MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | Change (%) | Market Cap. | ||

|---|---|---|---|---|---|

| Weekly | Monthly | Since the Beginning of the Year | |||

| BTC | 98,255.50$ | 2.34% | 31.57% | 122.00% | 1,94 T |

| ETH | 3,873.69$ | 8.70% | 47.94% | 64.61% | 466,37 B |

| SOLANA | 236.81$ | -0.92% | 28.96% | 116.00% | 112,60 B |

| XRP | 2.297$ | 43.37% | 331.00% | 265.00% | 131,41 B |

| DOGE | 0.4291$ | 5.58% | 119.00% | 369.00% | 63,43 B |

| CARDANO | 1.165$ | 10.66% | 226.00% | 87.41% | 40,99 B |

| TRX | 0.3203$ | 58.84% | 96.96% | 197.00% | 27,65 B |

| AVAX | 52.12$ | 19.80% | 100.00% | 24.51% | 21,34 B |

| SHIB | 0.00003035$ | 17.04% | 62.18% | 184.00% | 17,89 B |

| DOT | 10.310$ | 18.11% | 154.00% | 19.85% | 15,73 B |

| LINK | 23.53$ | 35.95% | 104.00% | 50.68% | 14,67 B |

*Table was prepared on 12.6.2024 at 11:30 (UTC). Weekly values are calculated for 7 days based on Friday.

Fear & Greed Index

Source: Alternative

Change in Fear and Greed Value: -6

Last Week’s Level: 78

This Week’s Level: 72

This week, the Fear and Greed Index fell from 78 to 72, indicating a decline in risk appetite in the markets. Fed Chairman Powell’s emphasis on the pace of interest rate hikes and his statement that inflation is making progress may have caused uncertainty in the market, causing investors to act more cautiously. In particular, the higher-than-expected US jobless claims may have supported the perception that the strong labor market may slow down somewhat, which may have weakened the confidence in the markets.

On the geopolitical front, the declaration of martial law in South Korea and the linking of this decision with threats from North Korea may have raised regional risk perception and caused concern in global markets. The combination of these factors seems to have caused investors to turn to safe havens and adopt a more cautious stance in the markets. The decline in the index is consistent with the negative impact of economic and geopolitical developments on market sentiment.

Fund Flow

| Asset | Week Flows (US$m) | MTD Flows (US$m) | YTD Flows (US$m) | AUM (US$m) |

|---|---|---|---|---|

| Bitcoin | -457 | 6,226 | 33,912 | 125,002 |

| Ethereum | 634.4 | 1,426.5 | 2,198 | 16,235 |

| Multi-asset | -16.3 | -25.3 | 441 | 7,021 |

| Solana | -3.8 | 39.8 | 110 | 2,096 |

| Binance | – | -0.4 | -2 | 653 |

| XRP | 95.0 | 115.1 | 141 | 442 |

| Litecoin | 0.2 | 5.3 | 47 | 224 |

| Cardano | 0.9 | 5.2 | 16 | 152 |

| Short Bitcoin | 0.5 | 58.7 | 120 | 115 |

| Chainlink | 0.8 | 3.6 | 40 | 73 |

| Other | 15.2 | 24.3 | 260 | 594 |

| Total | 270 | 7,878 | 37,284 | 152,608 |

Source: Coin Shares

Bitcoin broke the $100,000 mark for the first time, then briefly fell to $93,000 and stabilized at $96,500, recording more than $1.1 billion in crypto liquidation, of which $815 million came from long positions. While Bitcoin experienced a sharp correction, other cryptocurrencies such as Ethereum and Solana showed resilience, pointing to broader market stability. This event reset overheated funding rates, potentially setting the stage for a recovery.

Digital asset investment products saw inflows of USD 270 million last week.

Total inflows so far this year have set a new record of US$37.3 billion.

Total Money Inflows;

Ethereum saw an inflow of US$634 million.

XRP saw inflows totaling US$95 million. Litecoin, Cardano, Chainlink coins saw inflows of US$2.4 million. Other altcoins saw inflows of $15 million.

Money Outflows;

Bitcoin experienced outflows of US$457 million for the first time since early September this year.

Solana, there were outflows amounting to USD 3 million.

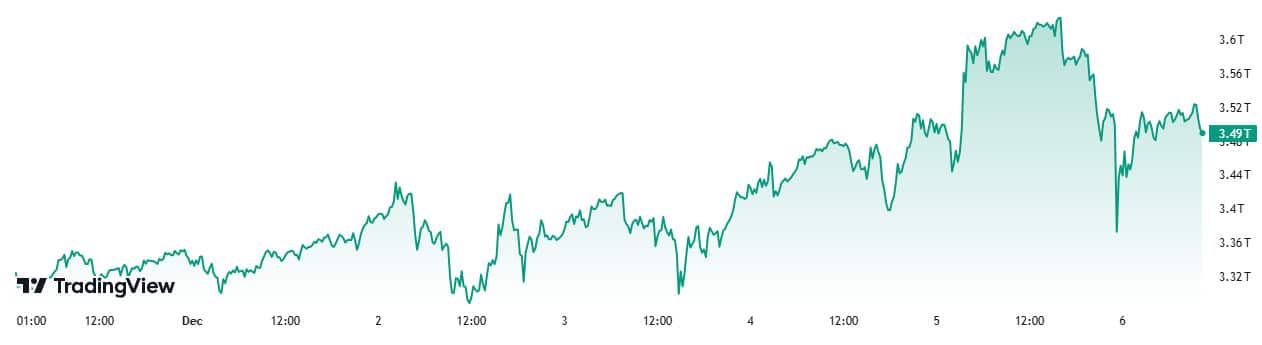

Total MarketCap

Source: Tradingview

Change in Market Value:

-Market Capitalization Last Week: 3.39 Trillion Dollars

-Market Capitalization This Week: 3.49 Trillion Dollars

The bull run on the cryptocurrency market is in full swing, the marketcap, which has not broken its 4-week positive streak, looks positive before the close of this week. The total market, which was worth $3.39 trillion at the beginning of the week, ranged between $3.26 trillion and $3.67 trillion during the week. The total market, which is currently at 3.49 trillion, has increased by 3.08% this week, while cryptocurrency markets have seen high valuations.

Total 2

The total market capitalization of altcoins stands at $1.55 trillion and has yet to cross the ATH (all-time high) of $1.7 trillion. This suggests that the main uptrend so far has been in Bitcoin, which continues to lead the crypto market. Bitcoin’s strong performance over this period accounts for the bulk of its total market capitalization and remains the main driver of the market’s direction.

Total 3

In contrast, Total3 (i.e. the market capitalization of altcoins only) hit a new ATH of $1.16 trillion this week. Following the 2021 ATH, this new high shows that altcoins are showing significant growth. However, despite this increase in Total3, Total2 (the total market capitalization of altcoins excluding Bitcoin) still hasn’t surpassed its ATH. This difference can be explained by the fact that Ethereum’s ETH performance, in particular, has relatively underperformed both Bitcoin and other altcoins.

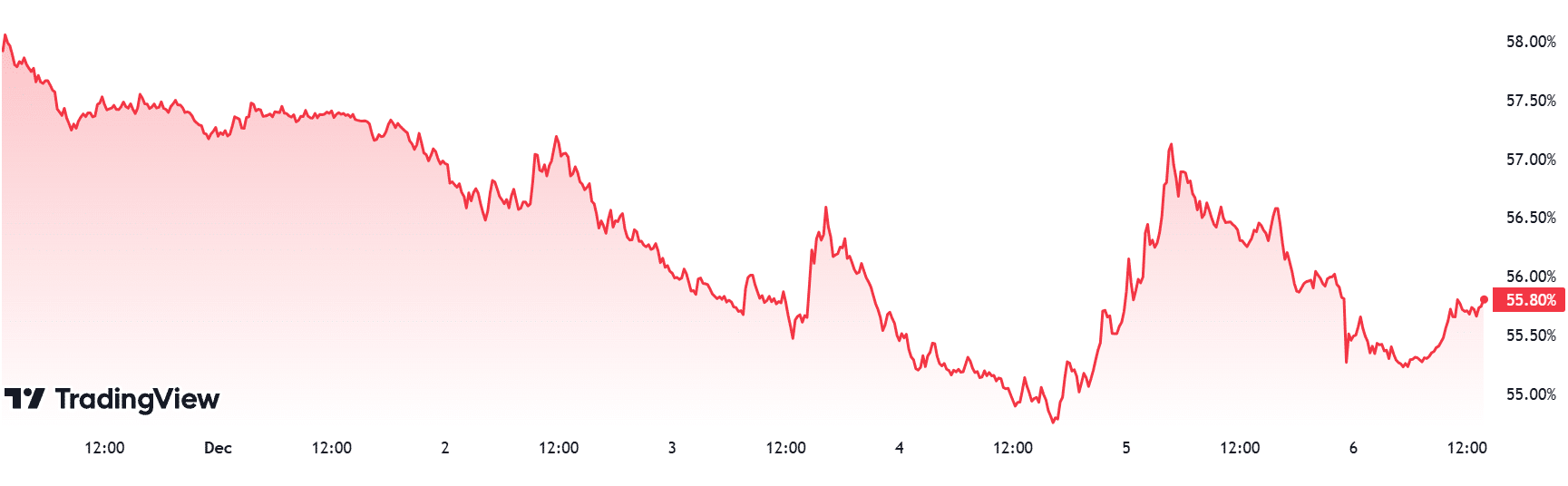

Bitcoin Dominance

Source: Tradingview

The Shift in Bitcoin Dominance

- Last Week’s Level: 56.80%

- This Week’s Level: 55.80%

Bitcoin Dominance

- Bitcoin dominance, which generally moved between50%- 61.50% levels in November, continued its negative momentum for the last three-week period in the first week of December. In this respect, Bitcoin dominance, , which we follow as an important level below 58.50%, is currently moving at 55.80% this week, while it was 56.80% as of last week’s close.

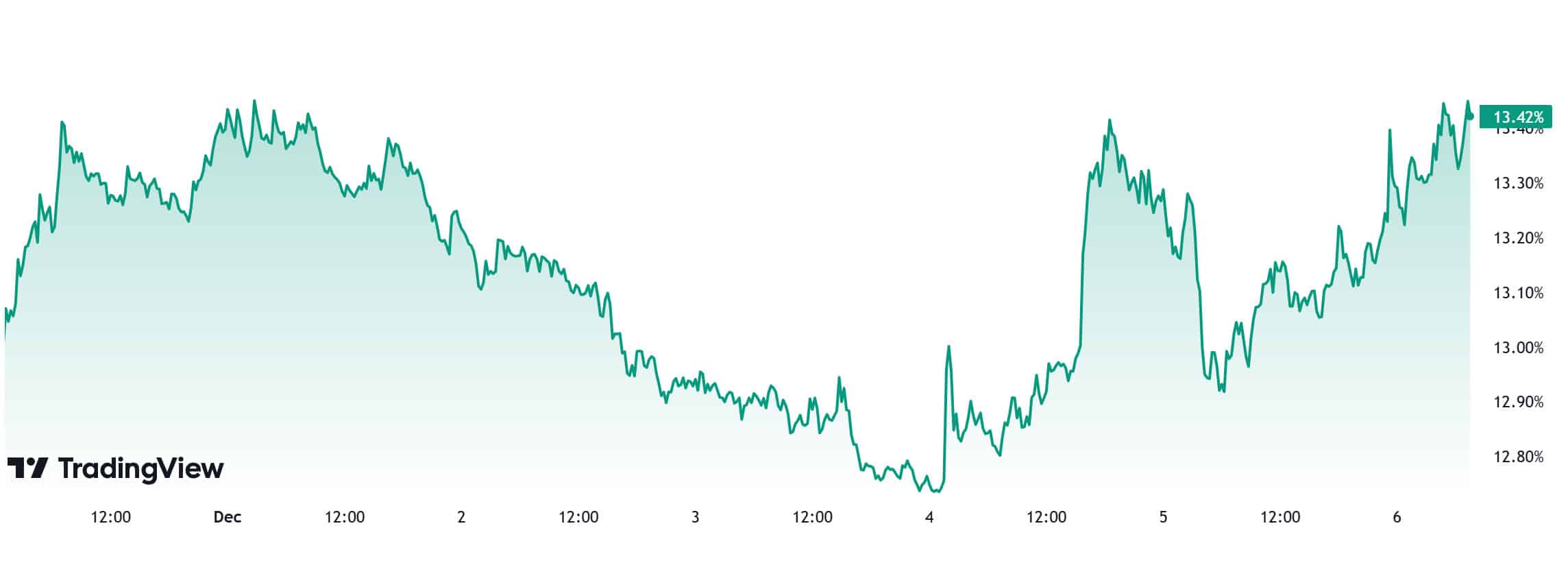

Ethereum Dominance

Source: Tradingview

Ethereum Dominance

ETH dominance, which closed last week at 13.19%, retreated to 12.66% in the new week, then increased towards Friday and is currently at 13.42%.

If the US consumer price index and producer price index data to be announced in the coming week are announced in line with expectations, an increase in ETH dominance may be observed with possible decreases in BTC dominance. As a result, ETH dominance can be expected to rise to 13.5% – 14%.

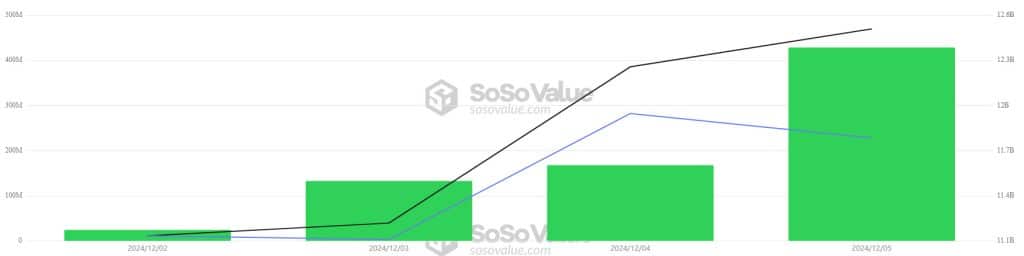

Bitcoin Spot ETF

Source: SosoValue

Featured Developments:

- Positive Net Inflow Streak: The positive net inflow streak in spot Bitcoin ETFs extended to 6 trading days. BlackRock’s IBIT ETF continued to lead the positive net inflow streak. Net inflows into Spot BTC ETFs totalled $2.35 billion during the period.

- BTC Price and Institutional Investor Interest: Between December 2-5, 2024, BTC surpassed $100,000 with an increase in value. In this process, BTC, which renewed ATH, rose to 104,000 and then fell below $ 100,000 with the depreciation it experienced on December 5. While this movement in the BTC price was taking place, interest in Spot BTC ETFs continued to increase. Especially under the leadership of BlackRock’s IBIT ETF, institutional investor interest continues to increase day by day.

- Cumulative Net Inflows: Cumulative net inflows into spot BTC ETFs exceeded $33 billion at the end of the 228th trading day.

| Date | Coin | Open | Close | Change % | ETF Flow (mil$) |

|---|---|---|---|---|---|

| 02-Dec-24 | BTC | 97,265 | 95,890 | -1.41% | 353.6 |

| 03-Dec-24 | BTC | 95,890 | 95,913 | 0.02% | 676 |

| 04-Dec-24 | BTC | 95,913 | 98,669 | 2.87% | 556.8 |

| 05-Dec-24 | BTC | 98,669 | 97,001 | -1.69% | 766.7 |

| Total for 02-05 Dec 24 | -0.27% | 2,353.1 | |||

Conclusion and Analysis

BTC broke the $ 100,000 level with its rise and rose above $ 104,000 and then declined with the sales. It lost 0.27% in value between December 2-5, 2024. During this period, investor interest in Spot BTC ETFs was great and a total net inflow of $ 2.35 billion was realized. The series of total net inflows continued, led by the BlackRock IBIT ETF. As a result of recent positive developments, the general view of market analysts is that Bitcoin will continue to rise in the long term and interest in Spot BTC ETFs will continue to increase.

Ethereum spot ETF

Source: SosoValue

Featured Developments:

Positive Net Inflow Series: The positive net inflow streak continued between December 2-5. Spot ETH ETFs reached a nine-day positive net inflow streak. It was the longest positive net inflow streak since the first trading day.

All-time High ETH ETF Daily Net Inflow: The Spot ETH ETF saw an all-time high daily net inflow of $428.5 million on December 5, according to Farside data. The BlackRock ETHA ETF had a net inflow of $292.7 million, the largest daily net inflow since its launch.

BlackRock and Fidelity Effect: BlackRock ETHA and Fidelity FETH ETFs stood out in spot ETH ETFs. In these 2 ETFs, which stood out in the positive net inflow series, the total net inflow was $ 786 million between December 2-5.

Cumulative Net Inflows: At the end of the 96th trading day, cumulative net inflows into US Spot ETH ETFs exceeded $1.3 billion.

| Date | Coin | Price | ETF Flow (mil$) | ||

|---|---|---|---|---|---|

| Open | Close | Change % | |||

| 02-Dec-24 | ETH | 3,711 | 3,646 | -1.75% | 24.2 |

| 03-Dec-24 | ETH | 3,646 | 3,616 | -0.82% | 132.6 |

| 04-Dec-24 | ETH | 3,616 | 3,840 | 6.19% | 167.7 |

| 05-Dec-24 | ETH | 3,840 | 3,787 | -1.38% | 428.5 |

| Total for 2-5 Dec 24 | 2.05% | 753.0 | |||

Conclusion

During the December 2-5 trading period, ETH price continued its ascent towards the $4,000 level with a 2.05% increase in value, while US Spot ETH ETFs saw total net inflows of $753 million. BlackRock’s ETHA has continued to lead the way in total positive net inflows over the last 9 trading days. Institutional investor interest in Spot ETH ETFs has continued to grow in recent weeks, with Spot ETH ETFs breaking records for trading volume and net inflows since their launch.

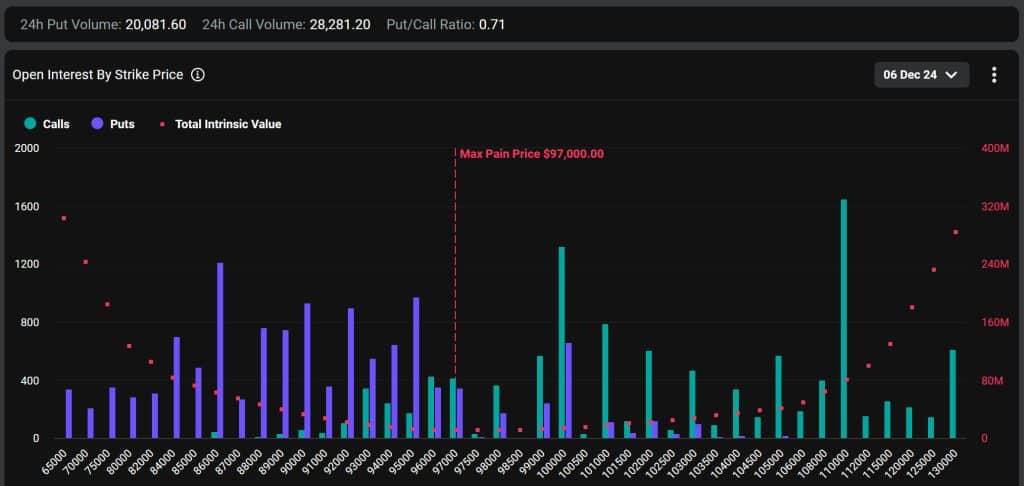

Bitcoin Options Breakdown

Source: Deribit

Lin Chen, head of Deribit’s Asia-Pacific business unit, shared that the probability of BTC exceeding $100,000 in the options market at the end of last year was 43.68%, while this rate was estimated at 51.46% at the end of January next year. On the other hand, there has been an increase in demand for put options, or contracts that give the buyer the right to sell an asset at a predetermined price within a certain period of time. According to Amberdata, which tracks digital asset market data, put options with strike prices of $95,000 and $100,000 saw the largest open positions in the last 24 hours. Demand for put orders between $75,000 and $70,000 also increased.

Deribit Data: Options contracts with a notional value of $2.04 billion BTC expire today.

Maximum Pain Point: Bitcoin’s maximum pain point is set at $97,000.

Option Expiration:

Call/Sell Ratio: The call/put ratio for these options is set at 0.71. A call/put ratio of 0.71 indicates that there is a strong preference for call options over put options among investors and a possible uptrend in the markets.

WHAT’S LEFT BEHIND

Bitcoin $100,000: With US President Trump’s crypto-friendly policies, Bitcoin surpassed $100,000, becoming the world’s 10th largest currency and 12th largest economy.

Congratulations from Trump: Donald Trump celebrated Bitcoin’s $100,000 peak and shared a message of support on social media: “You’re welcome, together we will make America great again.”

XRP Overtakes SOL in Market Cap: XRP surged 17.6% to reach a market capitalization of $130.1 billion, surpassing SOL and moving up to fourth place.

Bitcoin Futures Peak: Bitcoin futures hit an eight-month high of 20% annualized premium.

XRP Spot ETF Application from WisdomTree to SEC: If the application is approved, the fund will trade on the Cboe BZX exchange and BNY Mellon will handle custody.

Bitcoin Reserves on the Decline: Bitcoin reserves on exchanges have hit a multi-year low, which could put upward pressure on prices, according to CryptoQuant data.

Bitcoin Advice to Microsoft from Saylor: Saylor told Microsoft that it should adopt Bitcoin as a strategy and expects a market capitalization of $280 trillion in 2045.

Crypto Trade Volume Breaks Records: In November, crypto trading volume surpassed $10 trillion, with spot trading up 128% and derivatives up 89%.

Microstrategy Increased Bitcoin Stocks: Microstrategy bought another 15,400 BTC for $1.5 billion, bringing its total holdings to 402,100 BTC.

BTC Investment from Marathon Holdings: Marathon bought another 1,423 BTC, bringing its total holdings to 7,907 BTC. The company plans to increase these purchases.

Nano Labs to Start Investing in Bitcoin: Crypto mining chip design company Nano Labs has announced plans to buy and hold $50 million worth of Bitcoin over the next five years.

Genius Group Increased Bitcoin Reserves: Genius Group increased its Bitcoin reserves to 172 BTC, while the total value of these assets reached $15.8 million. The average cost per BTC was $ 92,000.

Mt. Gox Transfer of 2.4 Billion Dollars: Mt. Gox transferred 24,000 BTC to an unknown address as Bitcoin surpassed $100,000. The purpose of the transfer is unclear.

US Government Moves Silk Road BTC to Exchange: The government has transferred 19,800 Silk Road-linked BTC to a centralized exchange, a move seen as a preparation for the sale of confiscated Bitcoins.

Crypto and Digital Currency Move by Putin: Putin approved the law granting ownership rights to cryptocurrencies and proposed the use of digital currencies on the BRICS platform.

XRP Craze in South Korea: While XRP pushed the country’s crypto trading volume above the stock exchange volume, altcoins such as DOGE, XLM and SHIB were among the most traded assets.

Tax Postponement from South Korea: South Korea plans to postpone the 20% crypto gains tax for another two years. This will be the third postponement of the regulation.

Critical Appointments from Trump: Trump named Paul Atkins as SEC Chairman and David O. Sacks as “Director of Artificial Intelligence and Crypto”.

Powell: “Bitcoin is like Gold“: Fed Chairman Powell stated that Bitcoin is a speculative asset and is similar to gold, but it is not a competitor to the dollar.

Fed’s Message on Interest Rates: Fed official Musalem stated that rate cuts may be paused and inflation is expected to approach 2%.

HIGHLIGHTS OF THE WEEK

Digital asset traders witnessed historic moments this week, with Bitcoin reaching 6-digit price levels. President-elect Trump and his appointees are slowly shaping the new administration, which is largely made up of crypto-friendly figures. This raises hopes of a “crypto-regulation” in the world’s largest economy, which could open the door to a revolution for digital assets that could then become mainstream financial instruments. Pricing behavior also suggests that large traditional investors may show stronger interest in this market.

In addition to their own dynamics, crypto assets will continue to be affected by global developments, as is the case for all financial instruments. In this context, we can state that US inflation indicators will come to the fore for the markets next week. These macro indicators, which will be decisive in the risk appetite of the markets and will give clues about the interest rate path of the US Federal Reserve (FED), will be closely monitored. Especially after the recent employment data, which is thought not to be an obstacle to interest rate cuts…

Final CPI Data Ahead of the FOMC

The main task of the Federal Open Market Committee (FOMC) is to achieve price stability and keep inflation around the desired level of 2%. In this sense, Consumer Price Index (CPI) data is as important as employment data.

Source: Bloomberg

On an annual basis, the increase in the consumer price index, which showed a significant decline until mid-2023, followed a relatively more volatile course after this period. We have seen that the increase in prices continued to decelerate after March this year, albeit at a relatively more reasonable pace. However, the 2.6% increase in October, following the 2.4% increase in September, raised questions about whether the decline in the inflation rate has stopped.

In fact, the markets were already expecting to see a 2.6% reading. Nevertheless, this was enough to keep the markets on edge. Because a potential figure that would indicate that the rate continues to rise in November could cause the FED to pause interest rate cuts.

We think that a higher-than-expected CPI data set may reduce the risk appetite in the markets, thus bringing a decline in digital assets. In the opposite case, there may be grounds for new rises

DARKEX RESEARCH DEPARTMENT CURRENT STUDIES

Weekly Onchain Analysis – December 4

Darkex Monthly Strategy Report – December

Is MVRV’s Low Peak Signalling Selling Pressure in Bitcoin?

Net Unrealized Profit/Loss (NUPL) Analysis

Bitcoin: Puell Multiple Analysis

IMPORTANT ECONOMIC CALENDAR DATA

Click here to view the weekly Darkex Crypto and Economy Calendar.

INFORMATION:

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

LEGAL NOTICE

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.