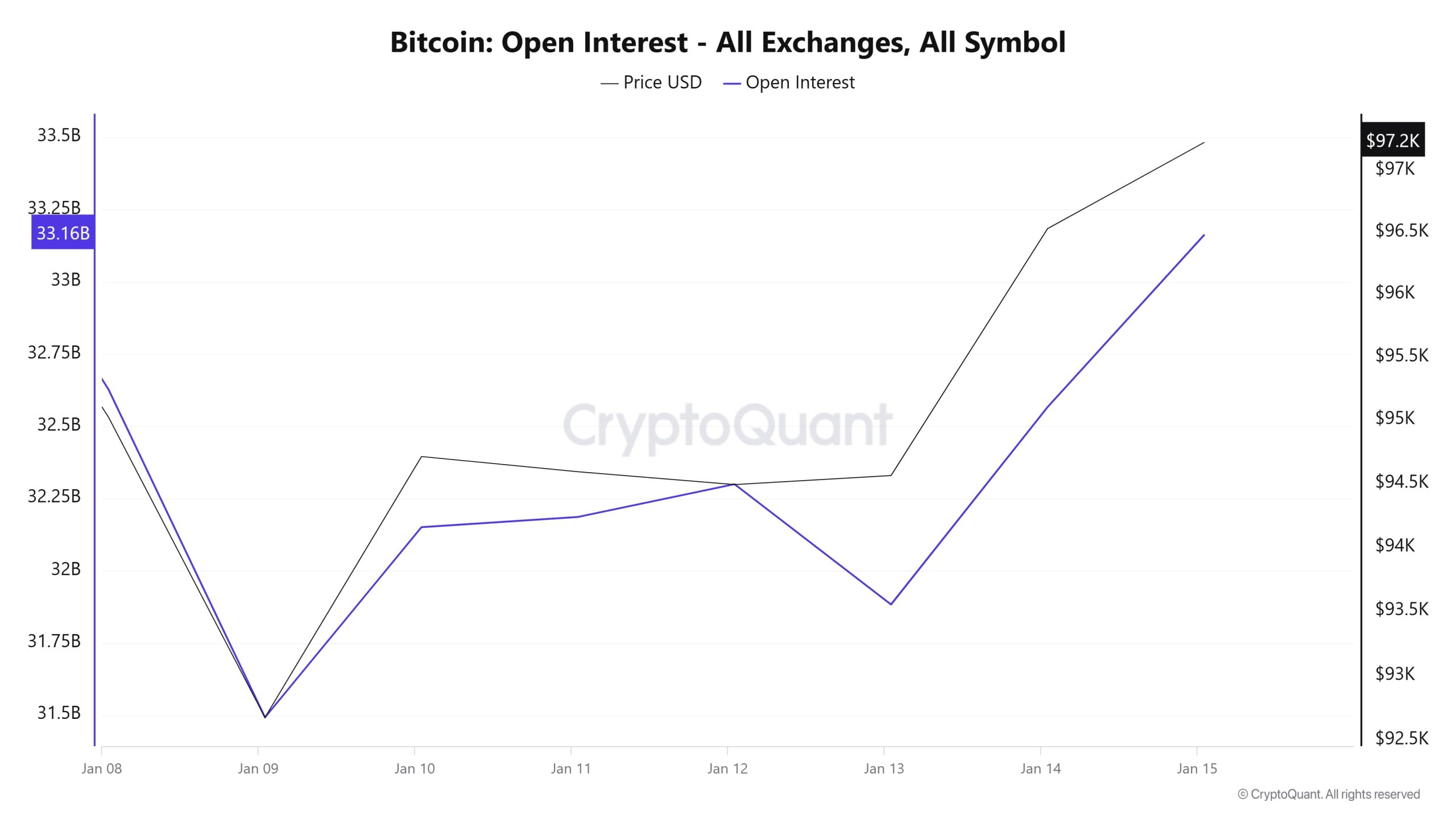

Open Interest

This week, Open Interest and price seem to be moving in line with the positive correlation. Open Interest has been on a steady uptrend, indicating increased investor interest in the futures market and more capital flowing into the market. The accompanying rise in the price indicates that the bullish sentiment is strong in the current market and that investors’ market expectations are shaped in a positive direction.

The sharp declines on Janeiro 9th and Janeiro 13th, which occurred simultaneously in both price and open interest, indicate that positions in the market were quickly closed. Such declines are usually seen during periods when investors engage in risk-reduction strategies due to short-term uncertainty. However, since Janeiro 14th, there has been a strong increase in price and open interest again. This rise clearly shows that new positions have entered the market and the risk appetite of participants has increased again. Especially the parallel increase in price and open interest is an important indicator for the sustainability of the bullish momentum.

However, the rapid rise in open interest also suggests that the market has become over-leveraged, a risk that could lead to large liquidations if price movements reverse. While rising open interest usually indicates the strengthening of a trend, if the price flattens or declines, it could be a sign of market tightness or the start of profit realizations. Such a scenario could lead to large volatility, especially when leverage is high.

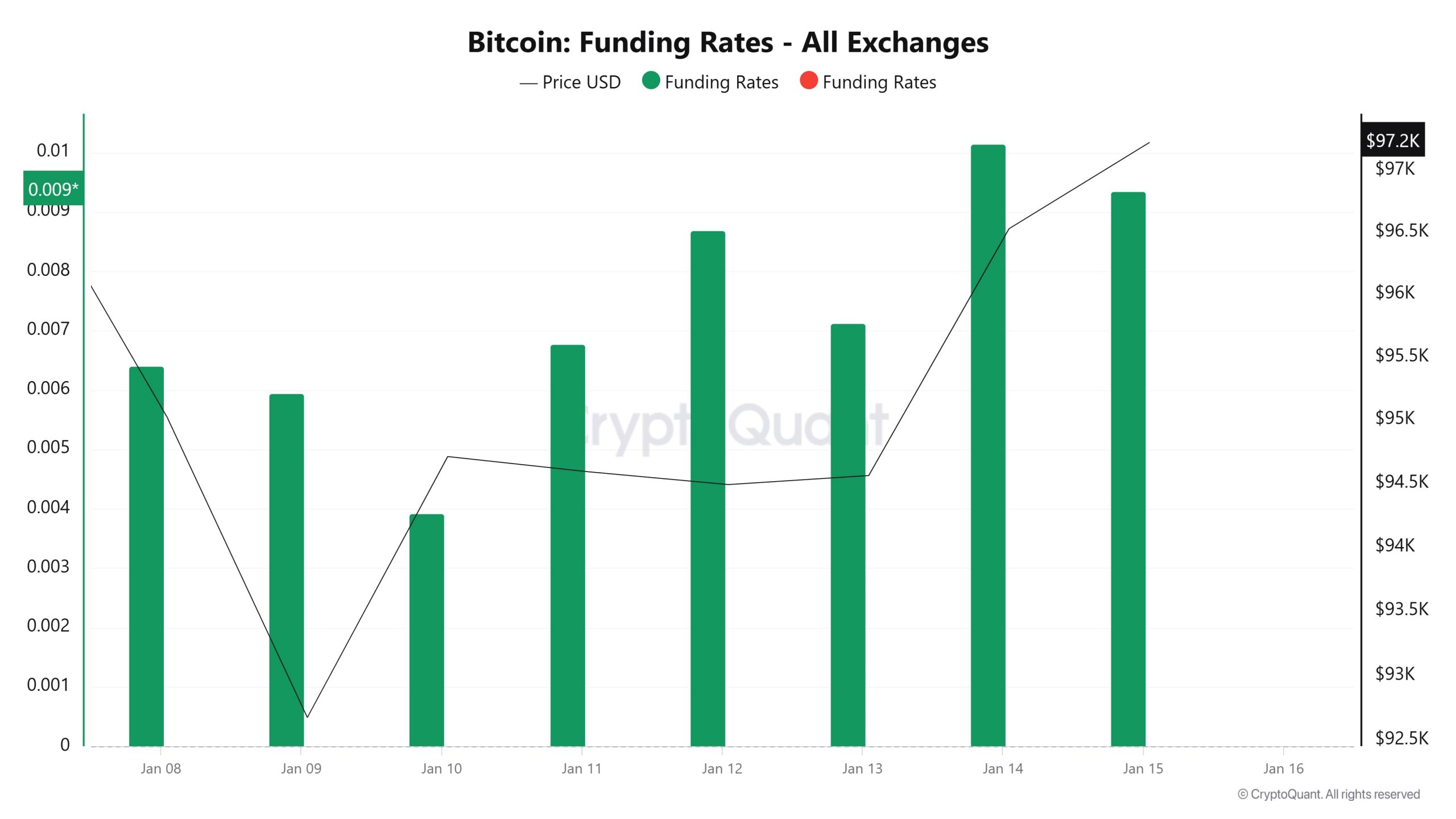

Funding Rate

Bitcoin funding rates continue to be positive, and the price is on an uptrend. Positive funding rates indicate that the market is largely made up of long positions and investors have strong bullish expectations. The decline around Janeiro 9 suggests that there was a pullback in both the funding rates and the price, suggesting that investors closed positions or short positions gained weight. However, the rise in the funding rate after Janeiro 14th suggests that bullish expectations are again strengthening in the market. However, if the funding rate remains at high levels for a prolonged period of time, the market could become over-leveraged and risk a possible correction

Long & Short Liquidations

After a very active week similar to last week, Bitcoin continues to price above the $96,000 level again. With the deep declines on Janeiro 8, 9 and 13, high amounts of liquidations in both long and short positions stand out. When the Liquidation heatmap is analyzed, the liquidation block formed up to 99,000 levels stands out. Although rises up to these levels seem possible, the lack of sufficient spot support and low volume data may indicate that Bitcoin is at a critical decision stage that requires caution.

| Date | Long Amount (Million $) | Short Amount (Million $) |

|---|---|---|

| 08 Janeiro | 26.44 | 17.08 |

| Janeiro 09 | 21.53 | 5.48 |

| Janeiro 10 | 7.21 | 23.29 |

| Janeiro 11 | 1.74 | 2.01 |

| Janeiro 12 | 12.31 | 1.16 |

| Janeiro 13 | 22.69 | 23.06 |

| Janeiro 14 | 6.31 | 10.84 |

| Total | 98.23 | 82.92 |

Supply Distribution

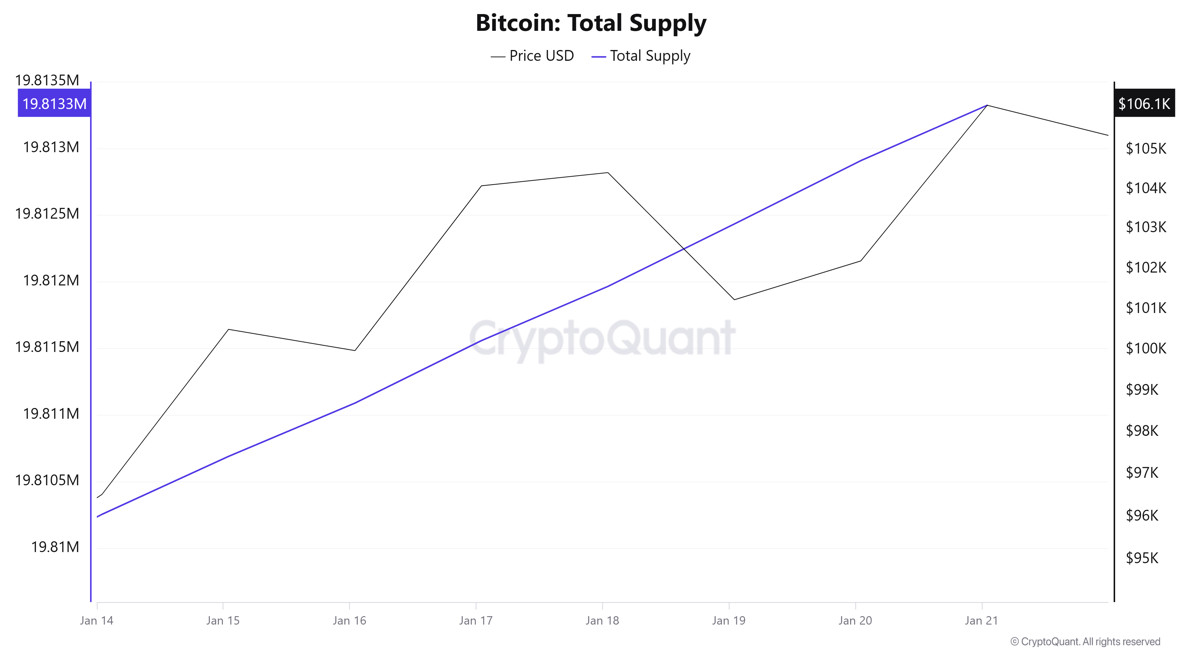

Total Supply: It reached 19,813,324 units, up about 0.0155% from last week.

New Supply: The amount of BTC produced this week was 3,069.

Velocity: Continued decline compared to the previous week.

| Wallet Category | 14.01.2025 | 21.01.2025 | Change (%) |

|---|---|---|---|

| < 0.1 BTC | 1.590% | 1.590% | - |

| 0.1 – 1 BTC | 5.417% | 5.409% | -0.148% |

| 1 – 100 BTC | 32.320% | 32.266% | -0.167% |

| 100 – 1k BTC | 22.569% | 22.646% | 0.341% |

| 1k – 100k BTC | 34.835% | 34.818% | -0.049% |

| > 100k BTC | 3.270% | 3.270% | - |

When we look at the supply distribution, the highest change was seen in the “100 – 1k BTC” category with an increase of 0.341%. In addition, there were decreases of 0.148% and 0.167% in the “0.1 – 1 BTC” and “1 – 100 BTC” categories, respectively. A small decrease of 0.049% was recorded in the “1k – 100k BTC” category, while there was no change in the “< 0.1 BTC” and “> 100k BTC” categories.

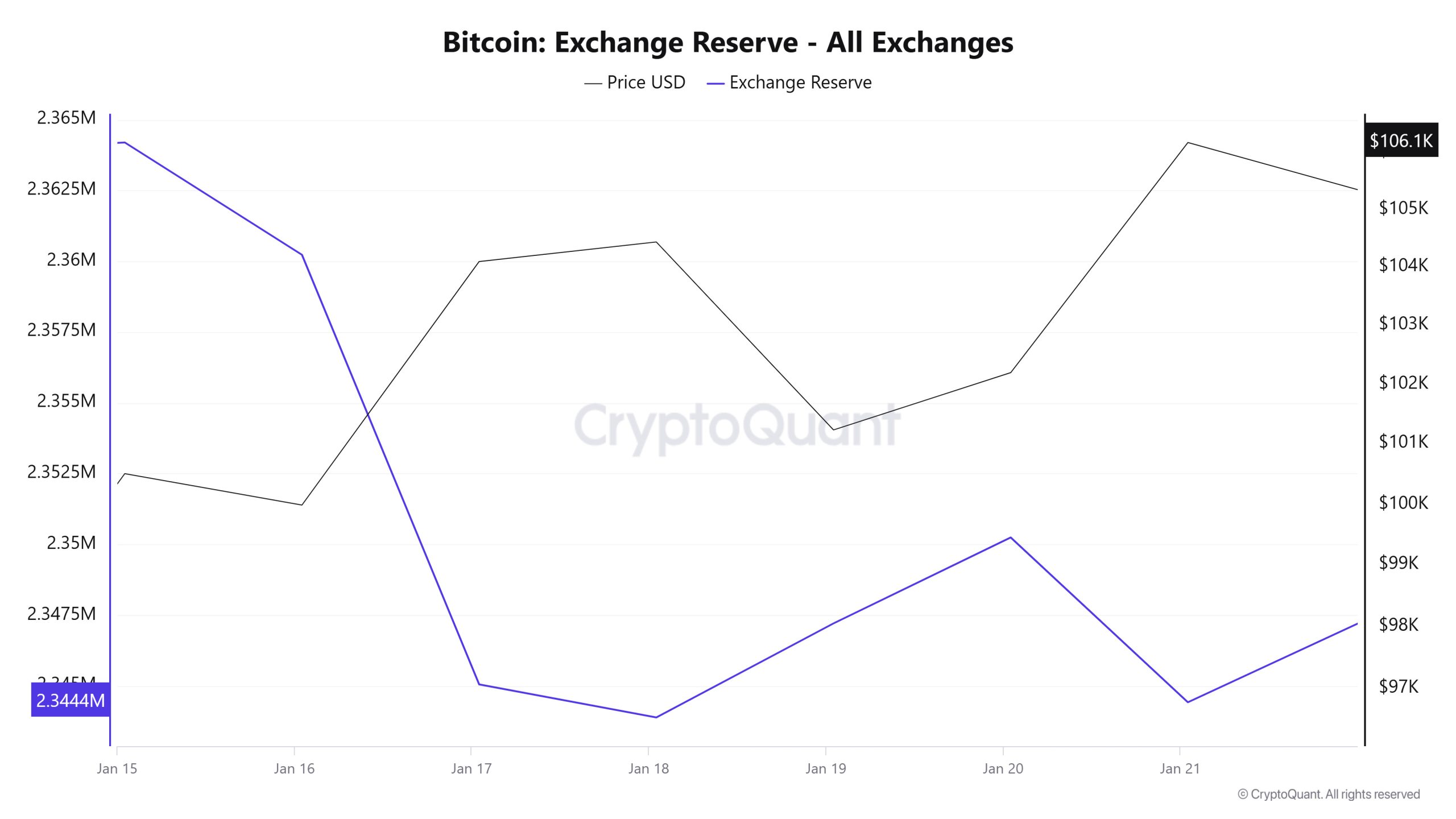

Exchange Reserve

Between Janeiro 15-21, 2025, Bitcoin reserves on exchanges decreased from 2,363,886 BTC to 2,344,417 BTC. In total, there was a net outflow of 19,469 BTC during this period and exchanges’ Bitcoin reserves decreased by 0.82%. The most notable movements during this period occurred on Janeiro 17, 2025. On this date, exchanges recorded a net outflow of 15,178 BTC and a significant drop in reserves. However, on Janeiro 19 and Janeiro 20, net inflows of 3,323 BTC and 3,036 BTC, respectively, were noteworthy. The price of Bitcoin increased by approximately 5.6% during this period. Bitcoin, which closed at $100,504 on Janeiro 15, 2025, closed at $106,165 on Janeiro 21, 2025.

Between Janeiro 15-21, 2025, Bitcoin reserves on exchanges decreased from 2,363,886 BTC to 2,344,417 BTC. In total, there was a net outflow of 19,469 BTC during this period and exchanges’ Bitcoin reserves decreased by 0.82%. The most notable movements during this period occurred on Janeiro 17, 2025. On this date, exchanges recorded a net outflow of 15,178 BTC and a significant drop in reserves. However, on Janeiro 19 and Janeiro 20, net inflows of 3,323 BTC and 3,036 BTC, respectively, were noteworthy. The price of Bitcoin increased by approximately 5.6% during this period. Bitcoin, which closed at $100,504 on Janeiro 15, 2025, closed at $106,165 on Janeiro 21, 2025.

| Date | 15-Jan | 16-Jan | 17-Jan | 18-Jan | 19-Jan | 20-Jan | 21-Jan |

|---|---|---|---|---|---|---|---|

| Exchange Inflow | 33,081 | 46,294 | 51,280 | 20,095 | 26,701 | 43,643 | 50,811 |

| Exchange Outflow | 32,772 | 50,262 | 66,457 | 21,263 | 23,378 | 40,608 | 56,634 |

| Exchange Netflow | 309 | -3,968 | -15,178 | -1,168 | 3,323 | 3,036 | -5,823 |

| Exchange Reserve | 2,364,194 | 2,360,227 | 2,345,049 | 2,343,881 | 2,347,204 | 2,350,240 | 2,344,417 |

| BTC Price* | 100,504 | 99,982 | 104,095 | 104,431 | 101,233 | 102,198 | 106,165 |

Fees and Revenues

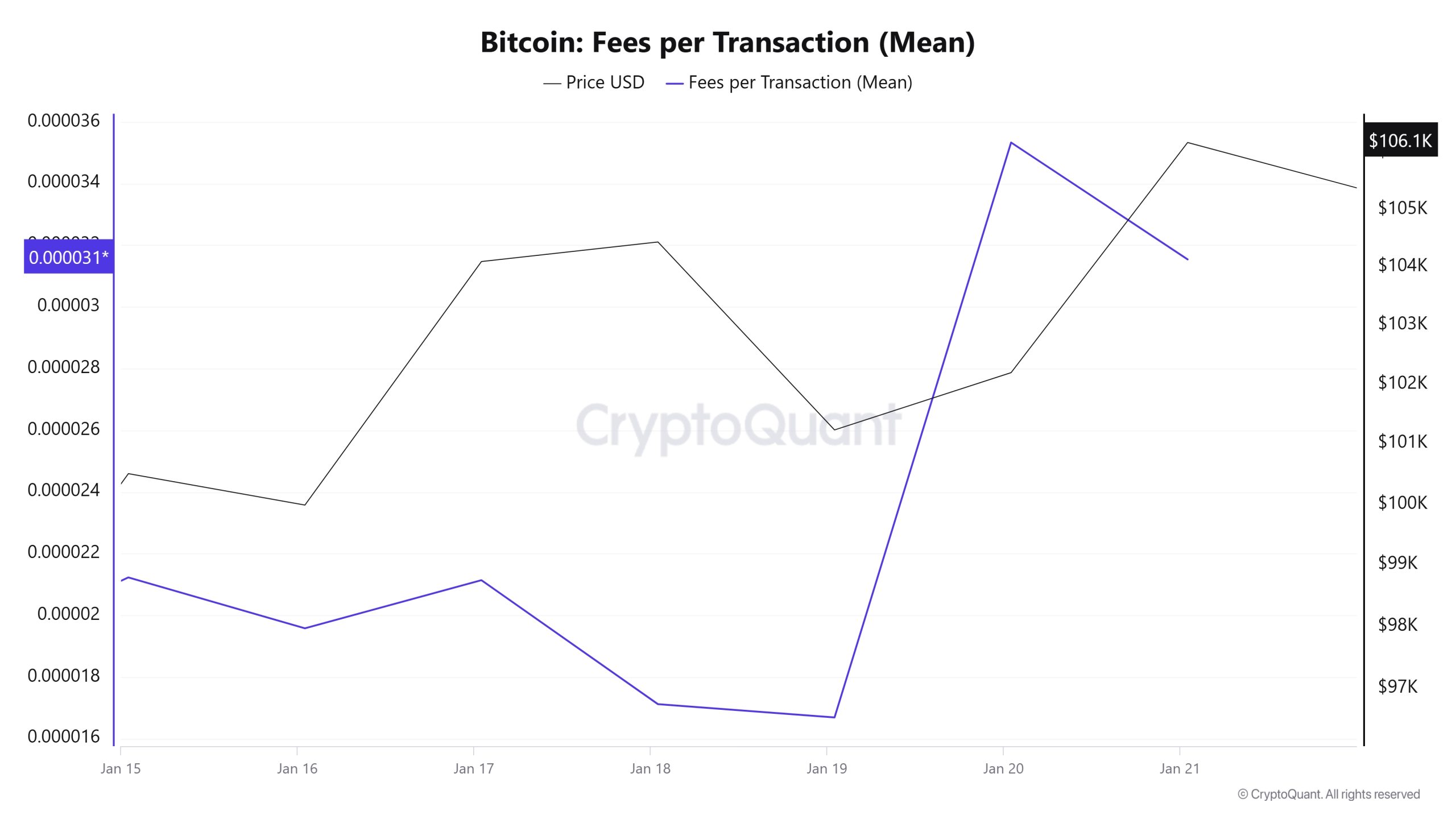

Analysing the Bitcoin Fees per Transaction (Mean) data between Janeiro 15-21, it was observed that this value was at 0.00002123 on Janeiro 15, the first day of the week. Until Janeiro 19, Bitcoin Fees per Transaction (Mean), which followed a parallel course with Bitcoin price, reached its lowest level of the week at 0.00001669 on Janeiro 19. Then, a volatile course was observed until the presidential oath of office speech of Donald Trump, who was re-elected as the President of the US on Janeiro 20. In this context, it rose to 0.00003533 on Janeiro 20, reaching the highest value of the week.

Analysing the Bitcoin Fees per Transaction (Mean) data between Janeiro 15-21, it was observed that this value was at 0.00002123 on Janeiro 15, the first day of the week. Until Janeiro 19, Bitcoin Fees per Transaction (Mean), which followed a parallel course with Bitcoin price, reached its lowest level of the week at 0.00001669 on Janeiro 19. Then, a volatile course was observed until the presidential oath of office speech of Donald Trump, who was re-elected as the President of the US on Janeiro 20. In this context, it rose to 0.00003533 on Janeiro 20, reaching the highest value of the week.

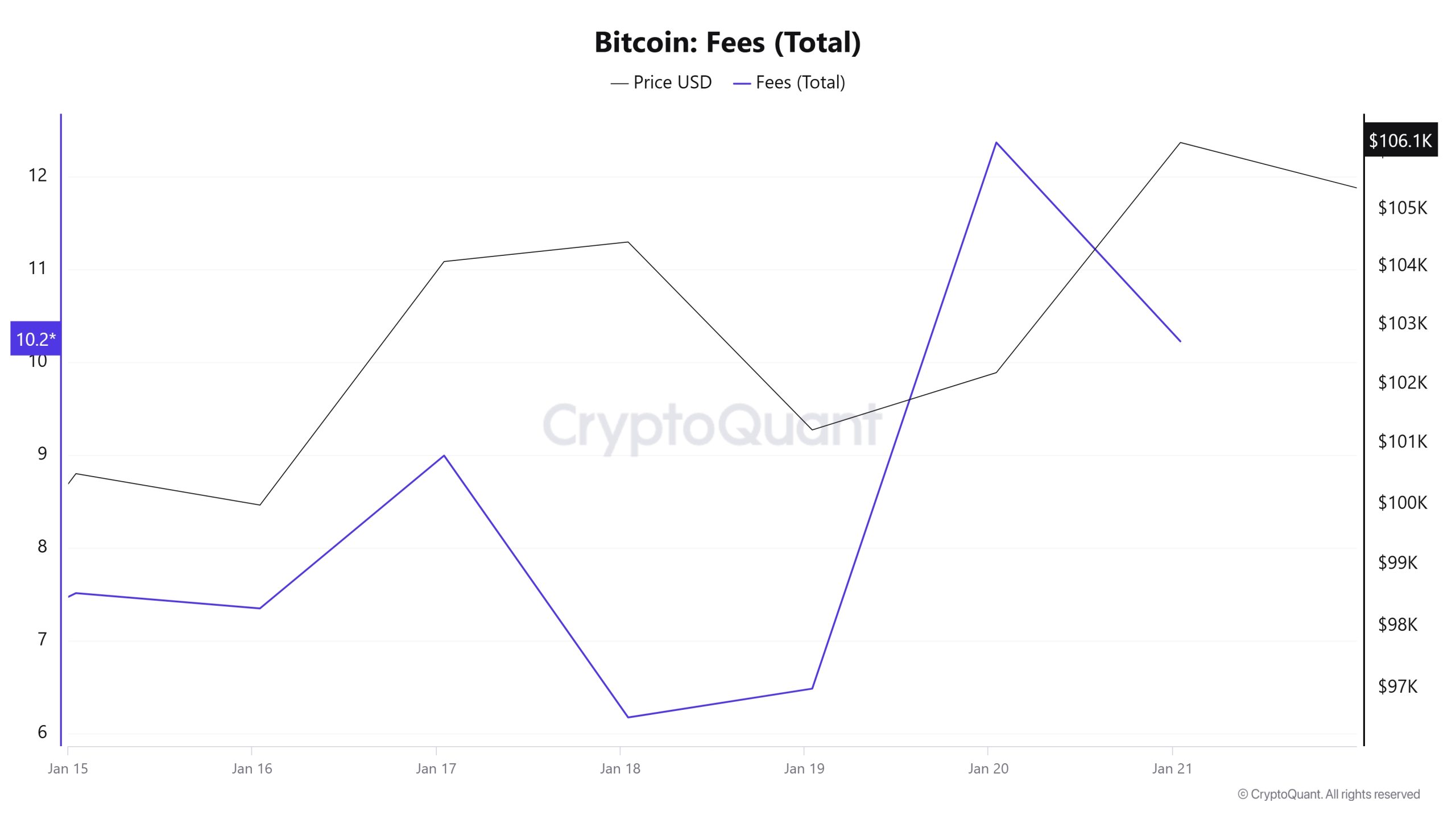

On Janeiro 21, the last day of the weekly period, Fees per Transaction (Mean) value started to decline again and fell to 0.00003154 with the relatively calm course and decreasing volatility observed in Bitcoin price. Similarly, when the Bitcoin Fees (Total) data between Janeiro 15-21 are analyzed, it is observed that the Bitcoin Fees (Total) value, which was at 7.51249449 on Janeiro 15, the first day of the week, showed a gradual decline until Janeiro 18 and reached the lowest level of the week with a value of 6.1723701.

Similarly, when the Bitcoin Fees (Total) data between Janeiro 15-21 are analyzed, it is observed that the Bitcoin Fees (Total) value, which was at 7.51249449 on Janeiro 15, the first day of the week, showed a gradual decline until Janeiro 18 and reached the lowest level of the week with a value of 6.1723701.

However, as of Janeiro 19, the Bitcoin Fees (Total) value also started to rise with the increasing volatility in the Bitcoin price. In this context, on Janeiro 20, the value reached 12,37123961 and was recorded as the highest value of the week.

Miner Flows

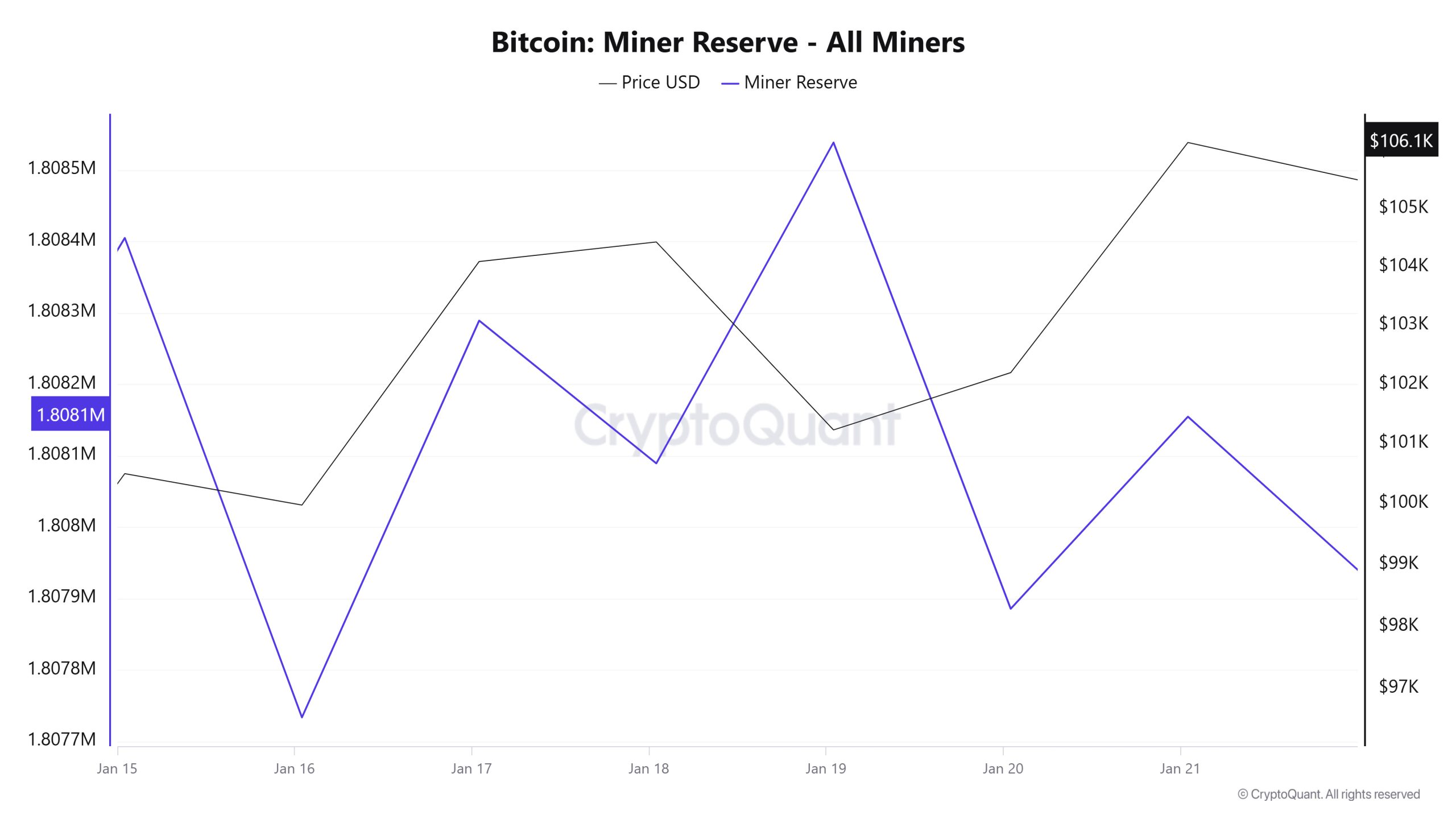

As can be seen in the Miner Reserve table, the number of Bitcoins in miners’ wallets decreased this week. Although the week started with a positive correlation between Miner Reserve and Bitcoin price, this correlation turned negative towards the end of the week.

Miner Inflow, Outflow and NetFlow

Between Janeiro 15 and Janeiro 21, 59,863 Bitcoins exited miners’ wallets, and 60,025 Bitcoins entered miners’ wallets between the same dates. The Miner NetFlow for this week was 162 Bitcoin. Meanwhile, while the Bitcoin price was $100,503 on Janeiro 15, it was observed as $106,164 on Janeiro 21.

During the week, the net flow (Miner NetFlow) was generally positive as Bitcoin inflow into miner wallets (Miner Inflow) was higher than Bitcoin outflow from miner wallets (Miner Outflow).

| Date | Janeiro 15 | Janeiro 16 | Janeiro 17 | Janeiro 18 | Janeiro 19 | Janeiro 20 | Janeiro 21 |

|---|---|---|---|---|---|---|---|

| Miner Inflow | 6,702.90 | 6,677.28 | 9,374.66 | 6,364.79 | 9,187.06 | 11,957.79 | 9,760.73 |

| Miner Outflow | 6,290.94 | 7,348.77 | 8,818.98 | 6,564.68 | 8,737.76 | 12,610.73 | 9,491.72 |

| Miner NetFlow | 411.96 | -671.49 | 555.68 | -199.89 | 449.30 | -652.94 | 269.01 |

Transaction

Transaction Count

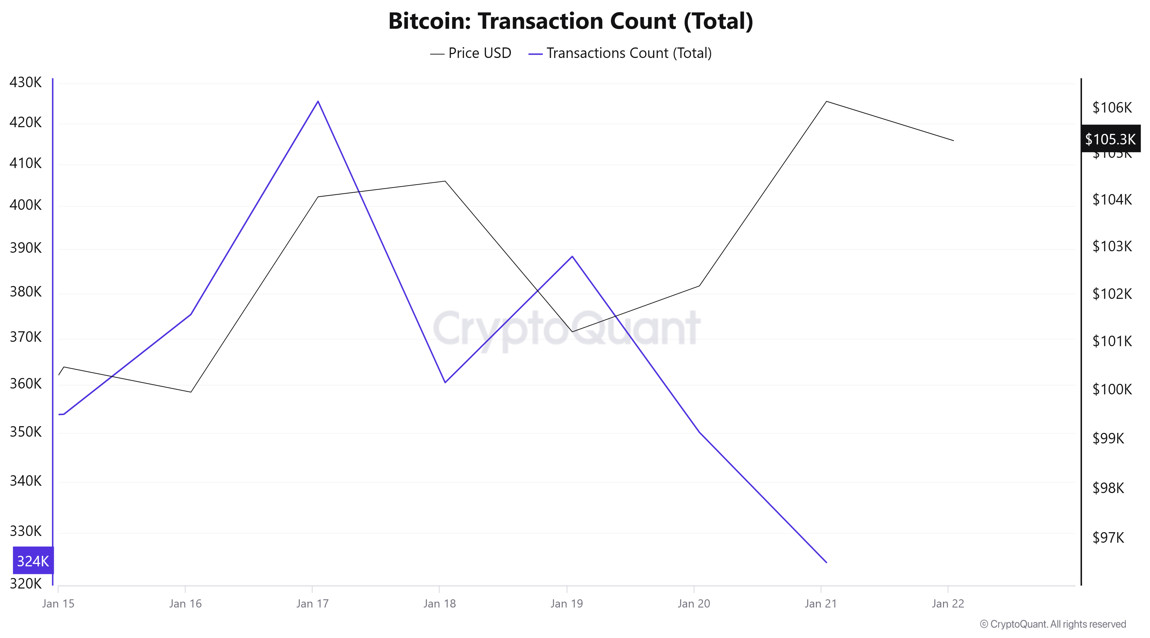

Transaction Count

During the week of Janeiro 8-14, a total of 3,196,381 transactions took place, while during the week of Janeiro 15-21, the number of transactions decreased to 2,578,010, a decrease of approximately 19.35% compared to the previous week. Remarkably, the lowest volume of transactions on the network occurred on Segunda-feira and Terça-feira, Janeiro 20-21. This marks a departure from the trading declines that are normally characteristic of weekends. The highest number of transactions for the week was 425,511 on Janeiro 17. While there was a positive correlation between the number of trades and the price until that date, the relationship reversed for the rest of the week, with an inverse correlation between the price and the number of trades.

Tokens Transferred

In the week of Janeiro 8-14, the amount of Bitcoin transferred was 4,760,329, while in the week of Janeiro 15-21, this amount increased by 26.16% to 6,005,751. The lowest levels in the amount of Bitcoin transferred were generally observed on Sábado and Domingo, as in previous periods. On Janeiro 16, 18 and 21, there was an inverse relationship between the amount of Bitcoin transferred and the price, while on Janeiro 15, 17, 19 and 20, the relationship was directly proportional.

Whale Activities

Cryptocurrency analytics firm Alphractal found that whales – large-scale traders – play an important role in shaping price trends, while individual traders provide liquidity but often lag behind the decision-making process. According to Alphractal, whales on exchanges are increasingly favoring short positions and closing long positions. In contrast, individual traders, defined as those with positions ranging from $1,000 to $10,000, have been steadily increasing their long positions.

Cryptocurrency analytics firm Alphractal found that whales – large-scale traders – play an important role in shaping price trends, while individual traders provide liquidity but often lag behind the decision-making process. According to Alphractal, whales on exchanges are increasingly favoring short positions and closing long positions. In contrast, individual traders, defined as those with positions ranging from $1,000 to $10,000, have been steadily increasing their long positions.

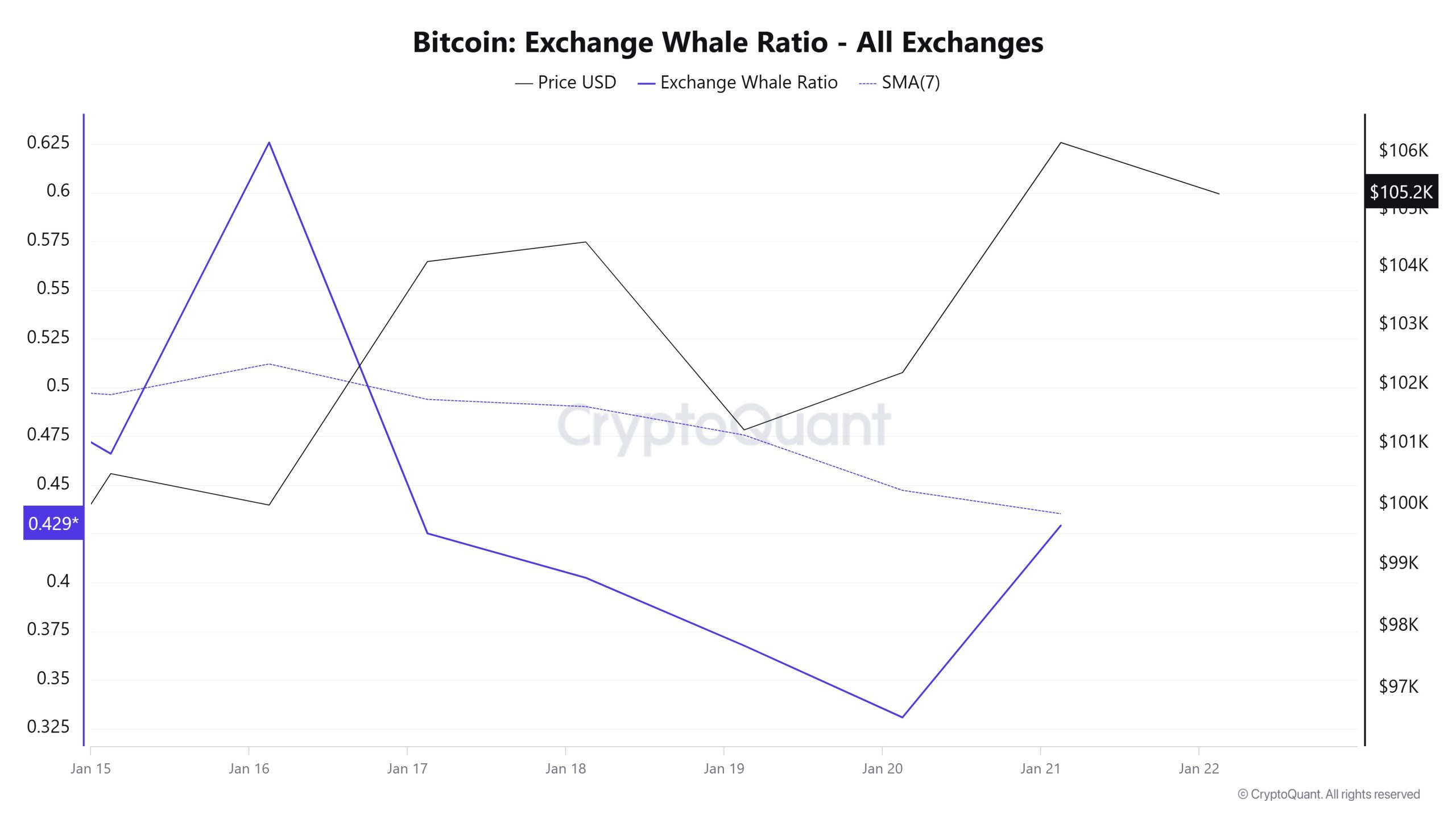

Whales Data

According to the data that has attracted attention in the cryptocurrency market in the last 7 days, whale activity on the central exchange has reached higher levels than ever before. When we look at the last 7 days of whale activity, it shows that centralized exchanges are being used by whales in an excessive way. When we look at the Exchange Whale Ratio metric, this metric, which was 0.62 on Janeiro 16, reached historical highs, and now whales have started to withdraw Bitcoin from exchanges. This ratio currently stands at 0.42. When this ratio is above 0.350, it usually means that whales frequently use centralized exchanges. In the first half of this 7-day period, it was seen that mostly BTC sellers used centralized exchanges. However, with Trump taking office in the last days of the process, there has been a strong accumulation of Bitcoin in the wallets of whales. At the same time, when we look at the total BTC transfer, we see that 6,005,751 BTC moved, an increase of about 26% compared to last week.

AVISO LEGAL

As informações, comentários e recomendações sobre investimentos contidos neste documento não constituem serviços de consultoria de investimentos. Os serviços de consultoria de investimento são prestados por instituições autorizadas em caráter pessoal, levando em conta as preferências de risco e retorno dos indivíduos. Os comentários e recomendações contidos neste documento são de caráter geral. Essas recomendações podem não ser adequadas à sua situação financeira e às suas preferências de risco e retorno. Portanto, tomar uma decisão de investimento com base apenas nas informações contidas neste documento pode não resultar em resultados que estejam de acordo com suas expectativas.

NOTE: All data used in Bitcoin onchain analysis is based on Cryptoqaunt.