MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | Change (%) | Market Cap. | ||

|---|---|---|---|---|---|

| Weekly | Monthly | Since the Beginning of the Year | |||

| BTC | 100,045.96$ | 1.76% | 14.31% | 126.00% | 1,98 T |

| ETH | 3,882.87$ | -0.03% | 22.61% | 64.93% | 467,30 B |

| XRP | 2.314$ | 1.06% | 251.00% | 267.00% | 132,25 B |

| SOLANA | 224.74$ | -5.00% | 8.62% | 105.00% | 107,54 B |

| DOGE | 0.4030$ | -6.41% | 7.64% | 338.00% | 59,27 B |

| CARDANO | 1.0893$ | -6.64% | 105.00% | 74.64% | 38,21 B |

| TRX | 0.2881$ | -10.11% | 63.44% | 167.00% | 24,84 B |

| AVAX | 51.66$ | -0.50% | 61.07% | 23.43% | 21,17 B |

| LINK | 28.44$ | 20.66% | 113.00% | 82.90% | 17,81 B |

| SHIB | 0.00002785$ | -8.64% | 16.15% | 160.00% | 16,39 B |

| DOT | 8.954$ | -13.22% | 77.67% | 3.94% | 13,66 B |

*Table was prepared on 12.13.2024 at 11:30 (UTC). Weekly values are calculated for 7 days based on Friday.

Fear & Greed Index

Source: Alternative

Change in Fear and Greed Value: +4

Last Week’s Level: 72

This Week’s Level: 76

This week, the Fear and Greed Index rose from 72 to 76, indicating an increase in risk appetite in the markets. Marathon Digital’s purchase of 11,774 Bitcoin may have created a positive sentiment in the markets as institutional demand strengthened. In addition, Goldman Sachs CEO’s statement that he would consider participating in crypto markets if regulators allow it seems to have boosted investor confidence. On the other hand, Microsoft shareholders voting against Bitcoin investment seems to have had a positive impact on the market. The increase in the index points to a positive perception supported by corporate statements in general.

Fund Flow

| Asset | Week Flows (US$m) | MTD Flows (US$m) | YTD Flows (US$m) | AUM (US$m) |

|---|---|---|---|---|

| Bitcoin | 2,546 | 2,546 | 36,459 | 132,896 |

| Ethereum | 1,159.8 | 1,159.2 | 3,358 | 19,635 |

| Multi-asset | -6.3 | -6.3 | 433 | 7,526 |

| Solana | -14.1 | -14.1 | 88 | 2,027 |

| XRP | 134.3 | 134.3 | 275 | 732 |

| Binance | 3.3 | 3.3 | 1 | 728 |

| Litecoin | 2.1 | 2.1 | 49 | 297 |

| Cardano | 5.2 | 5.2 | 21 | 176 |

| Short Bitcoin | 6.2 | 6.2 | 127 | 116 |

| Chainlink | 0.7 | 0.7 | 41 | 98 |

| Other | 14.5 | 14.5 | 275 | 756 |

| Total | 3,851 | 3,851 | 41,127 | 164,988 |

Source: CoinShares

Overview: Last week, digital asset investment products recorded the largest weekly inflows on record, totaling USD 3.85 billion. While the majority of these inflows went into Bitcoin and Ethereum, some altcoins also saw notable inflows.

Fund Inputs:

- Bitcoin (BTC): US$2.546 billion, the highest weekly inflow ever, topping total inflows.

- Ethereum (ETH): The ETF launched in July and saw its largest weekly inflow of US$1.2 billion.

- XRP: There was an inflow of USD 134.3 million.

- Litecoin (LTC): Received US$2.1 million in inflows.

- Cardano (ADA): US$5.2 million in inflows.

- Chainlink (LINK): received an inflow of USD 0.7 million.

- Other Altcoins: Total inflows amounted to USD 14.5 million.

Fund Outflows:

- Solana (SOL): Outflows of USD 14.1 million were recorded.

Evaluation

Last week, strong investment interest in digital assets saw a significant surge, driven in particular by ETFs of Bitcoin and Ethereum. The large investments in Bitcoin and Ethereum suggest that overall market sentiment is strengthening. However, some altcoins, such as Solana, experienced outflows.

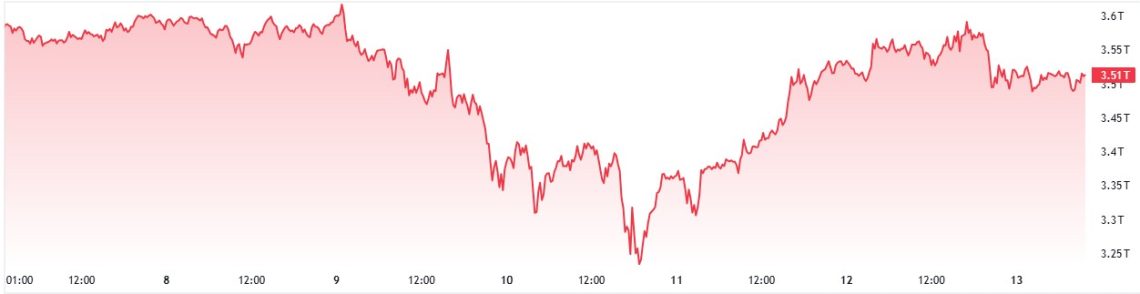

Total MarketCap

Source: Tradingview

Market Capitalization Last Week: $ 3.62 T

This Week’s Market Capitalization: $ 3.51 T

If the total market capitalization in the cryptocurrency market fails to reach 3.62 trillion dollars before the close this week after a 5-week upward streak, it will end its weekly upward streak. After falling to $3.22 trillion, the market is trying to recover, but has not yet been able to rise above the level it started this week.

Total2

When Total2 is analyzed, it is observed that the 5-week bullish streak continues and reflects a similar situation with Total. For the weekly uptrend to continue, Total2 needs to close the week above $ 1.61 trillion. Total2, which behaves more volatile than the decline on Total, shows that Bitcoin dominance continues.

Total3

To continue its 5-week bullish streak, Total3 needs to rise at a higher rate than Total and Total2. This shows that Ethereum has a more solid stance compared to the average of other altcoins. Compared to Total, Bitcoin’s performance is stronger than Ethereum’s.

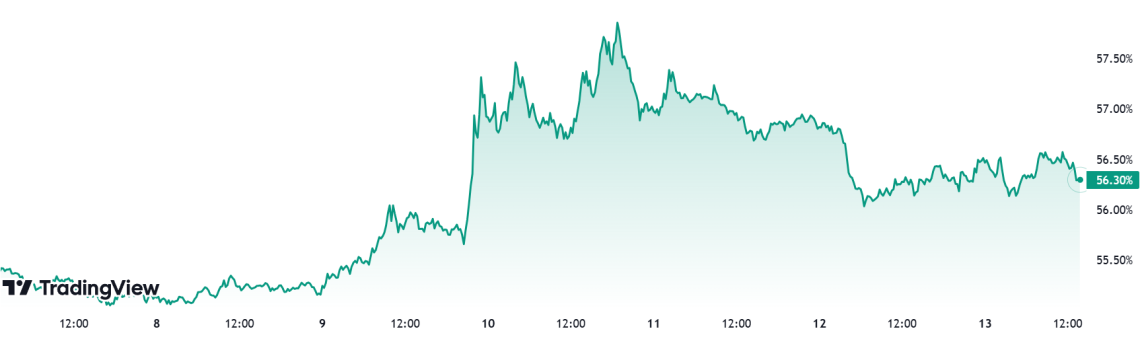

Bitcoin Dominance

Source: Tradingview

Bitcoin dominance, which was in a three-week retracement period until the previous week, showed positive accelerations as of the new week. So much so that Bitcoin dominance, which fell to 54.50%, which we follow as an important support level, accelerated positively with support from these levels. In this respect, Bitcoin dominance is currently moving at 56.30% this week, up from 55.36% as of last week’s close.

The Shift in Bitcoin Dominance:

- Last Week’s Level: 55.36%

- This Week’s Level: 56.30%

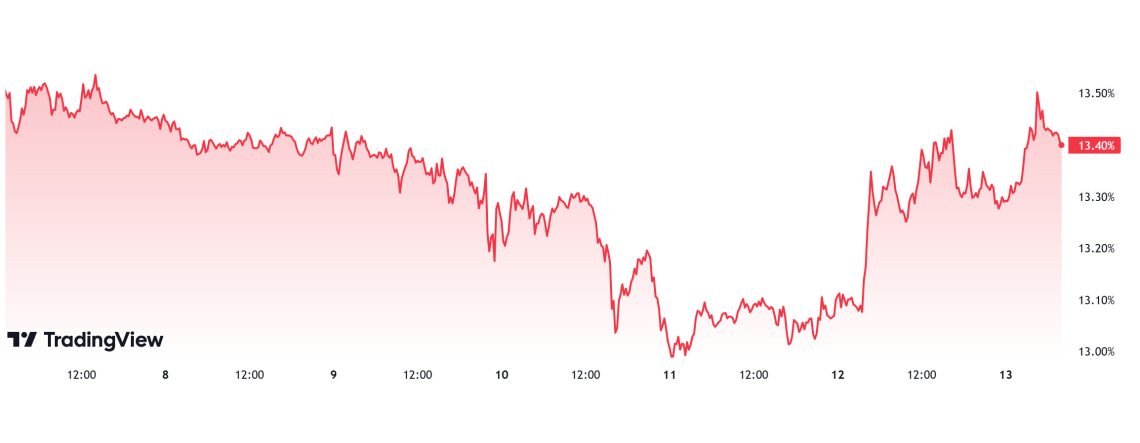

Ethereum Dominance

Source: Tradingview

Source: Tradingview

Ethereum Dominance

ETH dominance, which closed last week at 13.34%, retreated to 13.01% in the new week, then increased towards Friday and is currently at 13.40%.

If the US central bank FED cuts interest rates, which will be announced next week, an increase in ETH dominance can be observed with possible decreases in BTC dominance. As a result of this situation, ETH dominance can be expected to rise to 14% – 14.5%.

Bitcoin Spot ETF

Source: SosoValue

Featured Developments:

- Positive Net Inflow Streak: The positive net inflow streak in spot Bitcoin ETFs extended to 11 trading days. BlackRock’s IBIT ETF continued to lead the positive net inflows streak with approximately $1.4 billion in net inflows between December 6-12, 2024. Net inflows into Spot BTC ETFs totaled $2.11 billion during the period.

- BTC Price and Institutional Investor Interest: Between December 6-12, 2024, BTC price increased by 3.07% in value. While BTC price volatility was high during this period, investor interest in US Spot BTC ETFs continued to increase.

- Cumulative Net Inflows: Cumulative net inflows into spot BTC ETFs surpassed $35 billion at the end of the 233rd trading day.

| DATE | COIN | PRICE | ETF Flow (mil$) | ||

|---|---|---|---|---|---|

| Open | Close | Change % | |||

| 06-Dec-24 | BTC | 97,001 | 99,802 | 2.89% | 376.6 |

| 09-Dec-24 | BTC | 101,200 | 97,349 | -3.81% | 479.1 |

| 10-Dec-24 | BTC | 97,349 | 96,602 | -0.77% | 438.5 |

| 11-Dec-24 | BTC | 96,602 | 101,115 | 4.67% | 223.1 |

| 12-Dec-24 | BTC | 101,115 | 99,982 | -1.12% | 597.5 |

| Total for 06-12 Dec 24 | 3.07% | 2114.8 | |||

Conclusion and Analysis

Positive net inflows to US Spot BTC ETFs continued between December 6-12, 2024, when volatility in BTC price was high. In particular, BlackRock IBIT ETF and Fidelity FBTC ETF led the positive net inflows streak. While the BTC price fell, the continued positive net inflows of US Spot BTC ETFs were interpreted by market analysts as investors arguing that the BTC price will rise in the long term and that the interest in ETFs has increased in this context.

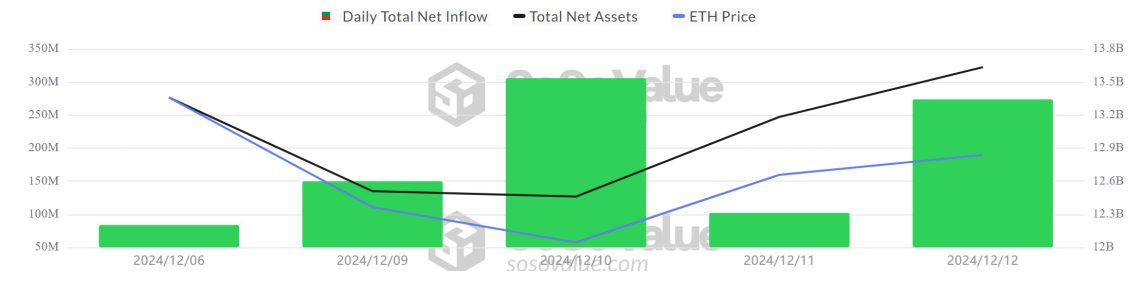

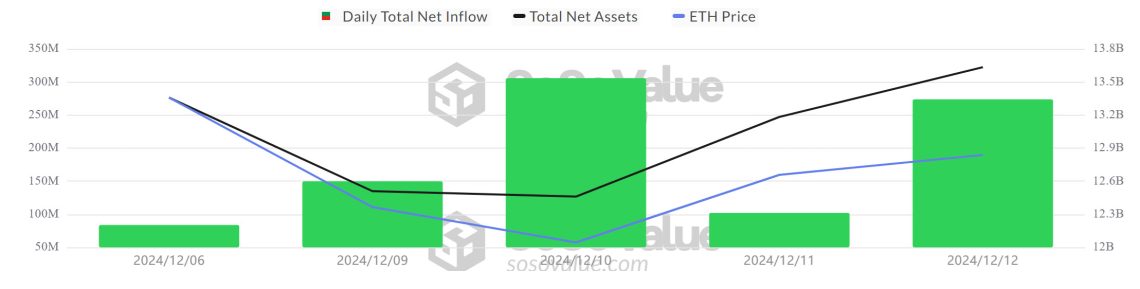

Ethereum spot ETF

Source: SosoValue

Featured Developments:

Positive Net Inflows Series Continued: The positive net inflow streak continued between December 6-12. Spot ETH ETFs reached a 14-day positive net inflow streak.

3rd Largest Net Inflow: Spot ETH ETF saw a net inflow of $305.7 million on December 10, 2024, the third largest net inflow since its launch, according to Farside data. Among Spot ETH ETFs, Fidelity FETH ETF stood out with a net inflow of $ 202.2 million and BlackRock ETHA ETF stood out with a net inflow of $ 81.7 million on December 10, 2024, when Ethereum price declined.

BlackRock and Fidelity Positive Influence Continues: Spot ETH ETFs continued their streak of positive net inflows, with net inflows totaling $548.2 million in BlackRock ETHA ETF and $299.6 million in Fidelity FETH ETF between December 6-12, 2024. GrayScale ETHE ETF saw a net outflow of $ 86.1 million in the said date range. Total net inflows in US Spot ETH ETFs totaled $915 million between December 6-12

Cumulative Net Inflows: At the end of the 101st trading day, cumulative net inflows into US Spot ETH ETFs exceeded $2.2 billion.

| DATE | COIN | PRICE | ETF Flow (mil$) | ||

|---|---|---|---|---|---|

| Open | Close | Change % | |||

| 06-Dec-24 | ETH | 3,787 | 4,001 | 5.65% | 83.8 |

| 09-Dec-24 | ETH | 4,007 | 3,712 | -7.36% | 149.8 |

| 10-Dec-24 | ETH | 3,712 | 3,628 | -2.26% | 305.7 |

| 11-Dec-24 | ETH | 3,628 | 3,830 | 5.57% | 102 |

| 12-Dec-24 | ETH | 3,830 | 3,880 | 1.31% | 273.7 |

| Total for 06-12 Dec 24 | 2.46% | 915.0 | |||

Between December 6-12, the ETH price rose by 2.46% to a daily close of $3,880 ahead of December 13. During this period, US Spot ETH ETFs received a total net inflow of $915 million. Positive net inflows to US Spot ETH ETFs continued, especially on December 9-10, 2024, while the decline in ETH price was noteworthy. This shows that investors’ interest in Spot ETH ETFs continues. Despite the fluctuations in the ETH price, Spot ETH ETFs, which continue their positive net inflow series, indicate that there may be an upward trend in the ETH price in the long term.

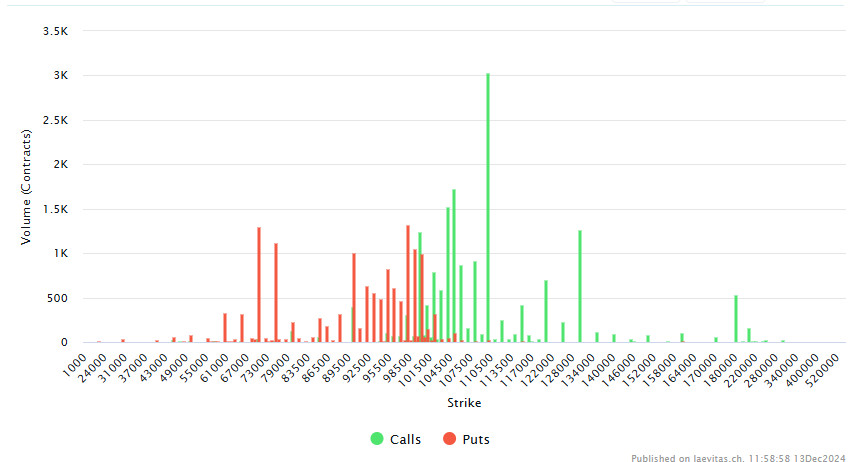

Bitcoin Options Breakdown

Source: Laevitas

Options market data shows that institutions have strong expectations for volatility ahead of Christmas. Adam, an analyst at Greeks.live, reported that the market has once again reached a strong divergence position after several days of regulation on social media on December 11. In another analysis, options market data suggests that Bitcoin could face resistance at $120,000.

Deribit Data: Options contracts with a notional value of $1.973 billion BTC expire today.

Maximum Pain Point: Bitcoin’s maximum pain point is set at $101,000.

Option Expiration

Call/Sell Ratio: The call/put ratio for these options is set at 0.59. A call/put ratio of 0.59 indicates that there is a strong preference for call options over put options among investors and that a possible upturn in the markets may be in question.

WHAT’S LEFT BEHIND

Trump Named Person of the Year 2024: Trump was named the Person of the Year for 2024 by Time magazine. Trump also said this week that “great things” will happen in the crypto space.

Microsoft Shareholders Reject Bitcoin Investment: Microsoft shareholders rejected a Bitcoin investment proposal.

US, Consumer Price Index (CPI) Announced: CPI: 2.7%, Expectation: 2.7%.

US Unemployment Rises, Rate Cut Expectations Rise: In the US, non-farm payrolls increased by 227K, while the unemployment rate rose to 4.2%. The probability of a rate cut was 85%.

US Producer Price Index (PPI) Announced: PPI: 3%, Expectation: 2.6%.

US Applications for Unemployment Benefits Announced: Jobless Claims: 242K, Expectation: 220K.

Trump to Keep Fed Chair Powell in Office: Trump stated that he is in favor of Jerome Powell continuing his duty and said, “I do not plan to replace him.”

MicroStrategy Continues Bitcoin Purchases: Michael Saylor shared Bitcoin Tracker information, indicating that MicroStrategy may increase its purchases. The company bought another 21,550 BTC between December 2-8, paying $2.1 billion.

MicroStrategy to Join Nasdaq-100 on December 23rd: MicroStrategy is expected to join the Nasdaq-100 on December 23.

Marathon’s $1 Billion Bitcoin Purchase: Marathon bought 11,774 BTC for $1.1 billion, bringing the total number of BTC to 40,435.

Alipay Does Not Support Cryptocurrency Purchases: Alipay announced that it does not support crypto purchase.

Bitcoin Treasury Proposal to Amazon: The National Center for Public Policy Research has proposed that Amazon add Bitcoin to its corporate treasury strategy; the proposal will be discussed in 2025.

Riot Platforms to Issue $500 Million in Bonds: Riot Platforms is planning a $500 million convertible bond issue for the purchase of Bitcoin.

El Salvador, Bitcoin Policy Change: The administration plans to change Bitcoin and some of its related laws in line with the $1.3 billion IMF deal. This step is considered a significant change to the country’s 2021 policy of recognizing Bitcoin as a legal currency.

El Salvador and Argentina Sign Crypto Cooperation Agreement: El Salvador and Argentina have signed an agreement for cooperation in the crypto sector.

Iran Focuses on Crypto Regulations: Iran will prioritize regulations over restrictions on digital currencies.

Argentina Allows Crypto ETFs: Argentina announced that it will open its market to foreign investment products linked to crypto assets.

Ukraine, Crypto Legalization Plan: Ukraine plans to legalize crypto in 2025.

Google Unveils Quantum Chip Willow: Google announced Willow, a new quantum chip that cannot yet decrypt Bitcoin encryption mechanisms.

Ripple Receives Final Approval from NYDFS for Stablecoin RLUSD: Ripple has received approval from the NYDFS for its RLUSD stablecoin.

FTX Debtors Repurchased $14.5 Million in Assets with Political Contributions: FTX borrowers repurchased $14.5 million in political contributions.

Trump Family’s Crypto Project WLFI Exchanged 5 Million USDC for 1,325 ETH: The Trump family’s WLFI project exchanged 5 million USDC for 1,325 ETH.

French Hill Named Chairman of the US Financial Services Commission: French Hill was elected Chairman of the US Financial Services Commission.

HIGHLIGHTS OF THE WEEK

As global markets prepare to enter the new year, position and expectation adjustments continue. The sharp decline of Bitcoin on December 5 and the rapid recovery that followed was interpreted by some as a “quantum computer” effect. Last week, we saw similar textures and pricing behaviors in BTC, although not as deep, and the market’s largest digital asset seems to have continued to reflect the effects of position adjustments, hovering around the 100,000 level.

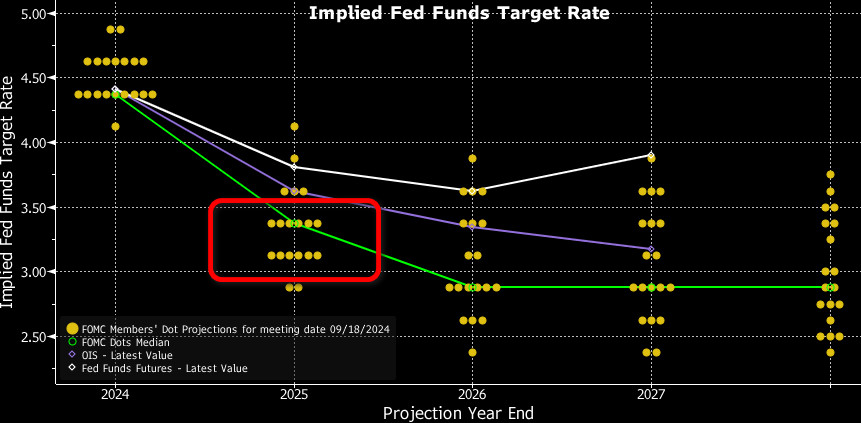

Next week will be the last week of the year when the big, traditional market traders are fully in the game. It will also be the last meeting of the FOMC for this year and we can safely say that this will be the most important development of the week.

FED done or not?

It would not be wrong to say that the most important December development that may move the stones in asset prices will be the results of the FOMC meeting. It seems that the tone of financial tightness will continue to play a leading role in the decision-making process of global investors about whether the necessary environment for taking more risk has been created. In this context, we can say that the FED’s monetary policy decision is the main variable.

On December 18, after the FOMC meeting, investors will try to find answers to the following questions.

- Has the interest rate been cut?

- Is there a message in the statement for a new interest rate cut?

- What changes are there in the “Dot Plot” table?

- What will Powell say about the rate cut path and the US economy?

When the statement comes, of course, the first thing we will look at is whether there is a rate cut or not. After the minutes of the FOMC meeting held on November 6-7 and the latest inflation data, the markets started to give a 25 basis point rate cut a higher probability. The message between the lines of the minutes was cautious but gradual rate cuts. Inflation, on the other hand, did not surprise and did not pose an obstacle for Powell and his team to decide on another rate cut. Therefore, the FED is expected to cut interest rates by 25 basis points on December 18 and we agree with this.

If the FED cuts interest rates by 25 basis points, we do not expect this to have a deep impact on the markets because this is already priced in. However, if the FOMC makes a surprise decision to leave the interest rate unchanged, we can say that this may negatively affect digital assets. We consider the possibilities other than keeping the interest rate unchanged or lowering it by 25 basis points as very low.

Source: Bloomberg

Immediately after the rate decision, the press will simultaneously review the FOMC’s economic projections and the “dot plot” graph showing the members’ expectations for future interest rates. In this flood of information, the dot plot will be our priority.

The policy rate, which is currently in the range of 4.50%-4.75%, is expected by FOMC officials to fall to 4.25%-4.50% by the end of the year, according to the latest documents published in September. So, there is room for one more 25 basis point cut. On December 18th, however, we will look at this chart and see what level the interest rate will be at by the end of 2025. In the last dot plot, we see that FOMC officials are concentrated in the 3.0-3.50 range. This implies that, assuming another 25 basis points rate cut in December, there could be another 100-150 basis points of rate cuts in 2025. We will closely monitor how this view will change in the new chart to be published. A chart that may indicate further rate cuts may support market expectations of a faster easing in financial tightness, which in turn may increase risk-taking incentives. In such a case, we would expect digital assets to continue to rise. However, a “dot plot” chart that would chart an interest rate cut course at a slower pace could lead to a contrary trend and cause a pullback in cryptocurrencies, even if short-term.

After the release of the statement and the documents, attention will now turn to FED Chairman Powell. He will first read the statement and then answer questions from the participants. We can say that the question-and-answer session will be the part where volatility will increase once again. Inflation, the labor market, other non-economic risks and the Trump factor… The President will try to answer every question by choosing words that are reasonable and will not shake the markets, but this may not always be possible.

We are all curious about the impact of Trump and his team’s new fiscal policies and how the Fed is preparing in response. But in his recent speeches, Powell did not go into these issues at all and dodged every question. We think he will do so again, but we also think that journalists will not refrain from pressing the Chairman. It is difficult to analyze the answers to these questions, but we can say that if Powell feels cornered too much, he may express a little more harshly that they will mind their own business, not Trump’s policies.

The main topic will be the FOMC’s rate cut path in 2025. The dose of financial tightness is very important for the markets and every investor wants to know how fast rates will decline. Powell could lay out a course in this regard. A message that rates could be cut at a fast pace would be a surprise. A similar, but opposite, effect could be seen if he suggests that interest rate cuts should be suspended for a while. We expect Powell to emphasize the health of the US economy and the strength of the labor market, saying that inflation is under control, that they will monitor the data and act accordingly, and that 25 basis points is a reasonable dose of rate cuts “when necessary”. Statements that imply otherwise may cause fluctuations in asset prices. A possible message that interest rates will come down at a slower pace may put pressure on digital assets, while the opposite situation may pave the way for new rises.

DARKEX RESEARCH DEPARTMENT CURRENT STUDIES

Weekly Onchain Analysis – December 11

Darkex Monthly Strategy Report – December

Is MVRV’s Low Peak Signalling Selling Pressure in Bitcoin?

Net Unrealized Profit/Loss (NUPL) Analysis

Bitcoin: Puell Multiple Analysis

IMPORTANT ECONOMIC CALENDAR DATA

Click here to view the weekly Darkex Crypto and Economy Calendar.

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone.

The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

LEGAL NOTICE

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorized institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely on the information contained in this document may not result in results that are in line with your expectations.